Morningstar: The EU will successfully eliminate Russian gas imports in the long-term

Morningstar: The EU will successfully eliminate Russian gas imports in the long-term

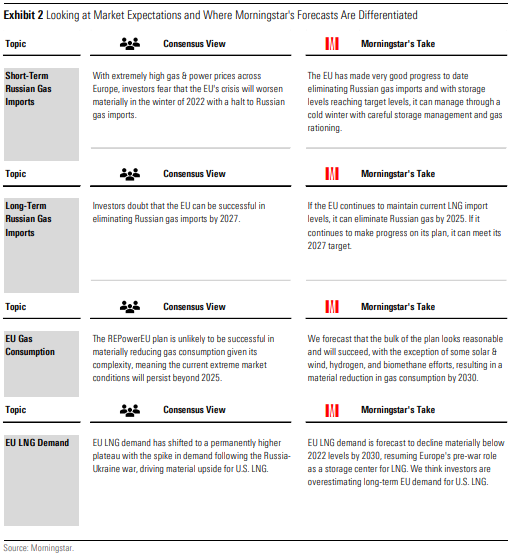

Morningstar’s latest Energy Observer assesses the impact of the Russia-Ukraine conflict on the European energy market. While the situation is impacting domestic European markets, we expect the EU to be successful in eliminating Russian gas imports in the long term.

Key takeaways:

- The Repower EU plan contains multiple significant initiatives across a wide variety of areas. Investors are rightly skeptical whether the plan can achieve all its goals. Morningstar agrees EU gas consumption will be higher than the plan expects, as initiatives regarding renewables, hydrogen, and biomethane will fall short. While we expect higher gas consumption than the Repower EU plan, our base-case forecast is well below investor expectations, as measured by the widely followed IEA forecasts. Investors and the IEA underestimate the degree of the plan's success across what we consider to be many realistic goals and the ensuing large decline in EU gas consumption over the next few years.

- This forecast has material implications, particularly for U.S. LNG exporters such as Cheniere. US LNG is a material contributor to helping wean the EU off Russian gas in the short run, but this is a demand driver that will diminish well below investor expectations in the coming years, as material initiatives from the EU chip away at gas consumption and the need for US LNG imports.

- Chief among our assessments is the overvalued nature of Cheniere. We think investors are either assuming two unrealistic scenarios in that European gas prices stay higher for longer, or assuming that European demand for LNG has changed on a permanent basis to effectively compete with Asia.

- In energy, we like Energy Transfer, Equitrans, Shell, TotalEnergies, and BP for valuation. Equitrans and Energy Transfer are cheaper, and Equitrans has a material valuation catalyst in the second half of 2023 with the Mountain Valley Pipeline entering service.

- Across utilities, we favor RWE, Engie, and Centrica. Of the trio, Centrica stands out with the strongest ratings across our criteria.

Stephen Ellis, Senior Equity Analyst, Morningstar, commented: “The current situation in Europe is an enormous humanitarian and economic crisis. The EU has not done itself any favors by not diversifying its energy imports for decades; now it has to undergo a series of painful changes in a very short time frame to address the challenges of relying on Russian gas. It has introduced the Repower EU plan, which is designed to eliminate the use of Russian gas in the EU by 2027 using a variety of demand- and supply-side initiatives. EU storage management is the exception to the rest of the initiatives, as it is a mix of managing near-term gas demand and acquiring expensive gas supply on the open market.”

Market Expectations and Where Morningstar’s Forecasts Are Differentiated