Tikehau IM: Private Debt with impact, a transition accelerator

Is it possible to invest with impact in private debt? To have a lending strategy that accelerates the sustainable transition, supporting SMEs along their impact journey? Yes it is.

By Nathalie Bleunven, Private Debt - Head of Corporate Lending, Tikehau Investment Management

Private debt with impact consists of offering more favourable financing conditions, such as lower interest rates, to companies if they meet sustainability objectives defined in advance with management. With this in mind, ESG ratchets are integrated into the financial terms of a loan. These are ESG indicators which, if met, allow the interest rate margin of a loan to be lowered. The definition of relevant non-financial criteria and their measurement are key. We work with companies according to their maturity, sector and size to identify ambitious and measurable indicators: the reduction of the carbon footprint, the training rate, the proportion of women in teams, et cetera. Consequently, granting an ESG premium when setting up loans should, in our opinion, become a standard for players in the financing of sustainable growth. The role of a responsible investor also consists of identifying an environmental or social issue in a company and helping to address it.

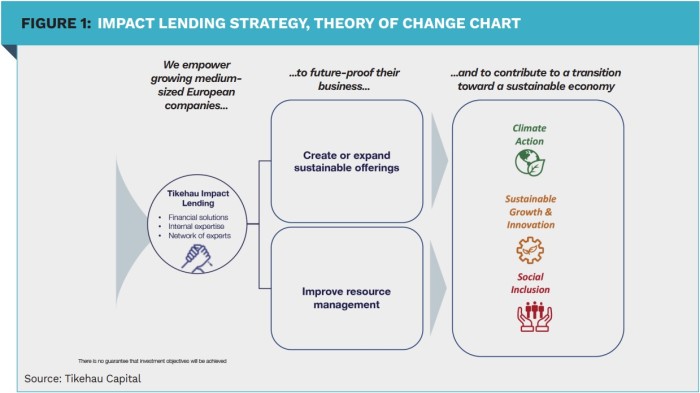

Our impact lending strategy is dedicated to financing the sustainable growth of European SMEs and intermediate-sized companies that are committed to driving a transition towards a more sustainable and inclusive economy. We support and finance companies which, through the evolution of their offering and the management of their human resources or their industrial process, contribute to this transformation. Our approach focuses on providing an advantage to companies that undergo transformation and encourage others to do so via financing conditions combined with ESG ratchets.

For each transaction, the private debt team identifies and negotiates with the company between three and five relevant ESG criteria and sets challenging targets in relation to them. If these targets are met, borrowers are rewarded with a reduction in the interest rate margin, typically between 5 and 25 basis points. In the opposite scenario, a marginal upward adjustment can be considered. Our impact lending strategy invests in three key themes, namely climate, social inclusion, and sustainable and innovative growth, with a focus on 5 of the 17 SDGs. If the company meets at least two SDGs and three KPIs related to the themes of the fund, it becomes eligible for the interest margin reduction.

Our impact approach also aims to help improve the potential return profile of portfolio companies, with the objective of enabling Tikehau Capital to deliver market-rate returns and positive impact to investors and society at large simultaneously.

ESG ratchets to promote impact

The ESG ratchets that Tikehau Capital helped pioneer in Europe are now really systemic. We have had a lot of interactions with trade organisations to make sure they become market standard. With ESG ratchets, there are agreed KPIs that companies need to measure, track and improve on, which has driven a major change in the way in which we engage with companies. This approach involves integrating two or three ESG criteria – adapted to the company – in the financing documentation.

As an example, four criteria were selected in the case of Odigo, a publisher of contact centre solutions: the proportion of women in the organisation, staff training, client satisfaction, and ESG certification. For the loan granted to a manufacturer of garden sheds, GartenHaus, the three criteria used related to its carbon footprint, the traceability of roof timbers, and the implementation of a supplier code of conduct.

Overall, the selected criteria break down more or less equally between social and environmental at 40% and 38% respectively, with those relating to governance at 22%.

We moved one step ahead and we committed to setting a net zero pathway for all new private debt funds.

More recently, we moved one step ahead and we committed to setting a net zero pathway for all new private debt funds. Each fund’s decarbonisation objectives have been designed to meet the annual reduction required to reduce greenhouse gas emissions by 50% by 2030. This is consistent with the net zero pathway, and with a 1.5°C aligned carbon budget. The key to success in this implementation will be the quality of our engagement approach through ESG ratchets.

Supporting companies in their ecological transition

The ambition of our impact lending strategy is to support companies in the ecological transition of their business model. We think that an impact approach is key and that private debt provides a robust and flexible way to support SMEs along their impact journey in Europe or more locally.

One example of this is the VDK Group, a Dutch provider of installation, service, maintenance and renovation works within the midmarket construction market. The company has a strong focus on energy-efficient sustainability and health & safety services across factories, offices, education, and healthcare customers. Tikehau Capital defined five ESG KPIs alongside the sponsor and VDK management, with ambitious targets across various criteria. Through these ESG ratchets they are incentivised to reduce waste generation through prevention, reduction, recycling, and reuse and to reduce carbon footprint in line with the Paris Agreement. They are also aiming to increase the share of revenue derived from climate change mitigation or adaptation activities.

Impact transition will enable corporates to strengthen their credit profile and should ultimately help them become more profitable and sustainable, keep their employees engaged, and attract new talent and customers. We are convinced that an impact approach will become mainstream across all asset classes in the very near term.

|

SUMMARY Granting an ESG premium when setting up loans should become a standard for players in the financing of sustainable growth. Our impact approach aims to help improve the potential return profile of portfolio companies, to deliver market-rate returns and positive impact to investors and society at large simultaneously. We committed to setting a net zero pathway for all new private debt funds. Each fund’s decarbonisation objectives have been designed to meet the annual reduction required to reduce greenhouse gas emissions by 50% by 2030. An impact approach is key. Private debt provides a robust and flexible way to support SMEs along their impact journey in Europe or more locally. |

|

Important notice: This publication is intended as a marketing instrument and does not satisfy the statutory requirements regarding the impartiality of a financial analysis. This document is not an offer of securities for sale or investment advisory services. This document contains general information only and is not intended to represent general or specific investment advice. Past performance is not a reliable indicator offuture results and targets are not guaranteed. |