Harry Geels: Trump's call to lower interest rates is grotesque and dangerous

Harry Geels: Trump's call to lower interest rates is grotesque and dangerous

This column was originally written in Dutch. This is an English translation.

By Harry Geels

Donald Trump recently said that the new Fed chair should consult him on interest rate policy and that the US should have the lowest interest rates in the world. This undermines the Fed's independence, is likely to lead to a further weakening of the dollar, increase inequality, and undermine free markets.

In an interview with The Wall Street Journal, Trump said that the next Fed chair – he is considering appointing Kevin Hassett or Kevin Warsh, among others – should take his opinion into account when making interest rate decisions. He does not believe that the Fed chair should blindly follow him, but he does believe that they should take his input seriously. Trump wants US interest rates to fall to around 1% or even lower, so that they are the lowest in the world, something he considers appropriate given the size of the economy.

He once again criticised the current chairman, Jerome Powell, for acting too slowly, despite a recent interest rate cut of 0.25 percentage points after a narrow approval. This interference in Fed policy, which is not the first time, is grotesque and dangerous for four reasons. I described one of the reasons earlier in a column entitled “Trump, the ‘capitalist’ who abolished capitalism”. With his new attack, he is further undermining free markets. But let's discuss the other three points first.

1) Further erosion of the Fed's independence

Trump's repeated pressure on the Fed is a clear erosion of its independence. He has insisted on substantial interest rate cuts, threatened to dismiss Fed officials, including Chairman Powell, and made appointments contingent on personal loyalty. Now he is also demanding influence over policy decisions, which is at odds with the principle of political neutrality. This interference, combined with open criticism via social media and interviews, undermines confidence in autonomous monetary policy and reinforces the perception that the Fed is under political pressure.

2) Further weakening of the dollar

The dollar index (DXY) has fallen by more than 10% this year, the biggest decline since the 1970s. There is still no sign of a (technical) bottoming out, and Trump's latest statements are not helping the dollar. Trump has repeatedly said that he believes a strong dollar is damaging US exports. His call for aggressive interest rate cuts is in line with this strategy: a weaker currency stimulates exports and can improve the trade balance, which is in line with his protectionist agenda.

3) Upward pressure on (asset) inflation, greater inequality

Trump's pressure on the Fed to cut interest rates sharply, despite continued excellent economic growth and high government spending, is inflationary. Low interest rates stimulate credit and consumption, creating demand-driven inflation.

Higher inflation than interest rates then helps the government make its debts relatively cheaper through financial repression, but it harms households that have to spend a large part of their income on daily expenses.

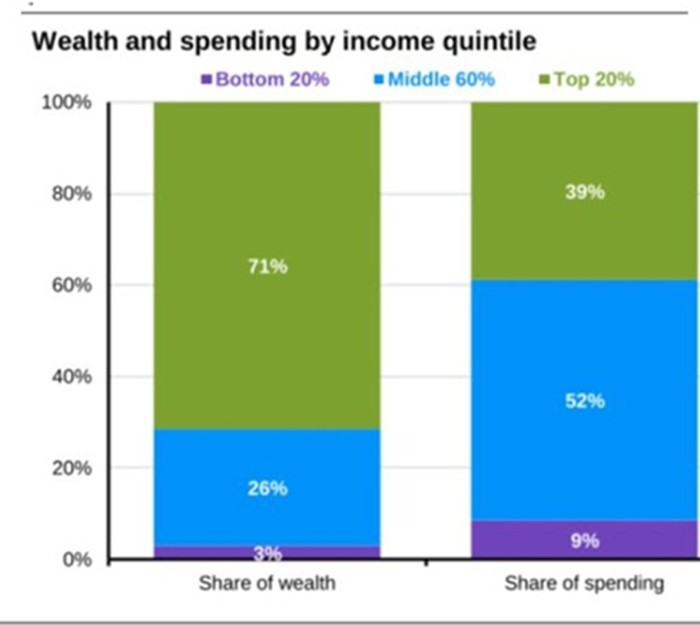

Figure 1: Share of wealth versus share of spending (per income quintile)

Source: J.P. Morgan via Mike Zaccardi/Tilo Marotz

Figure 1 shows that lower income groups have to spend a relatively larger proportion of their income and are therefore harder hit by inflation. At the same time, low interest rates drive up the prices of assets such as shares and property, which benefits wealthy groups. The result is a double dynamic: a loss of purchasing power for lower incomes due to price inflation and capital gains for higher incomes due to asset inflation, further increasing inequality.

4) Erosion of free markets

Another consequence of Trump's interference is a further erosion of free markets. Free markets – as an expression of the wisdom of the crowd – are the best mechanism for determining prices or interest rates. As soon as governments or central banks start to interfere, prices are influenced and distortions arise in the efficient allocation of assets and wealth transfers from one group to another, which is exactly what has been happening on an increasing scale since Trump took office.

A dangerous erosion of the currency's stability

As I have often said, capitalism no longer exists. The current system is a dirty cocktail of powerful corporations, central banks and governments. It is difficult to say what the greatest danger of Trump's interference is at this point. History has taught us that a weakening of the currency is accompanied by disaster. It was Lenin, of all people, who predicted in 1919 that the destruction of money's value would lead to the collapse of capitalism. And Keynes agreed with him at the time.

This article contains the personal opinion of Harry Geels