J.P Morgan: US stocks are already pricing in quite a lot of bad news

The Federal Reserve is tightening monetary policy aggressively in an attempt to slow the economy and moderate inflation. As a result, recessionary risks have risen.

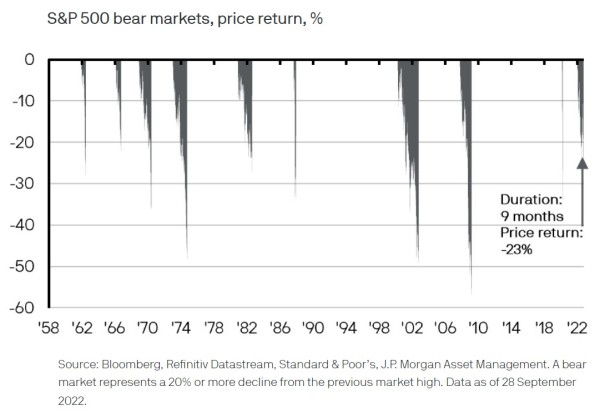

However, whilst the economic backdrop may deteriorate further, equity markets have tended to move in advance of the real economy. With the exception of the Global Financial Crisis, bursting of the dot-com bubble and deep mid-70s recession, more ‘normal’ recessionary bear markets tend to cause US stocks to fall somewhere between 20 and 35%. Given the S&P 500 is now down about 23%, it suggests a moderate recession is already largely priced in. As such, the risk-reward for equities is starting to improve.