Dr Svetlana Borovkova: Post-corona trends and their role in immunizing your investment portfolio: Part II

Dr Svetlana Borovkova: Post-corona trends and their role in immunizing your investment portfolio: Part II

Dr Svetlana Borovkova, Probability & Partners

In my previous column, I have outline three emerging trends that, for a large part, will characterize post-corona world, i.e., the way the society and economy will operate after the coronavirus epidemic.

These trends are:

- Social transformation (cautiousness in travel, increased interest in staying and buying local, new ideas about public space, preference for car and bike use over public transport, attention to hygiene and healthcare)

- Accelerated digitalization (Digitalization of work and services, remote working, less business-oriented travel, broader acceptance of online solutions and increased importance of IT security)

- Sustainable innovation (emphasis on sustainable transformation, de-globalization, shift towards circular economy and increased demand for sustainable products)

These trends will have significant consequences for investment portfolios, as some companies are better positioned to be resistant to (or even benefit from) these trends, while others will have harder time coping with the “new world” and hence, generating value for their shareholders.

It is easy to identify sectors and industries that are better positioned with respect to these trends (e.g., Health Care or Tech) and those which will suffer (e.g., Travel and Leisure). An obvious action would be to tilt an investment portfolio towards those more resistant sectors. However, sector diversification is an important investment consideration, guaranteeing properly diversified and less risky portfolios.

To preserve sector diversification and still “immunise” your portfolio against these trends, individual companies in any sector can be qualitatively assessed and scored in terms of these trends. A critical look at the company’s operations (upstream/downstream) allows us to identify how it will be affected when each trend materializes.

For example, Danone (a leading food company) scores highly on all three trends: with consumers staying and working at home more, the demand for (healthy) packaged foods will grow. Furthermore, the increase in health awareness will boost Danone's product portfolio as its major labels are mostly health oriented, and it will benefit its medical business. Danone invests heavily in carbon neutrality, regenerative agriculture and circular economy of packaging. It also invests in its people and their communities, promoting health and inclusive growth.

Another example is BMW: on one hand, the preference towards car travel over public transport will raise demand for cars, but on the other hand, the increased digitalization and working from home means less business car travel. So the market for private vs company cars needs to be assessed carefully in this case to understand the net effect of the first two trends. In terms of sustainability, BMW does not score highly, as it is mostly producing traditional oil-fueled cars. Company does not seem to undertake significant investment in the space of electric cars or other sources of fuel.

Such an assessment is based on high level descriptions of the company’s operations. More detailed investigation, including yearly reports and financial statements, would provide an investment analyst with a more comprehensive outlook.

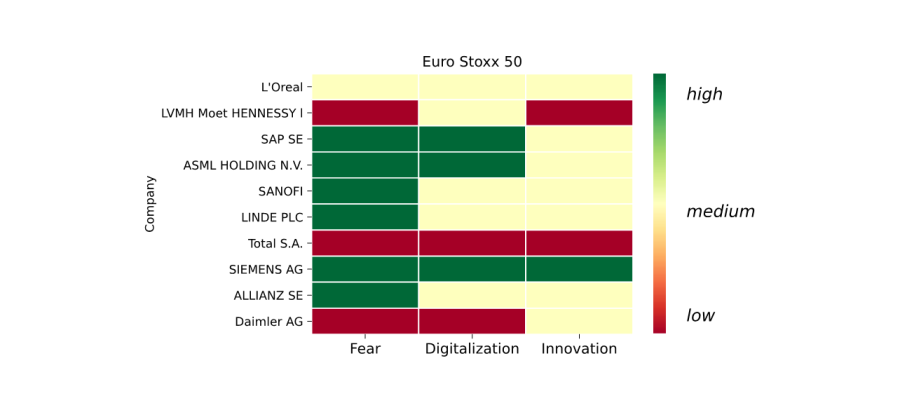

We scored a number of large cap EU and US companies for their resistance to the three trends, and an example of such a broad assessment for a handful of EU firms can be seen on the following figure. (Here green means high score with respect to a trend, yellow – neutral and red – low).

Source: Probability & Partners

With such an assessment at hand, we can think of these emerging trends as new “investment factors, alongside factors such as quality or sustainability, which have proven to perform well at the onset of the coronavirus crisis. Subsequently, portfolios can be “tilted” towards these new factors, making them more resistant to post-corona situation. This goes beyond simple sector selection and can preserve portfolio diversification.

Probability & Partners is a Risk Advisory Firm offering integrated risk management and quantitative modelling solutions to the financial sector and data-driven companies.