Monex: Onderschat Draghi nooit

Hieronder volgt een commentaar in het Engels van Bart Hordijk, valuta-analist bij Monex Europe, op de persconferentie van ECB president Mario Draghi volgend op de ECB-beleidsvergadering.

Draghi benadrukte uitvoerig tijdens de persconferentie dat de ECB over “alle gereedschappen” beschikt die het nodig heeft voor haar monetaire beleid. Ondanks dat het opkoopprogramma afgelopen december al beëindigd is, lijkt de ECB dus klaar te staan om bijvoorbeeld verdere LTROs en tiering uit de gereedschapskist te halen om de economie te blijven ondersteunen, hoewel Draghi over de details nog vaag bleef. Het hoe en wanneer van mogelijke renteverhogingen werd nauwelijks besproken, wat wel aangeeft dat de ECB voonamelijk is gefocust op de negatieve risico’s voor de Eurozone die aanleiding zouden kunnen zijn voor verder ruim ECB beleid. Net als de financiële markten denkt de ECB dat positieve ontwikkelingen momenteel minder voor de hand liggen voor het grootste vrijhandelsblok ter wereld.

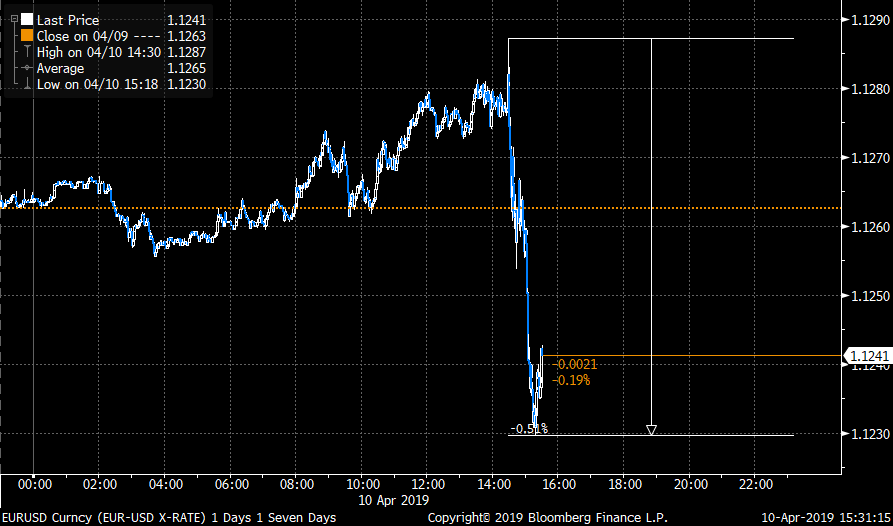

Draghi spent a lot of time this afternoon emphasizing that the ECB had plenty of tricks left in its monetary toolbox. The ECB President seemed to grab every opportunity to stress the ECB has not run out of monetary ammunition after it ended its purchasing program last December, though he remained characteristically vague on the when and how of these instruments. Nevertheless, the repeated reminders that the ECB possesses the tools for further loose monetary policy is a sign for us the ECB is sliding more towards a dovish bias, as for example the timing and structure of rate hikes weren’t even discussed.

The justification for this is that there is “a picture of weakening growth” in the Eurozone, while external risks remain persistent. Draghi acknowledged the $11 billion worth of trade tariffs floated by the Trump administration this week pose a threat to the Eurozone economy as trade tensions hurt sentiment in the Eurozone before. However, he did downplay it by saying there is often a wide gap between what is said and what is finally implemented.

Draghi skillfully deflected every question on subjects the ECB had not reached consensus on such as deposit tiering, by saying further analysis and discussion within the Governing Council about these subjects is needed. This sets up the June and September meetings to discuss looser policies using the LTRO and tiering tools. If risks indeed materialise this would enable the ECB to increase their accommodative stance, without smashing market expectations. A game well played by the ECB if that happens, while Draghi can easily ignore these discussions if Eurozone prospects improve in the meantime.