Monex Europe: Bond markets are unconvinced by path ECB after March

By Simon Harvey, Head of FX Analysis at Monex Europe

The ECB followed through on its December guidance by hiking all of its interest rates by 50bps and vowing that the likeliest scenario in March is a successive 50bp hike.

This came as no surprise to market participants, not just because of President Lagarde’s forward guidance in December, but the fact that the majority of the Governing Council doubled down on that same guidance in their intermeeting communications in January. Instead, it was the guidance for policy after March’s meeting that started to move markets ahead of the press conference. From Q2 onwards, the ECB rate statement suggested that the central bank would return to a meeting-by-meeting, data-dependent approach as it would “evaluate the subsequent path of its monetary policy”.

Although an intuitive statement in isolation, in the context of a bond market that has shown its desperation to pick the peak in rates and actively trade the subsequent easing cycle over both Fed and BoE meetings in the past 24 hours, the inclusion of this point in the rate statement saw Eurozone bonds rally across all curves and tenors.

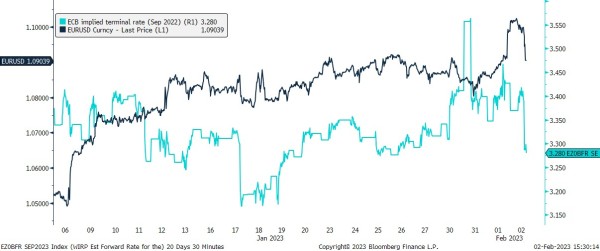

The corresponding drop in eurozone rates as markets reassessed the terminal level and the path for eurozone rates further out on the curve began to weigh on the euro. However, the momentum in these trades soon began to slow as President Lagarde reiterated throughout the Q&A that the ECB’s resolve to keeping rates elevated and bring inflation down to 2% “should not be doubted”, a sign that 3% is not the ultimate end point of the ECB’s hiking cycle.

This follows our view that the ECB will cease their hiking cycle in Q2 at a terminal rate of 3.25% and our latest EURUSD forecasts, which foresee the currency pair trading in the 1.08-1.10 range in Q1 as “hurdles remain before the 1.10s become sustainable”.

The market-implied terminal rate for the ECB joins that of the Fed and BoE in taking a hit after today’s decision, weighing on EURUSD

On the whole, little new information was provided from President Lagarde in the press conference in terms of the ECB’s economic outlook. Core inflation and a tight labour market remain major concerns, although the skew of risks to the inflation outlook have become more balanced due to the moderation in energy prices. While the ECB isn’t set to publish fresh forecasts until March, this is an early indication that the trajectory for HICP will be lowered.

In terms of growth, Lagarde also stated the obvious, that conditions have improved over recent months but growth conditions in the near-term are likely to remain soft due to the continued pressure on consumer purchasing power from high inflation and tighter financial conditions.

The only area in which new information was provided was in terms of the ECB’s plans for quantitative tightening. While we already knew from the December meeting that the ECB wished to wind down its Asset Purchase Programme by an average €15bn per month, further details have now been supplied.

The ECB has now stated that QT will include both public and corporate bonds. Within the PSPP, partial reinvestments will be made in a proportional manner to the overall redemption profile across national and supranational issuers, while within the CSPP, partial reinvestments will be tilted towards issuers with a better climate performance.