Harry Geels: Global Titans conquer the world

Harry Geels: Global Titans conquer the world

By Harry Geels

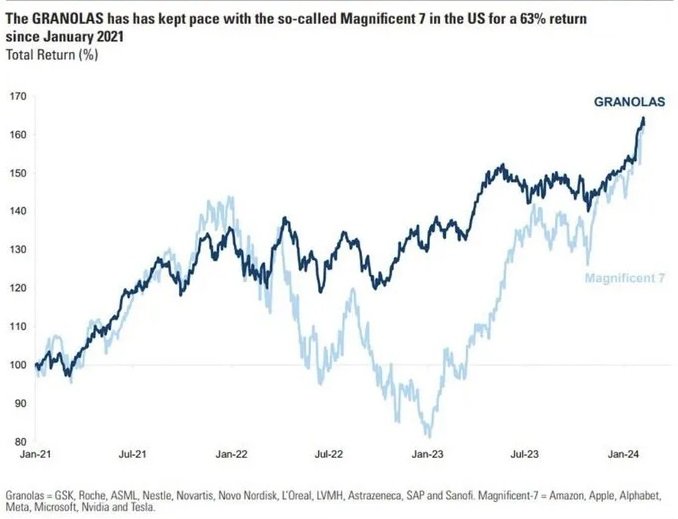

A handful of stocks (the Magnificent Seven in the US and the Granolas in Europe) are playing an increasingly dominant role in the world. This has a number of far-reaching consequences for society in general and investors in particular.

In the financial world we love working with acronyms, especially when certain investments are doing well. When the major emerging countries Brazil, China, India and Russia did so well on the stock market in the period 2000 to 2007, the BRIC acronym was coined. When Facebook, Amazon, Apple, Netflix and Google overperformed from 2014 to 2018, the FAANG acronym was quickly born (it was FANG at first, because Apple initially didn't do as well as the other four).

But FAANG no longer sufficed either, because there are now seven leading stocks, renamed the Magnificent Seven: Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Telsa. Netflix apparently no longer fit the narrative. These types of labels actually have a high opportunistic element. Of course, Europe cannot lag behind. There are also some well-performing megacaps grouped together here. After some puzzling, the Granolas acronym was devised for GSK, Roche, ASML, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP or Sanofi.

Six social consequences

Whether we call the large (American) shares FANG, FAANG or Magnificent Seven (and it's nice that there are apparently well-performing megacaps in Europe too), something fundamental is going on in society: the emergence of increasingly larger and more powerful companies. We also speak of a corporatocracy, which violates the principles of the free market. This has all kinds of social consequences. If the power of those companies undermines the free market, it will lead firstly to less innovation and secondly to more fragile economies.

Nassim Taleb explains in his book Antifragile that a robust system, for example an economy, benefits from so many diverse entities that if one collapses, the continued existence of the system is not threatened. Many sectors now only consist of oligopolies, in which technology and the 'winner takes all' principle have created increasingly powerful companies that are no longer allowed to collapse, because this has too many negative consequences for the rest of the system.

Other consequences of megacaps are moral hazard (if companies are too big to fail, they can take too big business risks that - if they go wrong - can be transferred to society), a shift in the balance of power from consumers to companies (for example that megacaps are increasingly gaining more pricing power), increasing inequality (larger companies have larger salary structures, with often mega salaries at the top), and the disappearance of the level playing field (megacaps can plan better tax-wise and attract better employees than smallcaps).

Three consequences for investors

But the rise of megacaps is also a headache for investors. Firstly, these megacaps weigh so heavily in all kinds of indices that active investors can quickly experience a huge deviation from the index ('active share') if they do not like one or more megacaps. This can lead to major underperformance (which in turn leads to all kinds of discussion) or to outperformance (which is usually met with skepticism: 'it must be luck'). In other words, active investors must largely endorse the corporatocracy, even if they do not want to do so for all kinds of reasons.

Secondly, this presents a challenge for sustainable investors. Because what if you want to avoid the Magnificent Seven, for example because you find the salary buildings, the enormous energy or water use of the digital storage centers, or Tesla's governance model unsustainable? The sustainable investor then has to go to great lengths to justify these types of mega caps in the portfolio, otherwise the active share will become too large for them. 'Fortunately' the megacaps have deep pockets to appoint sustainability officers and the like: they know exactly how to provide the right answers in the ESG field.

Thirdly, there are fewer and fewer small companies on the stock exchange, because investors and banks are (forced to) focus on the large ones. Anyone who wants to collect the supposed small cap premium will have to go to the private markets.

But it can also change

'Things can change,' Bredero once said. The world is changeable. Look at BRICS. When everyone was well invested in it, things came to a standstill, mainly due to the Great Financial Crisis. In Brazil due to corruption and political unrest, in China due to growing pains, Russia is leveling itself out and South Africa is in danger of becoming a second Zimbabwe. Only the Indian stock market performed satisfactorily.

Something like this could of course also happen with the Magnificent Seven or the Granolas, although that is not yet obvious. As mentioned, the world is changing, partly due to technology and AI. Three system forces are now interfering with the currently existing corporatocracy: neo-egalitarianism, conscientious capitalism and (techno)feudalism.

We don't know exactly what will result from that. Social developments are always achieved through action and reaction. In the meantime, it seems wise to follow Warren Buffett's wisdom: 'The single-most important decision in evaluating a business is pricing power. If you've got the power to raise prices without losing business to a competitor, you've got a very good business. And if you have to have a prayer session before raising the price by a tenth of a cent, then you've got a terrible business. I've been in both, and I know the difference.'

So you might as well join the trend of investing in powerful megacaps, at least if it doesn't raise ethical concerns.

This article contains a personal opinion from Harry Geels