J.P. Morgan AM: Strong economic data pushes bond yields to 16-year high

J.P. Morgan AM: Strong economic data pushes bond yields to 16-year high

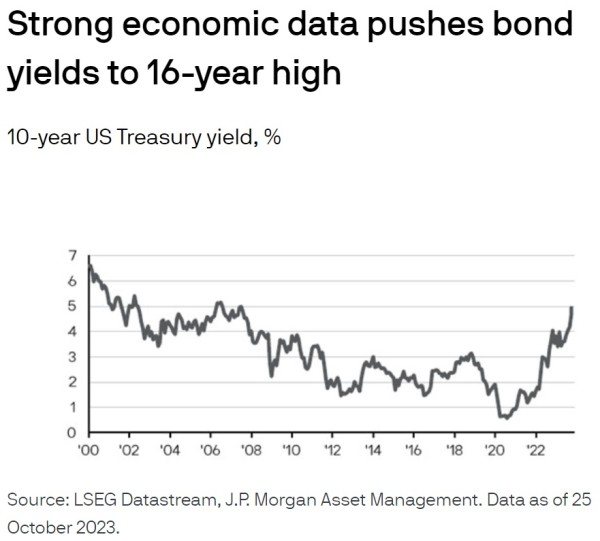

Bond yields have been on a rollercoaster ride in the past few weeks, with the 10-year Treasury yield hitting 5% for the first time since 2007.

While this volatility may have echoes of 2022, there are important differences in the drivers behind this year’s moves. Whereas 2022’s sell off was driven by inflation fears, the more recent rise is likely a result of stronger-than-expected US economic data forcing markets to re-evaluate the level of rates required to cool activity.

In our view, cracks in the growth outlook are likely to become clearer over the coming months, which could bring greater stability to the bond market. If this economic slowdown does materialise, we see bonds acting as a useful diversifier in portfolios to hedge against deflationary recession risks.