Twelve Capital: Insights from an Insurance-Linked Securities manager

Twelve Capital: Insights from an Insurance-Linked Securities manager

Recent capital markets volatility coupled with significant global insured losses from severe weather events have highlighted the importance of both low correlation to financial markets and portfolio positioning when considering an allocation in Insurance-Linked Securities.

By Dr. Urs Ramseier, Founding Partner, CIO, Twelve Capital, and Jan Peters, Executive Director, Distribution Benelux & Nordics, Twelve Capital

Insurance-Linked Securities (ILS) are financial instruments whose underlying value is driven by insurance risk. ILS instruments provide capital market investors with access to ‘pure’ insurance risk premium. ILS are fully collateralised with no direct exposure to the credit risk of the issuer. The collateral is invested in cash equivalents or floating rate securities with the risk-free component moving with the risk-free rate. ILS are generally structured in either a tradable liquid format, in the form of Catastrophe Bonds, or more illiquid privately structured transactions.

Catastrophe Bonds are generally highly standardised and have well defined exposures with funds typically offering weekly liquidity. The risk-return profile of Cat Bond portfolios tends to be more risk remote. Cat Bonds have an average maturity of approximately three years.

On the other hand, private transactions are often highly customised with products offering a wider range of risk-return profiles. Fund liquidity is matched more closely to fit the maturity of the underlying insurance policies, that is to say annually.

Diversification in times of market volatility

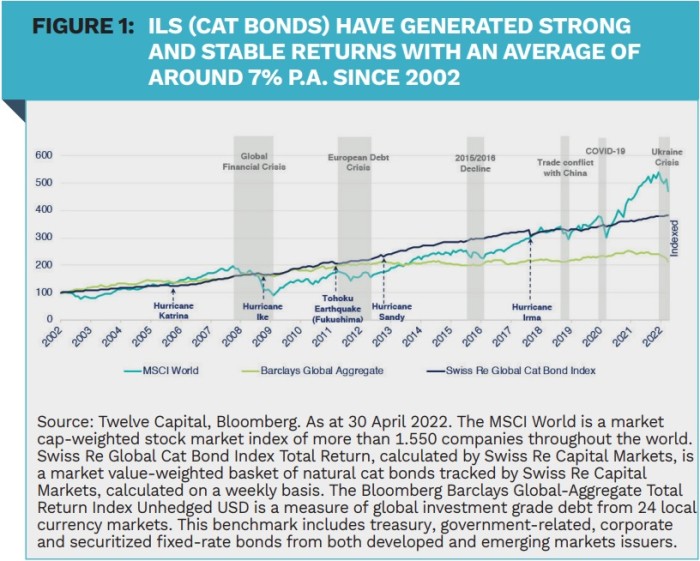

ILS offer the potential to enhance risk-adjusted returns to capital market investors by adding diversification and reducing the volatility of an institutional portfolio. The asset class remains low correlated compared to others, particularly highlighted by recent market volatility. The year-to-date 2022 performance remains positive with no significant volatility seen in indexed-returns during the Ukraine crisis, the second market event in three years to highlight such diversification benefit following the COVID-19 pandemic (see Figure 1).

ILS investments also have minimal sensitivity or exposure to interest rate or broad inflationary trends. They are generally of short duration with the invested capital in cash equivalents or floating rate securities, thus the risk-free component of return moves with risk-free rates.

Maintaining a principled approach within an established market

The ILS market was born out of the wake of Hurricane Andrew in 1992, where the number of insurance companies became insolvent highlighting the need for alternative ways to manage the insolvency risk associated with large concentrations of natural catastrophe exposed insured value – such as US hurricanes and earthquakes. A large insolvency risk to insurance companies drives higher regulatory capital charges, thereby generally producing higher associated risk-premium.

ILS will continue to drive ESG benefits by providing risk transfer to those vulnerable to large catastrophic events.

Today, the ILS market has evolved and makes up nearly 15% of all reinsurance capital and now includes a somewhat broader range of insurance exposure outside of just natural catastrophe risk, such as life, marine, energy and aviation. The increased diversification opportunities available in the market have led, in part, to more differentiation and performance dispersion amongst ILS managers, product types and risk-return profiles. The track records of proven ILS strategies are distinguishing themselves more than ever.

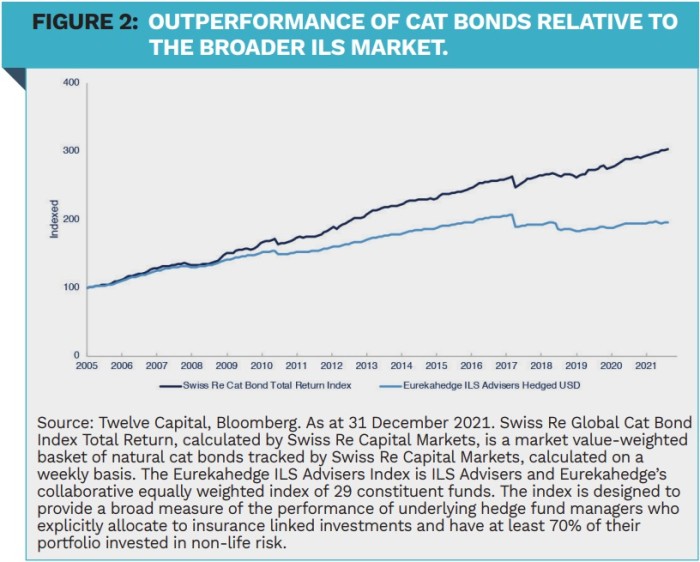

For example, the risk-return profile of the Cat Bond segment of the market as a whole still remains skewed to US hurricane risk, with a more senior risk appetite when compared to the wider ILS market. This risk positioning has led to an outperformance of Cat Bonds within the ILS segment (see Figure 2) which coupled with weekly liquidity has driven significant investor interest over the past 3 years.

A proven track record in hurricane risk transfer

The risk transfer of natural catastrophe risk from the insurance industry to the capital markets has been a guiding principle of the ILS market ever since its inception. Continuous evolution in risk quantification, risk-transfer mechanisms and regulatory regimes meant that when Hurricane Katrina made landfall in New Orleans, Louisiana, in 2005 (causing $ 65 billion in total insured losses, relative to $ 15 billion for Andrew) no insurance company was declared bankrupt1, unlike the aftermath of Hurricane Andrew in 1992.

As a result, the insurance industry is well-positioned to navigate the volatility inherent in severe natural catastrophe events with any future changes in risk likely to drive further supply-demand imbalances, regulatory scrutiny and an evolution in climate modelling and risk assessment. All of which are addressed in year-on-year risk-adjusted price considerations.

Moving forward, ILS will continue to drive ESG benefits by providing risk transfer to those vulnerable to large insured catastrophic events. The ILS managers who maintain a principled approach to risk assessment and portfolio construction will likely continue to deliver attractive low correlated returns to investors.

What to consider when allocating to ILS?

- Diversification

Largely uncorrelated to financial markets. - Transparency

Clear and manageable risk transfer. - Consistent risk-return profile

Risk appetite should be defined with an understanding of the need for capital within a wider (re)insurance context. - Modelling & uncertainty

Risk must be credibly modelled with loss causing events and subsequent pay-outs known with high conviction. - Future need for capacity

Sustainable need for capital over an investment cycle.

[1] Swiss Re: a History of Insurance, 2013/1017.

|

SUMMARY Insurance-Linked Securities (ILS) are financial instruments whose underlying value is driven by insurance risk. ILS portfolios typically contain exposure to natural catastrophe risks such as US hurricanes and earthquakes that pose concentration risks for the insurance industry, but offer diversification benefits to capital markets investors. ILS have inherent ESG benefits by supporting the insurance industry in providing effective risk transfer to those vulnerable to large insured catastrophic events. They are generally of short duration, with minimal sensitivity or exposure to interest rate or broad inflation trends. The securities are fully collateralised with no direct exposure to the credit risk of the issuer. Climate change will increasingly drive supply-demand in the future. The ability to assess and manage the impact of climate variability on ILS portfolios is key for benchmarking ILS risk-premium and return expectations. |