T. Rowe Price: The case for high yield

T. Rowe Price: The case for high yield

Improved credit quality and attractive yields support the case for high yield bonds. Why is that and why is the category interesting right now?

By Jason Bauer, Sector Portfolio Manager High Yield, Paul Massaro, Head of Global High Yield Team, and Rodney Rayburn, Portfolio Manager High Yield Fund, all at T. Rowe Price

High yield bonds have produced durable returns over time

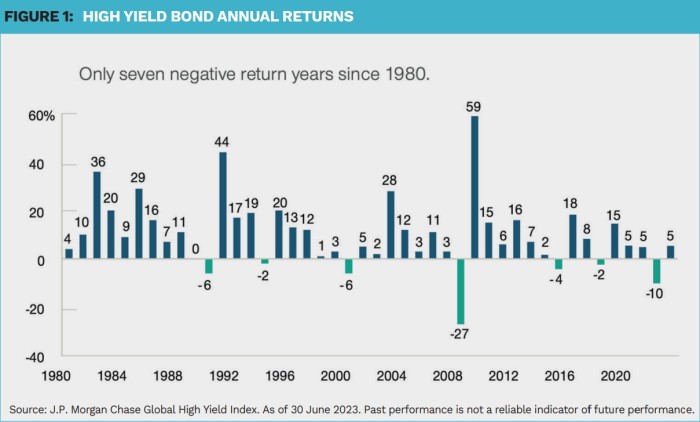

Global high yield bonds have broadly performed favorably across different market cycles. Since 1980, the high yield market has only experienced seven calendar years of negative returns. Perhaps even more impressive is that there have never been two consecutive years of negative returns in the asset class covering 40 years.

Following a year of negative returns, the asset class usually experienced a year of outsized gains or several years of modest returns. This resilient return pattern is simply due to ‘bond math’. The high yield market may experience bouts of weakness, resulting in lower dollar prices, but it still generates high coupons, and eventually bonds are pulled to par as they near maturity, fortifying the returns recovery.

Leveraged credit has generated compelling risk-adjusted returns

While return is certainly an important consideration when evaluating an asset class, volatility must also be evaluated. The Sharpe ratio, which measures return in excess of the risk-free rate1 per unit of standard deviation2, can be a useful metric to compare risk-adjusted returns across asset classes. Over the last 10 years, high yield bonds have had the second-highest risk-adjusted returns, trailing only below investment-grade bank loans. Consequently, we believe that investors have been fairly compensated for the additional performance risk when moving to below investment-grade credits.

Low default rate profile

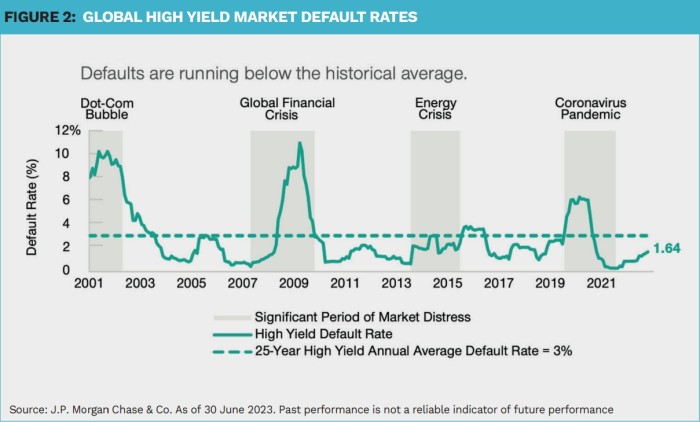

Although the macro backdrop remains challenging for risk assets, high yield fundamentals continue to be resilient. Since the global financial crisis (GFC), high yield market new issuance has been dominated by refinancings, as issuers capitalized on historically low interest rates. Additionally, record capital markets activity in 2020 and 2021 (post-COVID drawdown) at cheap financing rates has strengthened balance sheet liquidity and increased interest coverage3 metrics to peak levels. The high yield default rate marginally increased to 1.6% in June 2023 from 0.8% in December 2022, but remains well below its long-term average of 3%.

Why high yield bonds now?

There is, as shown, good reason to seriously consider high yield bonds. We see three justifications for why we should do so right now.

1) Evolution to a higher credit quality market

The current high yield market is drastically improved compared with the GFC in terms of credit quality. Using the Credit Suisse High Yield index as a proxy, the high yield market has migrated up considerably in credit quality since the GFC. In 2007, only 37% of the index had at least one BB rating, but today that figure is roughly 60%. Partially the result of record fallen angel volume ($ 240 billion) entering high yield in 2020, the average company in the high yield market has a larger market cap and generates more free cash flow today than prior to the GFC. Therefore, we feel the asset class is in a position of strength, should the economic outlook weaken.

2) Today’s yields have rarely been observed over the last 10 years

Rate and credit spread4 volatility since the first quarter of 2022 have resulted in attractive yields and dollar discounts not seen since the GFC, attributed to unprecedented quantitative tightening and related recession fears. As of 30 June 2023, the yield to worst5 on the J.P. Morgan Global High Yield Index was north of 9%. This is well above the average level of 6.86% observed over the last 10 years. Considering that the credit quality of the market is much higher today, the absolute yield on the asset class screens attractive, especially compared with similar dislocation levels during the energy crisis (2015–2016) and the pandemic sell-off, when both the quality and fundamentals of the market were lower than levels observed today.

3) Yields indicate attractive valuation

While we cannot predict future returns from current yields, we can use history as a baseline for when the high yield market had similar yield levels and what forward, or subsequent, returns looked like. Since 2012, the high yield market has crossed the 9% yield threshold five times. In each instance, the one-year forward return picture has been in the mid-double-digit range. Since 2012, the median 12-month forward returns have been in double digits when yields in the market have exceeded 7%.

1 Risk-free rate of return is a theoretical return of an investment with zero risk and the measure is used as a rate against which other returns are measured.

2 Standard deviation measures historical volatility. Higher standard deviation implies greater volatility.

3 Interest coverage measures an issuer’s ability to meet its interest payment obligations.

4 Credit spread measures the additional yield that investors demand for holding a bond with credit risk over a similar-maturity, high-quality government security.

5 Yield to worst is a measure of the lowest possible yield on a bond whose contract includes provisions that would allow the issuer to redeem the securities before they mature.

|

SUMMARY The global high yield market has performed well across different market cycles thanks to high coupons and a return to par at maturity. Issuer fundamentals have remained resilient despite the challenging macro backdrop. Improved credit quality is paired with the most attractive yields available in over a decade. |

|

Important Information This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. The views contained herein are those of the authors as of September 2023 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates. This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision. Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Fixed‐income securities are subject to credit risk, liquidity risk, call risk, and interest‐rate risk. As interest rates rise, bond prices generally fall. Investments in high‐yield bonds involve greater risk of price volatility, illiquidity, and default than higher‐rated debt securities. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only. T. Rowe Price Investment Services, Inc. © 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc. |