Jurgen Vermeulen and Taco Lens (FMO): Critical months ahead for MSMEs

By Jurgen Vermeulen, Evaluation Officer, FMO, and Taco Lens, Senior Strategy Advisor, FMO

COVID-19 has hit small firms in developing countries hard. Most must find ways to return to profitability in the coming months as revenue losses due to lockdowns have drained reserves.

THE IMPORTANCE OF MSMEs

Micro, Small and Medium sized Enterprises (MSMEs) matter greatly across the world, but particularly so in developing countries. The World Bank estimates they provide employment for seven out of ten workers in developing countries. They also contribute large shares of total economic activity in those countries (<50%). They have however structurally faced difficulties obtaining access to finance. Development finance institutions (DFIs), like the Dutch development bank (FMO), have therefore traditionally targeted financial support towards MSMEs.

MSMEs in developing countries have taken a beating due to COVID-19. Unlike in much of the developed world, there is limited effective support there from governments for these companies. To better understand how MSMEs are adjusting to COVID-19 and what support would be appropriate in a next round of support, we launched a rapid impact assessment among MSMEs in six countries: Georgia, Jordan, Kenya, Tanzania, Zambia and Ghana. Conversations with about 900 MSME business owners and sector experts were held to gather on-the-ground insights.

WHAT IS THE PROBLEM?

The problem became acutely clear: MSMEs are in financial distress. Some 50-75% of MSMEs found it (very) challenging to meet operating expenses (including wages for their workers) and loan commitments in the first half of 2020 across the six countries. Government response measures (including lockdowns) induced by COVID19 are largely to blame for this. They created two problems:

- Drastically reducing demand for the goods and services sold by MSMEs.

- Causing difficulties to operate their businesses.

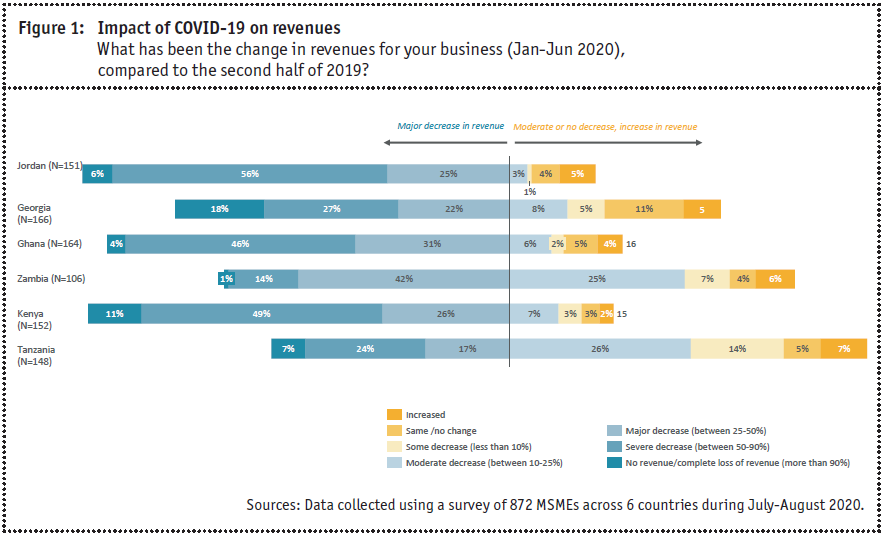

The first element has been the major cause of the problem. Some 81-87% of MSMEs have witnessed major decline in sales (>25% in HY1 2020 compared to HY1 of 2019) in Jordan, Georgia, Ghana and Kenya. The impact was relatively lower in Tanzania and Zambia due to lighter restrictions (see Figure 1). The World Bank found in their global Enterprise Surveys that MSMEs were indeed hit harder by the drop in demand than large firms: they faced a 10-percentage point greater fall in sales than larger firms. Tourism, transport, construction and select manufacturing sectors faced the biggest drop.

Lockdowns also caused a disruption of operations for businesses, notably the inability to operate during lockdowns and the inability to procure the needed inputs for production. Across countries, approximately 50% of MSMEs faced these operational struggles.

To some extent, it is ‘normal’ to see a share of MSMEs struggling. But only half of the interviewed MSMEs mentioned they had significant business challenges preCOVID-19, particularly in relation to obtaining affordable access to finance and procuring intermediate inputs. Currently, 50-75% of MSMEs are in financial distress. The two problems drivers (a significant drop in demand and an inability to operate) have thus exacerbated their struggles.

WHAT HAVE THEY TRIED TO DO THUS FAR?

Faced with their financial distress, MSMEs look for ways to improve their situation by:

- Trying to increase sales (to increase revenues).

- Adjusting operations (to lower costs).

- Refinancing their businesses.

Some 10-25% of MSMEs across the six countries acted on all three fronts, but the majority was less rigorous. Half of the MSMEs in Georgia, for example, did not take any action. Most only took workforce related action to lower costs by temporarily laying off staff or reducing their working hours.

More rigorous operational adjustments were not taken yet. Many MSMEs simply cannot adopt remote working easily: only up to 20% of MSMEs across the six countries reported to work remotely. Less than 10% invested in digitization or other long-term improvements.

The World Bank finds that this is common for MSMEs historically: most stay the same in size and business orientation. Indeed, the fraction of MSMEs that actively tried to recover sales (about 1 in 5) mostly focused on reaching new customers or reducing prices of existing products. Only MSMEs in the manufacturing sector tried to develop new products more actively, for example by capitalizing on the surge in demand for hygiene products.

WHAT IS THE OUTLOOK?

Since the main driver for the dire situation of MSMEs in emerging economies is the strong drop in demand due to social distancing measures, many MSMEs perhaps regard rigorous adjustments as unnecessary. They may assume that when measures relax, demand for their products could return quickly. That would also explain why less than 10% of MSMEs permanently laid off workers in order to allow them to scale up services fast as soon as demand returns.

In line with this view, most MSMEs express a desire for short-term financial support, such as working capital loans to tie over the crisis, and express fairly limited interest in non-financial support, such as support from consultants (on average 1 in 3 MSMEs did). If they did, they hope that third parties can help them expand their customer base to recover their income with their existing business models.

The main question is whether and when demand will return to pre-COVID-19 levels. In July and August, approximately half of the interviewed MSMEs either believed that demand recovery would take more than a year, or they were completely uncertain about recovery. Because even though most measures may be lifted currently in emerging markets, demand will not fully recover swiftly if the rest of the world is still faced with government measures. This is confirmed by recently adjusted economic outlooks. Yet, MSMEs do not have the reserves to wait for a year or longer for demand to recover. Half of them have 3 months of reserves or less and two-thirds for 6 months or less (see Figure 2).

CONCLUSION

The coming months will therefore be critical for MSMEs in emerging markets. Without adjustments, demand will have to return fast for them to recover. Yet, COVID-19 still has the world in its grip and will likely do so for the foreseeable future, leaving demand depressed. Thus, significant financial support would be needed for MSMEs to help them bridge the gap. However, many governments do not have the ability to do so and MSMEs have been facing challenges with access to finance for decades. Now more than ever, (international) financial institutions should continue their efforts to improve access to finance.

To keep their fate in their own hands, MSMEs should in the coming time be proactive and significantly change their operations (for example increase operational efficiency) to survive in a lower demand environment or adjust the business model to find new revenue sources. «