Alliance Bernstein: Five themes to guide insurance portfolios

Alliance Bernstein: Five themes to guide insurance portfolios

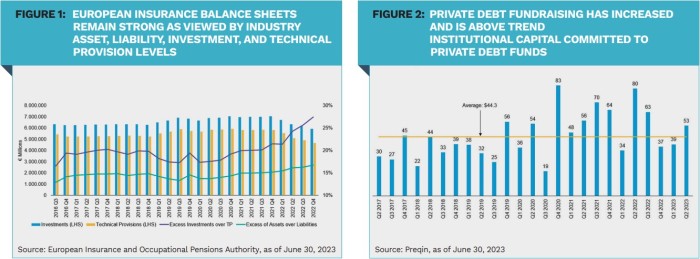

European insurers entered 2023 with strong capital ratios and healthier balance sheets. As summer winds down, there are five themes that matter to insurance investors.

By Richard Roberts, Co-Head EMEA & APAC Insurance BD, AllianceBernstein

Relevant questions regarding private allocations

While central banks make progress against inflation, it’s unclear what the exact path forward looks like. For insurers investing their next dollar, rate rises have presented an opportunity over the year to increase book yields. Concurrently, it raises questions of where that next dollar should go. Over the long term, increasing private allocations continues to be attractive. And while fundraising has picked back up, insurers should consider a few questions regarding their private allocations over the more immediate horizon:

1) Does the return still fully compensate me for the additional risks? Spreads in private markets adjusted at a slower rate than their public counterparts. As we’ve settled into the higher rate environment, however, we are once again seeing private markets offering yield premiums over public equivalents. For insurers, this means the answer should likely be ‘yes’ more often than at the start of the year.

2) Does the private asset diversify my balance sheet and make it more resilient? Genuine diversification is very valuable in volatile times. If diversification in some markets isn’t commonly available through public markets, demand for private assets should increase. We believe this is still very much the case.

3) Do I still have capacity to take on illiquidity today? This will depend on how insurers’ liability profiles have been altered – a topic examined below.

Asset and liability values continue to exhibit more volatility

When rates rise, the convexity within liabilities can magnify liability declines implied by duration alone. Policy lapses are the culprit – as policyholders face more attractive products in a higher rate environment. Increased daily living costs may also spur customers to surrender policies to fund basic needs. While this proved to be an unexpectedly significant liquidity draw, there is evidence of lapses crystallizing, particularly in P&C as customers have faced higher renewal costs.

Scrutiny continues to be recommended with regards to ALM positioning, focusing on dollar value approaches over duration alone, as asset and liability values continue to exhibit more volatility than they have in the recent past.

Additionally, insurers should revisit liquidity stress testing, ensuring they are both appropriate and consider a suitable range of possibilities. Importantly, insurers should consider liquidity candidates in portfolios and ensure managers can raise liquidity in a cost-effective and timely manner when needed.

Opportunities arising during volatile markets

Volatility has persisted throughout the year. While equity volatility is down, rates volatility is still elevated. This has opened up opportunities for insurers, although capitalizing on them is not always straightforward.

For instance, internal governance processes surrounding strategic asset allocation, regulatory capital, and operational and accounting expertise must be completed before an insurer can gauge appetite and shift opportunistically between asset classes.

Therefore, carving out a proportion of the overall fixed income allocation for a dynamic multi-sector approach, with solvency and accounting considerations incorporated, can help exploit market dislocations quickly.

Our view coming into the year was for insurers to be selective within fixed income, emphasizing quality and diversification as investors shifted focus from inflation to recessionary concerns. That view still holds and requires the expertise to tactically diversify allocations and utilize the full fixed income universe, risk profiles and geographies. In addition, it’s not uncommon to experience vast dispersion across fixed income asset class performance. Having the ability to analyze these sectors, as well as the flexibility to invest in them, can support optimally positioning portfolios – an aspect of portfolio construction that will be critical for insurers going forward.

As we’ve settled into the higher rate environment, we are once again seeing private markets offering yield premiums over public equivalents.

Impact of IFRS 9

We previously commented how the IASB’s implementation of IFRS 9 might result in insurers’ review of their equity allocations to ensure they’re optimal. Under the new accounting standard, listed equity will most commonly be treated as fair value through profit and loss (P&L), which is different for those insurers who previously accounted for equity as Available for Sale and had unrealized gains/ losses reflected through Other Comprehensive Income. The change brings potential volatility within financial statements. As insurers think through reallocating elsewhere, high yield can still offer value.

Analysis shows that high yield comes with half the volatility and return of equities, but significantly less than half the capital requirement. Under the new standard, fixed-income assets will require a determination of whether cash flows represent solely payments of principal and interest (SPPI), and with that a new impairment approach. Structuring a mandate to include a vast majority of assets that pass the SPPI test is relatively straightforward.

Notwithstanding the positive impacts from an accounting perspective, the market environment also presents an attractive entry point. The global high yield market ended June, yielding over 9%. Research shows that current yields are one of the most reliable indicators for future returns over the next five years.

Lastly, given the inverted yield curve, shorter duration high yield is looking to be an attractive substitute to equities without taking on significant interest rate risk.

Geographic diversification

We’ve continued to monitor trends in currency hedging costs, specifically in the context of European insurers’ ability to diversify core portfolios by utilizing non-domestic debt markets. The costs are still high but are now at their lowest level in the recent past. In June 2022, euro-denominated investors would have lost an annualized 2.67% to hedge US-dollar exposure back to euros on a three-month basis. As of June 2023, that cost is down to 1.85%. As that cost decreases, opportunities for geographic diversification should continue to appear.

Doors are open for European insurers to include exposures exhibiting strong relative value on a spread over SCR metric, such as investment-grade EM debt and global credit.

|

SUMMARY Increasing allocations to private markets remains attractive over the long term. Insurers should consider liquidity candidates in portfolios and ensure managers can raise liquidity in a cost-effective and timely manner. Insurers should be selective within fixed income, emphasizing quality and diversification. High yield comes with half the volatility and return of equities, but significantly less than half the capital requirement. It is recommended to include exposures exhibiting strong relative value on a spread over SCR metric. |