AXA IM: Integrating biodiversity into fixed income portfolios

One of the fundamental features of biodiversity is that it reaches into every part of our lives. That means the impact of biodiversity loss is felt across fixed income investment portfolios too.

By Bruno Bamberger, Core Solutions Strategist, and Liudmila Strakodonskaya, Responsible Investment Analyst, both working at AXA Investment Partners

There are important reasons why investors should begin to integrate biodiversity into their decision making. First, biodiversity loss presents risks that could impact the performance of fixed income portfolios. As with climate change, the starting point is to understand the risks in play, divided into two components. They may be physical risks from biodiversity loss and ecosystem degradation, or transition risks linked to global efforts to tackle the problem, which include increasing liability risks.

We expect that companies that do not proactively address these risks, and that fail to adopt more sustainable nature-positive business models, could face higher costs or lower revenues, therefore reducing their ability to repay debt in the future.

- Nature-related physical risks The dramatic degradation of biodiversity and of natural resources has created significant pressures on issuer supply chains and manufacturing processes. This in turn may lead to a loss of revenue or reduced profitability, ultimately impairing the ability of an issuer to repay its debt. Examples of this could include increased flood risks due to soil and flora reductions, difficulties sourcing raw materials, reduced suitability of land for crop cultivation, or costs incurred from forced relocations of manufacturing bases.

- Nature-related transition risks Consumers are becoming more aware of the dangers of biodiversity loss and could shift their spending habits to products and services less associated with having negative impact on nature. The transition could be more acute when controversial actions hit the news and a boycott of a company’s products occurs across a wide consumer base. In addition, issuers could face further risks from evolving regulation, technological breakthroughs, market changes, and litigation.

A good example of liability-related transition risks is the case of US litigation around perfluoroalkyl and polyfluoroalkyl substances (PFAS), a large complex set of synthetic chemicals used in consumer goods and known as ‘forever chemicals.’ This litigation has given rise to new regulatory measures in both the US and the European Union with a potential ban targeting these chemicals. Another recent example is the introduction of taxes on plastic packaging in some countries, like the UK.

Interactions between different categories of nature-related risks, in particular cascading interactions of physical and transition risks, could eventually lead to a nature-related systemic risk with consequences for global economies around the world.

We can see increasing interest from asset owners who want to mitigate their negative impact on biodiversity.

Asset owners: The momentum builds

A second reason why we believe fixed income investors need to take action is that we can see increasing interest from asset owners who want to mitigate their negative impact on biodiversity by reducing the biodiversity footprint of their investment and financing activities. This rationale extends beyond pure financial performance and into ‘double materiality’, the idea that investors should consider not only the impact the external environment has on a portfolio, but also the impact a portfolio has on the natural and social capital in the world.

This process can occur in two ways: by reducing the negative impact a portfolio has, or by identifying and supporting solutions that have the potential to drive positive biodiversity change within different sectors.

According to estimates from the Convention on Biological Diversity and the Intergovernmental Panel on Climate Change (IPCC), between $ 150 billion and $ 440 billion per year should be allocated to biodiversity solutions to reverse biodiversity loss. Current financial flows from the private sector are merely a drop in the ocean. But more regulation is on the way.

So, these are the three main drivers converging to put biodiversity centre stage: 1) the risks are becoming ever more evident, 2) large asset owners are starting to measure their impact and consider how to adapt portfolios, and 3) this process is spurred on by burgeoning regulatory demands.

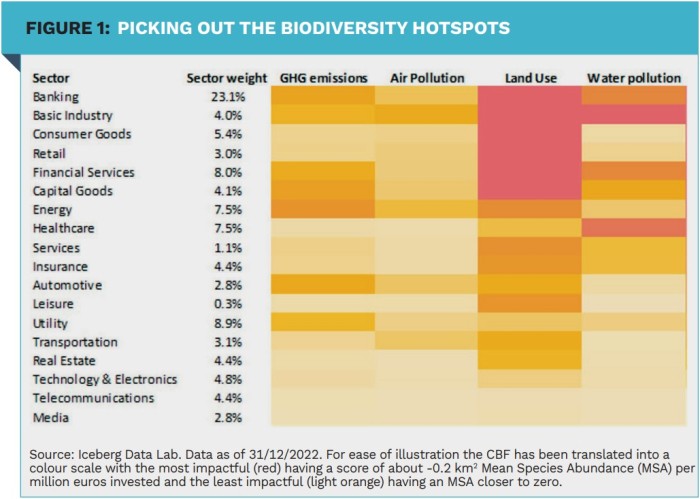

Figure 1’s heatmap shows four of the primary drivers of biodiversity loss across the global investment-grade credit sectors, as measured with the use of the Corporate Biodiversity Footprint (CBF) metric provided by Iceberg Data Lab.

Biodiversity as part of the investment process

After seeking out the portfolio ‘hotspots’ across sectors and specific issuers, investors can start the process of re-aligning their portfolio to reflect where the best practice lies in biodiversity integration.

A basic starting point is to tilt portfolios away from issuers that have a high biodiversity footprint and little ambition to reduce it, towards companies in the same sector that have identified the risks and impact and are managing (reducing) and monitoring them. Detailed issuer-level analysis is critical here to assess the ambition and credibility of any corporate objectives.

Fixed income investors may also use the lever of bond maturities to mitigate biodiversity-related risks within their portfolios. For example, issuers with a high dependency on natural resources or a high biodiversity footprint could be invested in only at shorter maturities and only reinvested in upon maturity if they have made sufficient commitments to mitigate those risks or lower their footprint.

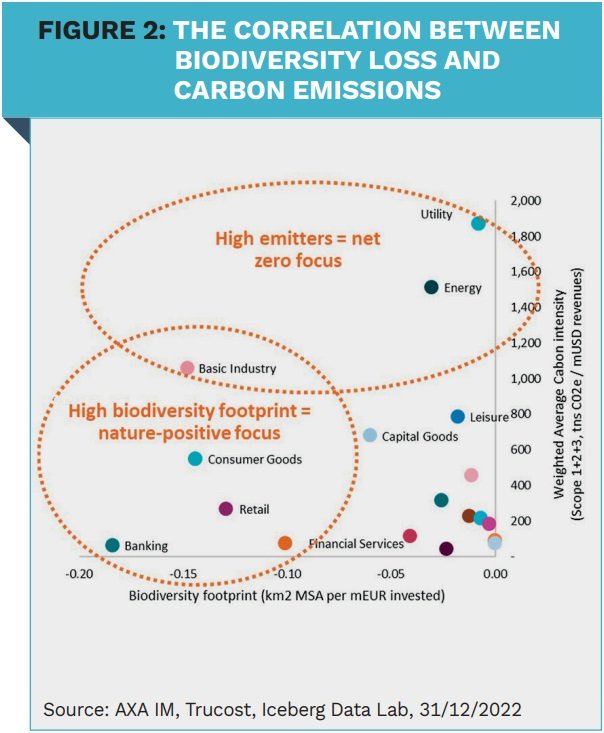

Climate, biodiversity and social factors are inextricably linked and climate change is one of the five direct drivers of biodiversity loss. Figure 2 shows the degree of correlation between the weighted average carbon intensity (WACI) and biodiversity footprint (excluding climate change) across the global investment grade credit sectors.

As a massive source of liquid capital, fixed income investors have a huge part to play in this emerging theme and can take steps today to actively improve the biodiversity footprint of their portfolios.

|

SUMMARY Managing risks, having a positive impact, and meeting regulations are three reasons why fixed income investors should consider biodiversity within their portfolios. Biodiversity loss is a complex issue. Active engagement and detailed sector and issuer-level analysis are required to tackle it. Biodiversity must be considered as part of a holistic sustainable approach, as opposed to isolated from climate change and social factors. |