AllianzGI: Private Credit, an all-weather asset class?

AllianzGI: Private Credit, an all-weather asset class?

Private markets have experienced significant growth over the last decade, when rates were low or even negative. We are now facing a new environment with rising concerns regarding the impact of higher interest costs on companies, especially since a majority of the debt is floating around in private debt markets.

By Damien Guichard, Head of European Private Credit, Allianz Global Investors

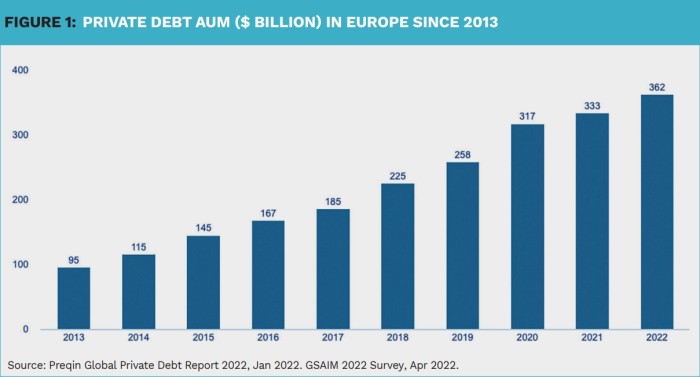

Signs of stress are emerging in the market, even affecting previously successful companies and sectors such as healthcare and tech that were perceived to be resilient. That does not mean that now is not the right time to invest in private debt. The market is expected to grow. According to research agency Preqin global private debt AUM is forecast to double its 2022 total of $1.5 trillion to a new record high of $2.8 trillion in 2028, a compound annual growth rate of 11%.1

Navigating European Private Credit

Private debt as an asset class is relatively attractive in the medium-term. Back in Q3 2022, when the European Leveraged Loan Index was below 90, it would have been difficult to argue for a significant premium in private debt versus public. But in the long run we do think that there will be a structural advantage favouring private over public debt. We sometimes talk about an illiquidity premium for private deals.

But from a borrower standpoint, it is very much about the structural advantages of going private versus public, at least for the mid-market companies. This will include ad hoc documentation, certainty of execution, no disclosure of your financials to competition, and the absence of public rating. In our view, borrowers are willing to pay up for that and this is why we maintain our belief that in the long run there will be some type of premium of private versus public debt.

One of the arguments in favour of private debt is that often the documentation is stronger, in particular in terms of covenants.

Value proposition for investors

One of the arguments in favour of private debt is that often the documentation is stronger, in particular in terms of covenants. There have been some covenant light deals within the private debt market recently, but that remains a rare occurrence.

We hope that it will remain the case, as having some meaningful covenant is really a key part of the value proposition for private debt investors.

When we look at the statistics on the public side, we observe that for leveraged loan transactions, the average leverage was probably around 5.5 times over 2020 and 2021, a bit lower in 2023. It is probable that the average leverage in private debt deals is similar. But with a stronger documentation, recovery rates should be better in the private debt markets versus the public debt markets. It’s also fair to say that in the public markets there is more opportunity to invest at the right time and to choose your entry point.

Private debt is a part of the strategy allocation. It’s an asset class in itself and you have to invest steadily in this asset class. You will get the benefit of diversification and you will probably get a decent return for the risk. But it is very difficult to do any market timing.

Charting the course: the right time and entry points

The decision to invest is very much about credit selection and process. Many strategists suggested that in the public markets the optimal time to invest in high yield is midrecession, when people are most worried about default rates. In the public market you have the opportunity to do some market timing or at least to choose your entry point.

With regard to private debt, however, you invest over a number of years. The key therefore is to be steady in your allocation with private debt and recognize that market timing is better suited for the public debt markets.

Private debt is now the instrument of choice for mid-market acquisition finance in Europe. On the supply side we see banks retreating, leaving space for direct lenders. As a result we see the private debt market becoming more mature across geographies as well.

Private credit most compelling opportunity

The most compelling opportunity going into 2024 is in private credit, where the risk-reward profile looks attractive. Just like in public credit markets, the rise in interest rates has pushed yields in private credit to levels investors haven’t been able to achieve in years.

The most compelling opportunity going into 2024 is in private credit.

Higher rates clearly also lead to stress in terms of corporate funding costs, and there are questions regarding the affordability of certain capital structures. With major bank lenders likely to grow more risk-averse in 2024, private markets investors should find opportunities to enter funding partnerships on favourable terms.

One of the benefits of private markets is the inflation protection afforded to investors by the structure of many investments, a theme which we think will remain relevant in 2024. Seeing private markets as an inflation hedge can be an oversimplification, but many of the deal structures do offer a good level of protection against inflation.

In private (corporate) credit, for example, many deals are on a floating-rate basis where payments rise in line with base interest rates, while infrastructure projects tend to have inflation-linked costs and prices.

It should be said that these are by no means perfect hedges against inflation, and they are most effective amid ‘normal’ levels of inflation (in other words: in the low single digits) rather than the spikes witnessed in the last 18 months. With inflation gradually moderating but with structural factors likely to keep it above central bank targets for some time yet, private markets can be a strong tool for addressing that concern.

1) Source: Preqin, Future of Alternatives 2028 Report, October 2023.

|

SUMMARY After having experienced significant growth when rates were low or even negative, private markets are now facing a new environment with concerns arising regarding the impact of higher interest costs on companies. Despite the higher interest costs, private debt as an asset class remains relatively attractive in the mediumterm. The key is to be steady in your allocation and recognize that market timing is better suited for the public debt markets. |