HanETF: World’s first Shariah compliant ETF has listed on London Stock Exchange

HanETF: World’s first Shariah compliant ETF has listed on London Stock Exchange

- Almalia Sanlam Active Shariah Global Equity UCITS ETF (ticker: AMAL) has listed on London Stock Exchange

- AMAL UCITS ETF has been passported across Europe including Scandinavia, the Netherlands, Italy, Austria and Luxembourg

- AMAL UCITS ETF to be compliant with Islamic Law

- AMAL UCITS ETF has appointed Sanlam Investments’ UK award-winning Global High Quality equity team to manage the assets

- AMAL UCITS ETF will be the 10 th and first actively managed ETF on the HANetf platform since it launched its first ETF in October 2018

The world’s first active global equity Shariah compliant ETF[1], Almalia Sanlam Active Shariah Global Equity UCITS ETF (the ETF) has listed on London Stock Exchange via HANetf’s ETF platform. The Shariah compliant ETF has also been passported across Europe to Scandinavia, Italy, the Netherlands, Austria and Luxembourg.

Almalia has selected Sanlam Investments UK to manage the assets of the ETF based on the success of its award-winning Global High Quality Strategy which was launched by Sanlam’s Global Head of Equities, Pieter Fourie, in 2008. The ETF will form part of this strategy and will be managed by Pieter along with his team of six investment professionals.

The ETF will aim to achieve capital growth over the medium to long term, whilst complying with the Principles of Shariah Investment. To this end, it will invest in companies with high returns on capital and low leverage, as well as enduring business models with a sustainable competitive advantage, producing significant free cash flow after capital expenditure. Investment screening, to ascertain the ETF’s on-going compliance with the Principles of Shariah Investment, will be overseen by a Shariah Panel of scholars from Amanie Advisors with deep expertise in Islamic Investment. Islamic financial products share four main features; they are asset backed, ethical, share risks equitably and are subject to good governance.

The fund may be suitable for investors looking to access an experienced active management team offering a high-quality strategy with the efficiencies, flexibility and democracy that are inherent to the ETF structure.

Paul-David Oosthuizen, CEO of Almalia said: “We are proud to be the first to launch an actively managed Shariah compliant global equities ETF. Our team is passionate about values-based investing and providing innovative solutions to underserved investors. This ETF may be suitable for investors looking for an actively managed strategy with a focus on good governance, as well as those who wish to invest in a Shariah compliant way.”

Lida Eslami, Head of Business Development, ETP and IOB, London Stock Exchange, commented: “Congratulations to Almalia on the listing of their actively managed Shariah compliant ETF. ETFs are an increasingly efficient way for institutional and retail investors to diversify their portfolios and gain access to a wide range of products for their evolving strategies. London Stock Exchange is a leading ETF listing and trading venue and will continue to work with innovative issuers to bring their products to market and provide choice to investors.”

When you trade ETFs, your capital is at risk.

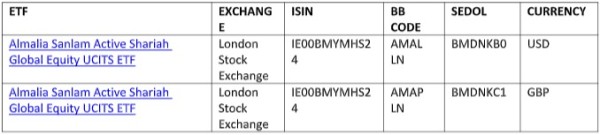

Product Information:

[1] Source: ETFGI as of 03.09.2020