PGIM: Investment opportunities across a changing food system

PGIM: Investment opportunities across a changing food system

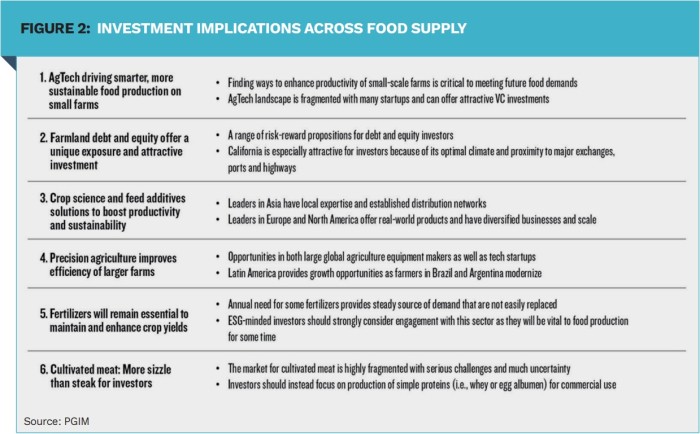

The entire food value chain is responding to the challenges of the 21st century. With innovation and technology leading the way, it is in the early stages of a major transformation.

By Shehriyar Antia, Head of Thematic Research, PGIM

From farm to fork, our global food system is vast – it produces and distributes 20 trillion calories daily. It is also complex, highly inefficient and increasingly unfit for purpose. It is becoming apparent that our food system needs to grow more productive and sustainable. For investors, there are two compelling reasons why this transformation needs to be on their radar. First, food can have major economic and political implications. Second, the drive for a more productive and sustainable food system leads to opportunities for investors to earn returns as well as to have measurable impact.

Geopolitical and macroeconomic vulnerabilities

Food is a critical good, and any disruption in its distribution can create immense economic and political turbulence. Given the reliance of the food system on international trade, interruptions in food supply chains can quickly lead to food price inflation, which hits consumers differently. If left unchecked by governments and central banks, food inflation can lead to civil unrest – particularly in countries where food expenses make up a large share of household spending.

The Russia-Ukraine war is a stark reminder of the global dependence on a few regions for critical crops and resources. Together, both countries account for nearly 30% of global wheat exports, and disruptions to their regular shipments sent wheat prices soaring. The conflict also impacted distribution of corn and fertilizer, causing their prices to surge as well. Going forward, investors need to recognize disruptions to food supply and distribution – whether they are due to extreme weather events or geopolitical tensions – will likely be more frequent and widespread. For investors, food inflation can be particularly destabilizing from a social and political perspective, especially in frontier and emerging markets. More importantly, it is not clear if current sovereign rating methodologies take food inflation and the ensuing political risks sufficiently into consideration and investors may want to consider supplementing these assessments of country risk.

Today’s food system resembles the energy sector of a decade ago

Today’s food system, in some ways, resembles the energy sector of a decade ago. It provides an existential good with inherent ESG tensions and opportunities in its production system – but not much detailed data to make informed and nuanced trade-offs. Applying an ESG lens to the food system can be exceptionally challenging. Nevertheless, food is becoming more prominent, given the food system’s interconnections with climate and biodiversity. For investors with commitments to decarbonization and sustainability, there is a growing recognition that the broad food system needs to play a vital role in achieving both objectives.

These issues are, by their nature, complex, and when looking at the current food system, several inconsistencies become apparent. One example is the use of synthetic fertilizers. Application of fertilizers in regions where they are underused is one of the simplest and most cost-effective ways of increasing crop production from smaller farms and can go a long way towards eradicating hunger and malnourishment. Furthermore, there are no real replacements for nitrogenbased fertilizers today. However, the production of industrial ammonia for fertilizers is very energy intensive and emits more carbon dioxide than any other chemical-making reaction. Additionally, some of the applied fertilizer runs off into sources of drinking water and waterways, and fertilizers also account for a sizable portion of human generated NO2 emissions.

So, what should ESG investors do?

ESG investors need to realize there are no perfect solutions when it comes to the food system. Given the criticality of meeting global food demand, excluding some segments of the food system based solely on carbon emissions is an ineffective strategy. Rather, an emphasis on active research that focuses on the actions of the broader industry as well as individual companies to address their most material ESG issues can be more effective.

Investors should have an approach that acknowledges current needs and limitations while working to shorten the transition to better, more sustainable options. For example, identifying the most forwardthinking fertilizer manufacturers that are taking relevant measures to reduce their carbon footprint today while also investing in startups working on more sustainable alternatives such as biologicals. One way of discerning between leading and lagging fertilizer producers is to really examine their corporate strategy – learning exactly how their research dollars are spent, assessing how realistic their carbon emissions targets are, the state of their progress and whether achieving these goals relies on current or future technology.

Investors also need to seek greater disclosure on a regular basis from the companies they invest in. Access to quality information and data is the basis for making informed trade-offs and identifying the most innovative companies. Greater transparency in data, however, is not costless and may be especially burdensome for small companies and farmers. Collective advocacy by investors for greater disclosure has led to better data in other sectors and industries. The FAIRR Initiative, for example, is an investor network that has been effective in providing data on a range of ESG risks associated with food production and offers tools and indices on the animal protein industry. Participating in initiatives like this would be a productive step.

From a sustainability perspective, the food system has evolved tremendously since the technological advances of the Green Revolution in the 1960s. Nevertheless, our food system, which represents 40% of global employment, remains fragile and the challenges it faces are significant. Our future food system will need to undergo significant changes to meet these challenges. Whether seeking attractive investment opportunities in public and private markets or mitigating hidden risks, it is imperative that international investors understand the rapid transform that is underway in our global food system.

|

SUMMARY Among investors with commitments to decarbonization and sustainability, there is a growing recognition that the food system needs to play a vital role in achieving both objectives. ESG investors need to realize that there are no perfect solutions when it comes to the food system. They should have an approach that acknowledges current needs and limitations while working to shorten the transition to better, more sustainable options. |