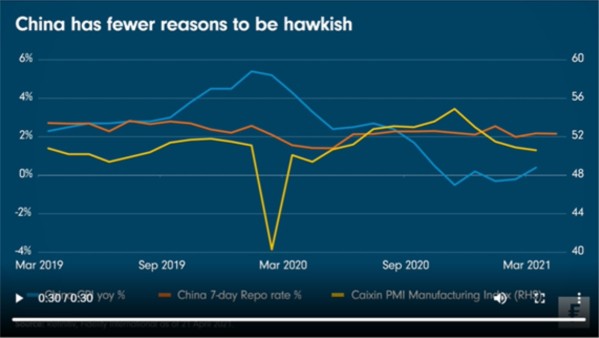

Fidelity: China has fewer reasons to be hawkish

China led the world in the post-Covid economic rebound, and the market has expected monetary policy to follow suit and tighten back to more normal levels. But so far this year, the opposite has happened - short-end rates have remained low while broad credit has rebounded. What should investors make of the mixed signals?

Before the Lunar New Year festival in mid-February, China had the best performing equity market among the major regions. Then sentiment turned due to a confluence of factors including hints of faster normalisation of monetary policy, announcement of a lower-than-expected GDP growth target for 2021 and concerns on a strengthened antitrust effort in the tech sector. In the two months since returning from the Lunar New Year break, China equities have underperformed every other major market.

Policy implications

Partly as a result, we see less urgency for the People's Bank of China to adopt a more hawkish policy from here, and several reasons why a moderate approach to dept deleveraging makes sense in the current climate, as opposed to the more disruptive deleveraging we saw in 2018.

On one hand, China’s economic recovery remains uneven, with the services sector and privately owned small- and medium-sized firms still lagging. This week’s Chart Room shows Chinese factory activity in March expanded at the slowest pace in almost a year on weaker overall domestic demand. The Caixin March PMI dropped to 50.6, the lowest level since April 2020.

On the other hand, inflation concerns are also less pressing, with the 0.4 per cent year-on-year rise in March CPI still a long way from the central bank’s notional 3 per cent target. While producer price increases have exceeded expectations, this appears largely driven by supply-side (and not demand-side) factors, and the increases aren’t feeding through to consumer prices yet.

There are pockets of concern. In the systemically important property market, where price inflation is indeed strong, the authorities are more likely to deploy targeted macro prudential measures rather than broad measures like rate hikes to stem excess credit creation. Lastly, we think the recent weakening of risk sentiment in China’s bond markets should also argue against the PBoC adopting a more hawkish tack in the near-term.

Takeaways for investors

Against this backdrop, and given their recent underperformance, we think China equity valuations have become more appealing. Value stocks such as banks and energy companies remain cheap historically as well as when compared to other markets, while popular growth stocks have corrected. The sell-off since Lunar New Year could prove an attractive entry point for long-term investors, particularly for onshore stocks that are less sensitive to movements to US Treasury yields.