Columbia Threadneedle: Why add to (UK) equities?

Columbia Threadneedle: Why add to (UK) equities?

By Maya Bhandari, Portfolio Manager Multi-Asset

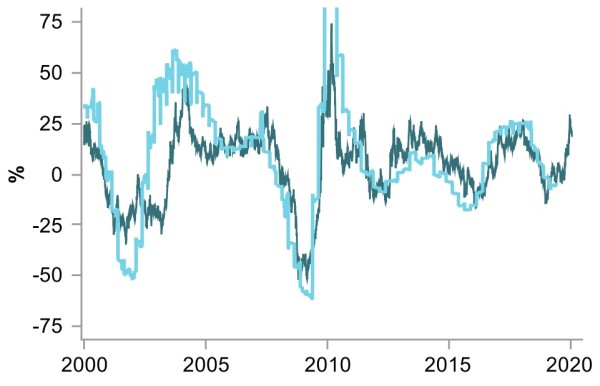

What a difference a year makes. After a bruising 2018, last year allowed investors to capture the second-best return on a blend of global equities and long-dated bonds in 30 years. For stocks it was also a year of record multiple expansion, trounced on only one occasion since the late 1980s – in 2009, when markets were recovering from the crushing financial crisis. Ergo: in 2020, earnings will need to “grow in” to prices for the rally to have “legs” (Figure 1).

Figure 1: Global equities (MSCI) earnings per share vs. prices (lead 156 days)

Sources: Bloomberg, Macrobond and Columbia Threadneedle Investments, 27 January 2020.

There are at least two reasons to think that they may. First, threats around global trade and a harder Brexit are considerably lower than they were, even in mid-December. Less uncertainty should allow business confidence and corporate earnings to recover somewhat in 2020, particularly in areas that were most sensitive to developments in each.

Second, on both consensus as well as our own forecasts, economic growth is poised to be almost “Goldilocks-like” – not so strong that interest rates will need to rise, nor so weak to rekindle fears of recession. Policymakers are thus postured to be “low for longer”, so the discount rate applied to anticipated earnings is likely to remain helpfully low, with credit spreads contained. The latter makes for uncomfortable broad-based equity investing, if bond markets are in the wrong place. But there are some exceptions – and the UK increasingly appears as one of them.

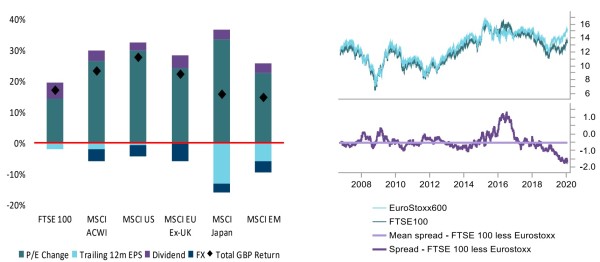

Figures 2 and 3: Disaggregated 2019 returns from a GBP perspective (lhs); Absolute and relative one-year forward P/E ratio

Sources: Bloomberg, Macrobond and Columbia Threadneedle Investments, 27 January 2020.

UK equities back in favour

In early January we raised our allocation to UK stocks to favour, from neutral previously, thereby lifting equities overall to a preferred asset class. Although UK stocks participated in last year’s broader rerating (Figure 2), the move relative to other markets was sufficiently subdued that the gap between one-year forward P/Es widened to nearly two turns versus Europe and three-and-a-half turns versus global equities – more than double historical averages and 15-year extremes (Figure 3). Investor underweights also appear extreme, notwithstanding the modest rise in ETF flows post the election.

That is not to say that the outlook for the UK is certain; rather it is meaningfully less uncertain than a month or two ago. Risks around the final destination of Brexit remain: with a weighty Conservative majority, the probability of a thin trade agreement might have in fact have risen, and the positive tail of a deal preserving the benefits of close alignment is diminished. Any deal or indeed extension of transition arrangements also requires agreement by all EU member states. Against this, however, the risks of higher corporate tax rates, nationalisation and a greater regulatory burden promised by a Jeremy Corbyn-led government have disappeared. And, of course, the UK is also an essentially defensive market, with decent dividends intact.

On balance, the UK market offers an attractive risk premium, both in its own context and particularly against other markets. The turn in analyst earnings revisions in recent weeks suggests greater optimism than that which is baked into current market valuations.

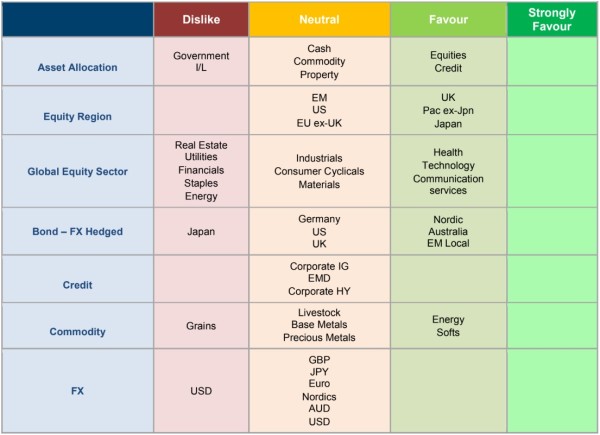

Figure 4: Asset allocation snapshot

Source: Columbia Threadneedle Investments, 27 January 2020.