Vlerick Business School: Active learning about asset management

Vlerick Business School: Active learning about asset management

Since 2018, Vlerick Business School in Brussels has been providing one of the few courses in Europe aimed purely at training asset management professionals. Instructors are faced with the task of introducing participants not only to the world of asset management, but also to the latest trends in asset management. How does an executive program reach professionals to keep them abreast of developments?

By Esther Waal

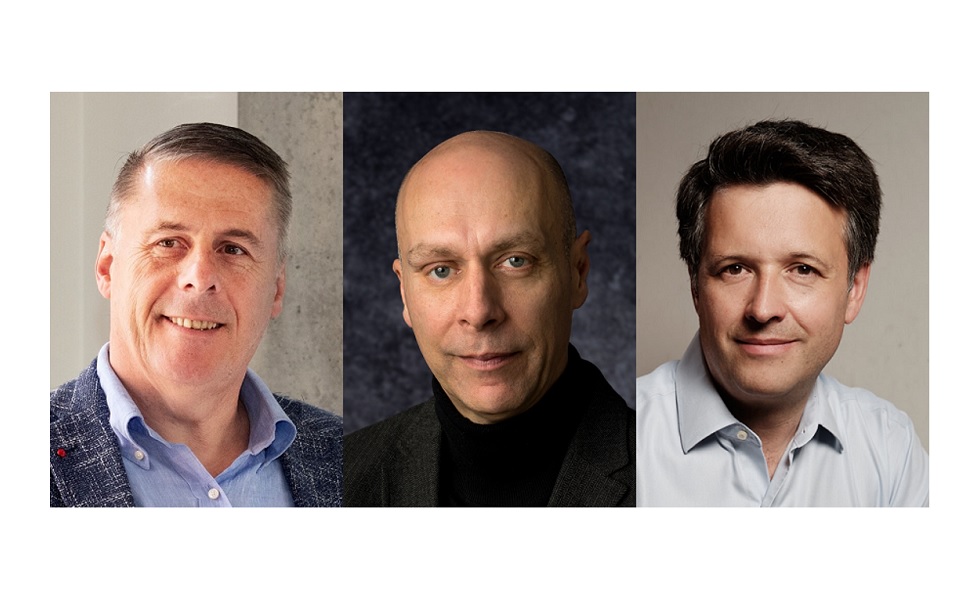

Vlerick Business School’s Executive Program on Asset Management (EPAM) aims to provide a top-quality executive education on asset management and to create a community in the Benelux. Both contribute to supporting professionals in dealing with the challenges confronting the sector. Financial Investigator talked to the program’s directors Jan De Bondt, Jan Longeval and David Veredas.

What is distinctive about the program?

Jan De Bondt: ‘Our target audience consists of young potentials and seasoned professionals in the asset management industry. The EPAM is especially interesting to those working in or for the industry without being portfolio or fund managers themselves, for example people active in compliance, risk management, commercial support, account officers, private bankers, or board members.’

Jan Longeval: ‘The program is a consortium between Vlerick Business School, asset managers, and institutional investors: AG Insurance, Belfius, Candriam, Degroof Petercam, Ethias, and Simcorp. Together, we co-create and co-deliver the program. The EPAM is delivered by a fine-tuned and wellbalanced mix of experienced professors and C-level professionals.’

David Veredas: ‘At Vlerick Business School, we focus on learning as opposed to teaching. What matters is that the learning objectives are achieved. ‘Active learning’ is the keyword. Learning occurs in class with discussions, in-class exercises, case discussions, preparatory readings, et cetera. Every year, the learning evaluations are analysed carefully and steps are taken for improving the program.’

We see a continued shift from active to passive, especially through passive ETFs.

What do you see as the most important trends in asset management?

Longeval: ‘We see a continued shift from active to passive, especially through passive ETFs, while the active space is more and more turning to alternatives such as private equity and private debt. From that point of view, you could say that the overall market is becoming ‘core satellite’: the core consists of a selection of ETFs (MSCI World or regional ones) and the satellite consists of a selection of actively managed funds in private markets or in less well monitored markets, like small caps, emerging markets and high yield.’

Veredas: ‘The active space is also more and more digital. Most active managers are now integrating big data and algorithms in their investment processes. AI will play a larger role and will help the portfolio managers in their security selection by analysing corporate balance sheets and going through the information contained in the footnotes and annexes of annual reports. On top of this, the ever-growing burden of compliance and regulation, especially in Europe, will force the asset managers to use AI to streamline. We believe that it will also lead to further industry consolidation.’

The ever-growing burden of compliance and regulation, especially in Europe, will force the asset managers to use AI to streamline.

In the US, there’s a backlash against ESG. Will this impact Europe?

Veredas: ‘In Europe, ESG benefits from a broad consensus and it remains very high on the EU agenda. Nevertheless, the realisation in Europe is growing that a transition at breakneck speed can create both social issues and undermine the competitiveness of Europe’s energyintensive industries. In our view, Europe’s policy makers need to keep three things in mind to avoid a backlash. The first is a clear strategy on how to decarbonise all the sectors of an economy. That should include a clear pathway with intermediate targets, as the case with the European Green Deal. The second is clear communication to all stakeholders, financiers in particular. Communication should focus on how decarbonisation can create jobs, reduce risks in the economy, and make it more resilient. Third are assurances and policies for leaving no one behind.

Decarbonisation isn’t a walk in the park and it requires important investments in industry, mobility, energy, and agricultural changes that affect communities and families. Funds like the Social Climate Fund of the European Commission are moving in the right direction.’

Impact investing is bringing ESG back to its essence.

What is your view on impact investing?

Longeval: ‘Impact investing is a logical step forward in sustainable investing as it offers a cure against widespread greenwashing. ESG as it stands today has often become controversial by itself. Think of the inclusion of nuclear energy and natural gas in the EU Taxonomy, think of the wide discrepancies between ESG scores of the same company, et cetera. Impact investing, if done properly, for example by complying with a strong normative framework such as the GIIN and by respecting the additionality criterion, is bringing ESG back to its essence. Hence, in that respect, interest in impact investing is set to increase with time. Since we see a lot of potential, Vlerick Business School will launch a new three-day executive program on impact investing in the autumn of 2024.’

What does the EPAM teach about active versus passive management?

Veredas: ‘We believe it is not an issue of one or the other, but of combining both. We learn in which asset classes active has a good chance of winning over passive and in which it has not. We discuss that the degree of market efficiency is not constant over time and how you can exploit this to your advantage. So, we present both sides of the coin.’

Is the program relevant to the Dutch market?

De Bondt: ‘The program is aimed at an international audience. The consortium program’s partners are active worldwide. Most participants are active in the institutional market, which is the most important segment in the Netherlands. In fact, Dutch pension funds have already sent participants.’