JP Morgan AM: Rising shipping costs could stall goods disinflation

The sharp fall in goods inflation in the second half of last year drove a large part of the move lower at the headline level. But the recent attacks in the Red Sea have increased the risk that this disinflation stalls.

The attacks have forced commercial shipping to reroute from the Suez Canal around the Cape of Good Hope. For a container ship from Shanghai to Rotterdam this lengthens the voyage by eight days and adds half a million dollars in fuel costs.

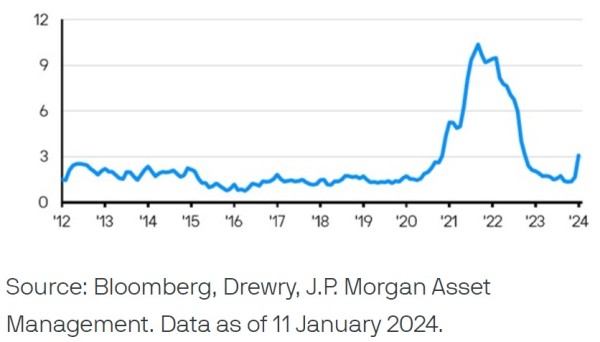

The Bloomberg WCI freight index has almost doubled since the start of the crisis. But costs are only a third of their 2021 peak and with China still exporting deflationary pressure the bar for a sustained acceleration in goods inflation remains high. That said, the longer shipping costs remain elevated, the greater the inflationary risks become.