AllianzGI: Three popular investment themes in private markets

Three investment themes in private markets should offer investors compelling opportunities this year: private credit, co-investments and GP-led secondaries, and infrastructure throughout the capital structure.

By Emmanuel Deblanc, Head of Private Markets, Allianz Global Investors

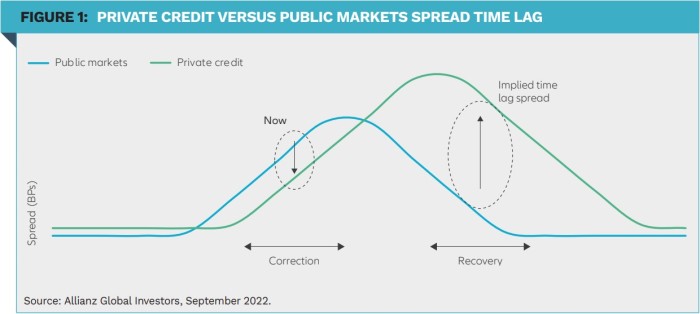

Ten years of abysmally low real and nominal interest rates combined with the ‘fear of missing out’ led investors to push up valuations in public markets and to embrace the illiquidity premium offered in some private markets. 2022 has been a pivotal year with rising costs hurting businesses globally, and with central banks’ attempts to control inflation raising the spectre of a global recession. Deployment in private markets has slowed down and we have reached a crossroads: it takes (more) time to agree on value in this new context.

However, private markets have developed into a global, highly diversified and heterogenous universe where – we believe – some sub-sectors offer investors relative and absolute value in a complex macroeconomic backdrop. Terms are being reset, but at an inconsistent pace. We set out below our favourite themes. In exploring these themes, it is worth remembering that there is no single ‘private market’. There are just private variants on public asset classes or asset classes traditionally only funded by banks:

- Private equity, where control of companies and the ability of investors to directly effect change in them to create value can outweigh the benefits of the greater liquidity and diversification in public equities.

- Private fixed income assets (bonds and notes) that aren’t publicly listed or traded but remain more ‘bond-like’ than ‘loan-like’.

- Bank assets, that is assets that are rarely seen in public markets, but which can be acquired from banks or sourced by disintermediating banks or both.

We expect GPs to stretch their investment periods through co-investments and thus to become more reliant on large and trusted partners to deliver on transactions.

Theme 1: Private credit with three areas of focus

European mid-cap lending

We see banks seeking solutions to reduce their balance sheets whilst seeking to retain fee generating businesses linked to bank credit. However, some institutions may struggle to simultaneously reduce balance sheets while keeping these related feegenerating businesses.

Trade finance

Trade finance is a short-term semi-liquid asset class with limited credit and rate risk which can be used as a tool to maintain portfolio returns while waiting for longer dated credit markets to reset. This is also a sector in which the supply-demand balance may favour investors, given banks are major funders of this sector and this is an asset class where banks may wish to maintain origination for both relationship reasons and the long-term attractiveness of the asset class for them, while easing short term balance sheet pressure.

Infrastructure debt

Infrastructure debt is an area of focus that will be discussed hereafter together with infrastructure equity.

Theme 2: Co-investments and (GP-led) secondaries

We see a tougher market for fundraising and portfolio adjustments by investors rather than a market meltdown with massive dislocations. Hence, we expect GPs to stretch their investment periods through co-investments and thus to become more reliant on large and trusted partners to deliver on transactions, rather than rely solely on the broad distribution possible in softer markets. Those same partners will be called upon for GP-led secondaries and continuation funds, which should offer our investors appealing entry points.

Theme 3: Infrastructure, both equity and credit

The huge capital needs in the energy sector, both for energy transition and security, may have been observed over several decades. Post Second World War, we have struggled to come up with a comparable context with such near term and large capital expenditure requirements.

Infrastructure assets often have features and contractual protections which allow to navigate periods of high inflation. A number of transactions offering some diversification from a corporate world could also come under pressure as a result of inflation compressing margins and a low growth backdrop.

We see banks seeking solutions to reduce their balance sheets whilst seeking to retain fee generating businesses linked to bank credit.

Infrastructure credit in Asia has the potential to continue to offer value, in our opinion. The region continues to grow and build renewables, the market is complex and is thus prone to tailor-made credit solutions, and the reshuffling of supply chains has generated opportunities across South-East Asia.

The infrastructure sector has kept on providing waves of opportunities, but it is the sheer scale of this latest wave which makes it unique.

|

SUMMARY Private markets have had a stellar decade of growth. The dislocation seen in public markets in 2022 and the capital demand in the energy sector should bring investors another window to enter some segments of private markets on attractive terms. Experience and understanding of these markets will matter more than ever, while uncertainty remains elevated. |

|

Disclaimer Diversification does not guarantee a profit or protect against losses. Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative offuture performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shallnot be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time ofpublication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed, and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin). 2700837 |