Reiniera van der Feltz: How pension funds are accelerating the Dutch energy transition

Reiniera van der Feltz: How pension funds are accelerating the Dutch energy transition

This article was originally written in Dutch. This is an English translation.

The energy transition in the Netherlands requires billions in investment. Pension funds can accelerate the scaling up of the Dutch energy transition with targeted green investments.

By Reiniera van der Feltz, quartermaster and strategic advisor for the Dutch energy transition

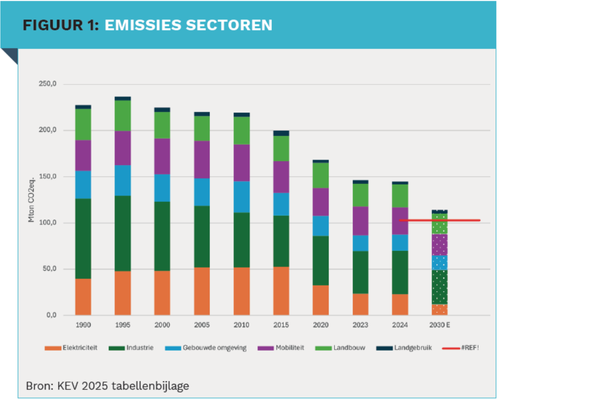

The Netherlands aims to be climate neutral by 2050. The interim target is a minimum 55% reduction in CO2 equivalents by 2030 compared to 1990 levels. The Netherlands Environmental Assessment Agency (PBL) considers the chance of achieving this to be less than 5%.1 PBL's realistic expectations for 2030 are between 47% and just under 55% reduction. So we need to step up our efforts.

Pension funds can have a major impact with their investments. Making industry, agriculture, the built environment and mobility more sustainable will lead to major changes in energy demand. Models predict that by 2050, energy demand will be 10% to 30% lower than it is today.2 This is mainly due to insulation and increased efficiency. At the same time, electricity demand will rise sharply due to electrification, doubling or tripling compared to today.

Financing grid expansion with green bonds

The National Energy System Plan (NPE) refers to creating maximum supply of renewable energy, such as wind and solar energy. The electricity grid is not suitable everywhere for transporting large quantities of locally generated energy. There is sometimes (the threat of) grid congestion, an overload of the grid at certain times. Companies cannot start or expand because they cannot obtain a (larger) electricity connection. The grids therefore need to be significantly expanded. According to Netbeheer Nederland, between now and 2050, 50,000 more transformer stations will be needed in addition to the 100,000 that currently exist. In addition, more than 670 high- and medium-voltage substations will have to be built by 2050 and more than 100,000 km of cable will have to be laid to ensure that residents and businesses have access to sufficient power.

The shareholders of the network operators (the state, provinces and municipalities) have contributed additional equity capital for this purpose. Pension funds can supplement this with the necessary loan capital. Green bonds issued by the network operators TenneT, Enexis, Stedin and Liander are ideal for this purpose (and Gasunie for the gas network). Due to their low risk profile, large size and trading liquidity, these bond loans are easy to fit into a pension fund's corporate bond portfolio.

Flexibility and storage crucial for a stable energy system

At most times, energy supply and demand are not perfectly balanced. Because wind and solar energy are weather-dependent, the energy supply is also becoming more volatile. Sometimes there is too much, sometimes too little. Future demand will also be different due to the sustainability of industry, the built environment and mobility.

In addition to expanding the grids, we need a flexible energy system that better adapts to supply. According to the II3050 (Integrated Infrastructure Outlook 2030-2050), the flexibility to compensate for electricity shortages must grow from around 3 TWh per year in 2019 to an average of 90 TWh [86 – 100] in 2050. The major challenge lies in evening demand peaks and cold winter periods, when energy demand is high and sustainable supply is low. The flexibility to absorb electrical surpluses is even expected to grow in the II3050 forecasts from around 5 TWh in 2019 to an average of 225 TWh [186 – 273] in 2050.

Flexibility does not only refer to batteries for electricity storage, but also to interconnection with other countries and conversion to and from energy carriers such as hydrogen and heat, demand management (switching off during peak demand, smart devices, dynamic tariffs), supply control (curtailment) and the use of backup power stations (e.g. gas-fired power stations that only come on during shortages or to stabilise the grid) or baseload power stations (e.g. nuclear power stations).

The Netherlands must further develop the various possible forms of flexibility. Many infrastructure projects, such as nuclear energy or very long-term storage using (hydrogen) gas in salt caverns, are inaccessible or too risky for investors. But consider private investment in innovation. Particularly in areas where the Netherlands excels, such as the production of heavy electric vehicles, saltwater batteries, flow batteries (for storage longer than 8 hours up to 60 hours), metal-air batteries, the integration of batteries into the electricity grid and heat storage. By investing in these areas through venture capital specialists, pension funds not only accelerate the energy transition, but also strengthen the Netherlands' innovative power.

In addition to expanding the grids, we need a flexible energy system that better adapts to supply.

Help make industry more sustainable with private debt

Industry is responsible for a large proportion of national emissions and often has a great need for heat for its processes. Many factories already use heat cascading, whereby high-temperature heat is reused as lower-temperature heat in another process. Where further sustainability improvements are possible with e-boilers or heat pumps, this requires careful integration into the entire production process.

Here too, sustainability requires large upfront investments. There is a good chance that your private (impact) investments will focus primarily on the “supply side”, such as electricity generation, charging infrastructure and companies that offer innovative products and services. The “demand side” consists of the companies that purchase energy. The task facing these companies in making their industrial processes, business parks, transport and real estate more sustainable is immense and is progressing more slowly than expected. It is therefore time for institutional investors to pay attention to this.

Smaller Dutch companies that want to become more sustainable usually turn to their house bank for a loan, or they pay for it out of their own pockets. However, banks are not always willing to finance such projects because of an investment horizon that is too long or a risk that is otherwise too high. When they want to share the risk of large projects, they usually turn to fellow banks to do the deal together.

The pension sector can have a huge impact if it also offers to provide private debt (in collaboration with banks). This could be a flywheel for financing the Dutch energy transition. Moreover, with private debt, you can set tailor-made conditions for the loans. Impact targets can be part of this. That is an advantage over regular bonds.

Your investments make the difference

From green bonds issued by network operators and private debt for making industry more sustainable to venture capital in Dutch innovations: your investments make the difference.

I challenge you to formulate a policy for your Dutch impact and to instruct your asset managers to seek opportunities within our national borders. By consciously investing locally, you will help the Netherlands move faster towards a climate-neutral energy system.

|

SUMMARY The Netherlands wants to be climate neutral by 2050, but there is little chance of this goal being achieved. We all need to step up our efforts. The challenges are numerous and the solutions are very capital-intensive. Equity investments alone are not enough. Debt capital is also needed. Green bonds from network operators strengthen the electricity grid. Flexibility and storage are crucial for a stable energy system. Private debt can help make the industry more sustainable. Private investments make the difference towards climate neutrality. |

1 Climate and Energy Outlook 2025

2 Netbeheer Nederland Scenario’s Edition 2025