WisdomTree: That which masks the risks is irrational exuberance

WisdomTree: That which masks the risks is irrational exuberance

Mobeen Tahir, Associate Director, Research, WisdomTree

Two streets on the same boulevard – but parallel universes

Investors in the tech-heavy NASDAQ Composite Index currently have a cheery disposition. They have earned nearly 11% in total returns year-to-date. For these investors, 2020 has been a great year and life is good on Wall Street. Their next-door neighbours, investors whose fortunes are aligned with the S&P500 Index, are a bit agitated because their returns have not been equally stellar. Their investments aren’t causing them to lose sleep, because they see the graph of their index ascending quickly.

Down the road on Main Street, 20 million jobs were lost in the month of April, and only 2.8 million were gained back in May. As of the most recent data in June, US unemployment now stands at 13.3%, compared to 3.5% in February. The US economy contracted by an annualised 5% in the first quarter, according to revised estimates. Then came the lockdowns which halted all activity. Second quarter growth numbers will be more worrisome. The aforementioned gain of 2.8m jobs in May was celebrated widely on Wall Street while residents of Main Street waited for their stimulus checks from the government to put food on the table.

The two streets have been closely connected in the past. They now appear to exist in different realities. Share prices forecast future activity. This depends heavily on the state of the underlying economy. What will determine how equity returns pan out in the second half of this year is this key issue: is the market getting ahead of itself, or are stock prices correctly forecasting what might end up as a quicker than expected recovery in economic activity?

It seems that if the equity markets are right, the economy has a lot of work to do. The two have never been so far apart since the global financial crisis (see Figure 01). What is causing this to happen? And what should investors do about it?

Source: WisdomTree, Bloomberg. Data as at 17/06/2020. Historical performance is not an indication of future performance and any investments may go down in value.

Where is the Federal Reserve situated?

Is it on Wall Street? Or Main Street?

After a sharp crash in the middle of March when the coronavirus pandemic tightened its grip on markets, equities have bounced back strongly. Many have ‘bought the dip’ helping the markets turn and build positive momentum. Markets found comfort from economic forecasts by the International Monetary Fund (IMF) and central banks around the world who were quick to forecast a strong recovery in 2021.

The holy grail, however, has been the intervention from the US Federal Reserve (Fed), and other central banks around the world. The effect, if any, of monetary stimulus on the real economy is not immediate. Growth comes when people spend money. But people hold back during times of heightened uncertainty. If a person’s employment situation is perilous, it is unlikely that they will go and buy a new car or house – even when the rates are low. Monetary stimulus, however, adds an immediate liquidity injection to financial markets. But are investors adding risk to their portfolios by buying stocks because stocks are attractive or because ‘there is no alternative’? If safer alternatives have zero or even negative yields, are investors being forced to take more risk?

Source: WisdomTree, Bloomberg. Data as at 17/06/2020. Historical performance is not an indication of future performance and any investments may go down in value.

Figure 02 shows the clear relationship between US money supply and rising equity valuations. Remember, forward price to earnings ratio is the price of a share today divided by expected earnings over the next year. Savvy investors would challenge me on the usefulness of this metric when expected earnings are so uncertain. But that is precisely the point. If earnings are uncertain, a more reasonable valuation would factor that into the price.

Back in the 1970s and 1980s, when the Fed interest rates were in double digits, price to earnings (P/E) ratios for US equities were often in single digits. Over time, Fed’s monetary expansion and asset buying brought interest rates down, increasing the risk appetite among investors pushing equity valuations higher. This has generally been a steady process until this year – when the size of the Fed’s balance sheet and equity valuations have both risen sharply.

Now, the price of a share is the present value assigned by investors to future cash flows for as long as the business exists. But herein lies the crux of the discussion. These businesses still need to exist once the crisis is over. As accountants would say, there must be a ‘going concern’. Smart investing recognises the risks. That which masks the risks is irrational exuberance.

Ignoring the risks doesn’t make them go away

On Thursday, 11 June, the S&P 500 Index fell around 6% when the bleak economic outlook presented by the Fed took the markets by surprise. The CBOE Volatility Index (VIX) rose from 27 to nearly 44 on the same day as investors flocked to seek protection. Markets were lifted again on 16 June when the Fed reiterated its decision to buy corporate debt. The ‘Fed put’ came into play – yet again putting a floor under prices for them to bounce back from. The underlying economic reality remained unchanged.

A whole host of risks remain on the horizon as markets charge forward: a second wave of the pandemic may force governments to tighten lockdown conditions again; increased bankruptcies could hurt business confidence; lost jobs may not be restored; and alas the U-shaped economic recovery may morph into a Nike swoosh or a ‘W’. And did we mention the issue that plagued markets and the global economy for 2 years prior to the pandemic? Trade wars! With renewed tension between the US and China recently on the Hong Kong security bill, the issue is far from over.

A smarter approach to managing the risks

A defensive approach could help manage the risks we currently see in markets. This does not mean foregoing potential upside gains. Instead, being defensive is more akin to taking a balanced approach to investing. It means recognising the risks and building resilience in the portfolio to achieve a better risk-adjusted outcome over time. It is about having an awareness of what is happening on Main Street. It is about building a portfolio that isn’t shocked when a central bank states the obvious – like the Fed saying that the ongoing global pandemic will create economic challenges.

There are myriad ways of building such portfolios. We know the importance of doing so and have dedicated a whole section on our website to a defensive assets framework. Pierre Debru’s literature on this subject highlights the principles upon which more robust portfolios can be built.

Source: WisdomTree, Bloomberg, Data as at 17/06/2020. Historical performance is not an indication of future performance and any investments may go down in value.

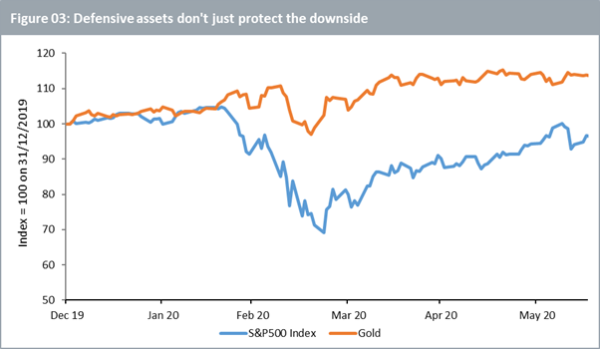

For now, I will leave you with this thought – defensive assets deliver when they are needed most. Consider gold’s strong outperformance over equities this year (See Figure 03). In a portfolio, gold does not replace equities, but complements them. Other defensive asset classes do the same – albeit in different ways. Remember the axiom ‘don’t put all your eggs in one basket’? It is something all investors need to think about.

And remember, ‘love thy neighbour’? Perhaps that is something for the residents of Wall Street to consider. Their fortunes may seem to have diverged from those of their neighbours on Main Street, but their paths will cross eventually. They have to.

Unless stated otherwise, the data source is Bloomberg as at 17 June 2020.