Harry Geels: Six reasons to pay with cash more often

Harry Geels: Six reasons to pay with cash more often

This column was originally written in Dutch. This is an English translation.

By Harry Geels

DNB and ECB recently released new studies into digital payment behavior. The growth of digital payments has been enormous in recent years and there are various trends that point to a further increase. To turn the tide: consider paying in cash every now and then.

Payment behavior varies enormously from country to country. The fact that more people pay with cash in some countries has practical (not everyone has digital options, or the digital infrastructure does not work adequately) and partly also cultural reasons. In Europe, Norway, Finland, Sweden, Denmark, the UK, Switzerland and the Netherlands respectively lead the rankings with the highest percentage of digital payments. However, almost everywhere, the number of digital payments is increasing, mainly due to the convenience and proliferation of the digital world.

Although the trend towards more digital is understandable, we better remain vigilant. As more and more people pay digitally, the step towards a fully digital payment circuit becomes smaller and smaller. There are six important reasons why we should also want to pay with cash.

1) Paying with cash leads to a better understanding and better handling of money

Research shows that children, but also adults, gain a better understanding of the value of money if they can hold it, pay with it and learn to count coins and notes. Cash is therefore important for general 'financial literacy'. Research also shows that paying in cash leads to less spending. People must first take it out of the ATM and carry it with them. Consumers who pay more digitally, especially with a credit card, tend to be overdrawn more quickly and build up debts.

2) With cash payments, less personal information is shared

Cash payments respond much more to the phenomenon of personal freedom than digital payments. Cash payments no longer make it easy to keep track of how often someone pays something and what it is spent on. The bank can also no longer properly calculate the environmental burden on someone's payment behavior. Banks and major retailers are hiring more and more data analysts who make analyzes based on people's purchasing behavior. These companies may also sell data to third parties who can gain commercially from it.

3) We can pay everywhere with cash

Cash is legal tender. In principle, we can use it anywhere and with anyone as a medium of exchange (one of the three functions of money), even with people who do not yet have a checking account, or organizations that can no longer open a checking account. Banks are increasingly operating as a 'moral counter', whether or not enforced by stricter regulations. For example, sex workers, starting investors (funds), or foundations that depend on donations or cash payments are finding it increasingly difficult to open accounts.

4) Cash is an outlet for citizens under evil regimes

Suppose we can only pay digitally, then the authorities will in principle have the opportunity to control the money flows. They can charge negative interest (for example as a form of tax), they can refuse or limit transactions. Of course, such things will not happen or will happen exceptionally in well-functioning democracies, but there have been 'special' foretastes, such as in Canada, where bank accounts of protesting truckers were frozen, or people were limited in their cash withdrawals during banking crises.

5) Cash is an outlet during (technical) system failures

Fortunately, it has not happened and is not likely, but suppose the entire internet experiences a prolonged outage, or a bank is hacked, making accounts inaccessible for days. Fortunately, you can still pay with cash (provided, of course, that people have sufficient cash at home, or that they can use ATMs at other banks). Disruptions can also occur in digital payment traffic, for example at peak times on special shopping days, or at the (digital) store where payment must be made.

6) Bob-a-job

Cash offers more versatile (or romantic) payment options than digital money. For example, you can pay neighborhood children for a 'bob-a-job'. Or send your children out to buy ice cream. Or cover a beautiful birthday card with coins or bills. Or give a tip to an employee who has provided good service, without it going directly into the company's bank account. Or help a homeless person on the street, or the seller of the homeless newspaper. Or what about coin collectors? They exist.

Is cash easier and safer than digital money?

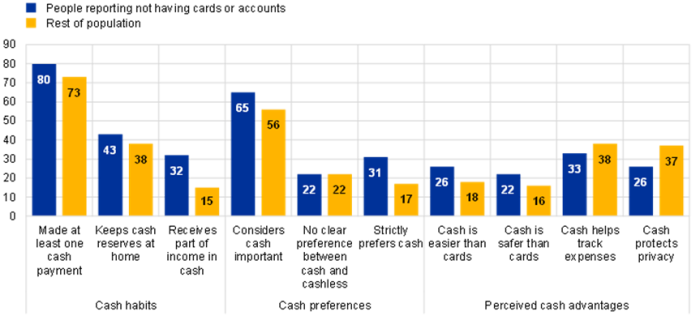

According to recent research from the ECB, almost a fifth of people in the EU still do not have digital payment options. It also emerged that more than half of EU residents consider cash important. It is also striking that only two of the above reasons are mentioned for using cash, namely that it helps to 'control' expenses and that it protects privacy. Two other benefits of cash are observed: convenience and security. These arguments are personal and open to discussion and are therefore not mentioned above.

Figure 1: Cash habits, cash preferences and perceived benefits of cash

Source: ECB

Developments that require attention

So there are plenty of arguments to avoid a completely digital payment world. And although central banks fortunately still emphasize the importance of cash, we cannot be reassured. And that is primarily due to ourselves. If we start doing everything digitally, what will stop the authorities from taking the step towards a fully digital world? Special trends are that Gen Zs and Millennials, our future, love digital payments. And that banks make depositing cash in high denominations expensive and some banks even want to ban cash.

Social unrest broke out in Australia when Macquarie Bank announced it would phase out cash in 2024. Some fintech banks, such as the emerging Revolut, do not (yet) offer cash deposit options. Furthermore, cash payments are also legally restricted. The current government in the Netherlands is working on a bill to ban cash payments above €3,000, where currently only a customer due diligence is required for amounts above €10,000. Another trend is that some sectors are increasingly allowing less cash payments.

And last but not least is the upcoming digital euro. 'Nomen is omen'.

This article contains a personal article by Harry Geels