Harry Geels: The lessons of the biggest bond crash of all time

Harry Geels: The lessons of the biggest bond crash of all time

This column was originally written in Dutch. This is an English translation.

By Harry Geels

The biggest bond crash of all time is currently taking place, strangely enough without the breathless reporting that we saw during the stock crash in 2008. Why is the crash happening now and what are the (political) lessons we can learn from it?

The iShares 20+ Year Treasury Bond ETF is down more than 50% since its August 2020 high. This is officially the largest percentage decline in history for this part of the bond market. In March 2020, at the start of the covid crisis, the yield on the 20-year Treasury was 0.87%, yesterday it was 4.97%. In other words: the yield has increased by 471%. It makes sense that the price has fallen so much. But at the same time also extraordinary, because Treasuries are known as a 'safe haven'.

Of course, not all parts of the global bond market have been as punished as long-dated Treasuries. Nevertheless, there is something special going on, which not everyone is yet fully aware of. To quote an appropriate statement from Charlie Munger, Warren Buffett's now 99-year-old business partner: 'If you're not confused, you're not paying attention.' There are at least five lessons to be learned from the current developments in the bond markets. There are also five further considerations for bond investors. Let's describe these briefly.

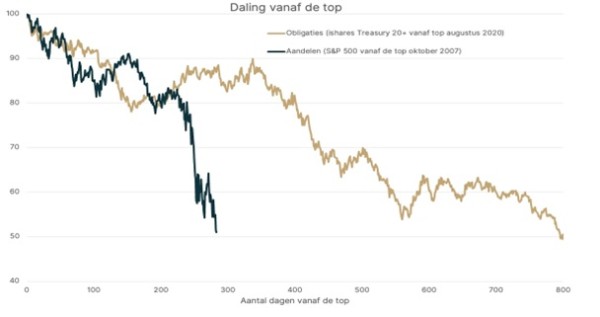

Figure 1: Crashes in shares (S&P500 from October 2007) and bonds (iShares Treasury 20+ from August 2020)

Source: Auréus - https://aureus.eu/het-risico-van-obligaties/

1) Apparently bond crashes are less interesting than stock crashes (for media and regulators)

When the stock market crash occurred from June 2007 to February 2009, the financial markets were shaken to their core. It felt that way, because the media was full of reports of collapsing banks and lines of people trying to get their money out of the wall. Government bonds performed very well during the credit crisis. They simply increased in value. No one really paid attention to that anyway. Apparently the fortunes of stock markets are more interesting to investors and the media than those of the bond markets.

2) Bond markets are sentiment driven (and not solely determined by 'smart money')

Perhaps it is an old-fashioned point of view, but it is still regularly said that better minds work on the bond markets than on the stock markets, because yield curves, duration and convexity simply have a higher level of abstraction than, for example, the price-earnings ratio. Bond markets would be less sentiment-driven and volatile. We now know better. Although volatility is now low, it briefly stood at almost 80% on the long-term US Treasury in March 2020.

3) Bonds are risky (riskier than stocks even!)

The statement that bonds are riskier than shares is a bold one. If we look at the average volatility, as measured by the standard deviation of returns, bonds are less risky. But with a measure such as a percentage decline ('drawdown'), as shown in Figure 1, the story changes. If we consider the maintenance of purchasing power in the long term - in a sense also a risk measure - then bonds are less 'safe' than shares over very long periods.

4) There is great uncertainty about out-of-control government spending

Perhaps the important message of the moment: now that interest rates are no longer artificially depressed by, for example, quantitative easing, the bond markets indicate that government budgets are getting out of hand and that the risks (of inflation or default) are increasing. A negative spiral can arise if no cuts are made. The interest costs then become increasingly greater. The advice from the 'free' bond markets seems to be: 'cut back, and now'.

5) And uncertainty about political systems

An even greater fear may be creeping into the bond markets, namely the change in political systems, with governments taking on an increasingly greater role, with an associated larger government budget, a system that The Economist recently called homeland economics. That is a disastrous path. Reuters wrote appropriately at the beginning of this month that the bond markets are becoming 'rebellious' (say, like Extinction Rebellion is about the climate) and that this is worrying.

Five considerations for bond investors

There are five more important things that we as investors should keep in mind.

- Higher interest rates increase systemic risks. It puts pressure not only on governments, but also on the profitability of highly indebted companies and the real estate markets, which are traditionally heavily financed. It is probably better to invest in companies with little debt.

- Inflation is not over just yet. After all, yields are also a compensation for inflation risk. Governments with rising deficits also drive up inflation.

- The US is not only waging a trade war with China but also a monetary war. China is buying fewer and fewer Treasuries and more and more trade is taking place in renminbi. The sharp rise in interest rates is an indication of the strength of the dollar, especially for the US.

- The higher yields make bonds more interesting again. The yield on bonds is now considerably higher than the dividend yield on shares and also higher than inflation.

- The trade-off between listed and unlisted investments. Investors would probably be wise to also look at the 'private markets'. Not only because they are less driven by stock market sentiment (and are therefore potentially less volatile), but also because they are growing (relative to stock market investments) and can be better tailored to the types of investments that investors specifically want in their portfolio.

Figure 2: Dividend yield shares versus bond yields (1926-202)

Source: Shiller

This article contains a personal opinion by Harry Geels