Harry Geels: Five extraordinary developments in 2023

Harry Geels: Five extraordinary developments in 2023

This column was originally written in Dutch. This is an English translation.

By Harry Geels

It is part of the financial markets' tradition to look back at the past investment year. There are five developments that stand out. The question is what they mean for investors going forward.

In the financial world, around the turn of the year, people always look back and forward, on the previous and new investment year respectively. There is always a lot to say and it is not always easy to make a choice. Realizing that it is a personal choice, I see five striking developments and provide an overview in five pictures with associated messages (for the future).

1) Suddenly there is a new (AI) hype (from which especially only a handful of stocks benefited)

2023 has become a special investment year for shares. After a bad 2022, expectations were not high. Inflation and interest rates had risen sharply and investors were mainly on the sidelines at the beginning of the year, partly because a banking crisis (see point 3) broke out at the beginning of the year. But in the end it turned out to be a good investment year, with the MSCI World Index rising by around 20%.

That performance could be attributed to two causes. In the spring, investors were taken in quite opportunistically by the AI hype, which mainly benefited seven major US technology stocks, and in the fall by positive reports from the Fed that inflation appeared to be coming under control and that a number of interest rate cuts were planned. Investors then put money (again) into technology stocks (and bonds).

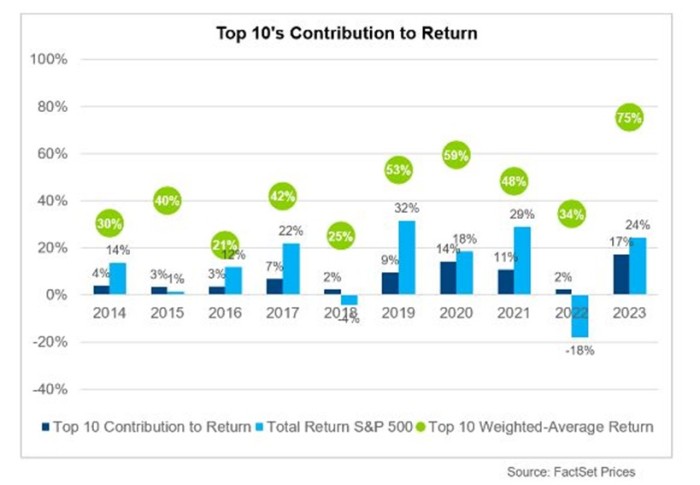

In 2023, only a few shares were responsible for the increase in the well-known indices. With regard to the S&P-500, for example, three quarters of the increase can be attributed to ten shares. In jargon: the 'market breadth' is limited. This last happened on this scale in the late 1990s (although the situation is now even more extreme). The generals have advanced. 2024 can only be a good investment year if the soldiers follow suit.

Figure 1: The S&P's top 10 largest stocks accounted for 75% of the rise in 2023

2) The 60/40 portoflio is not dead (as it turned out in the year Markowitz died)

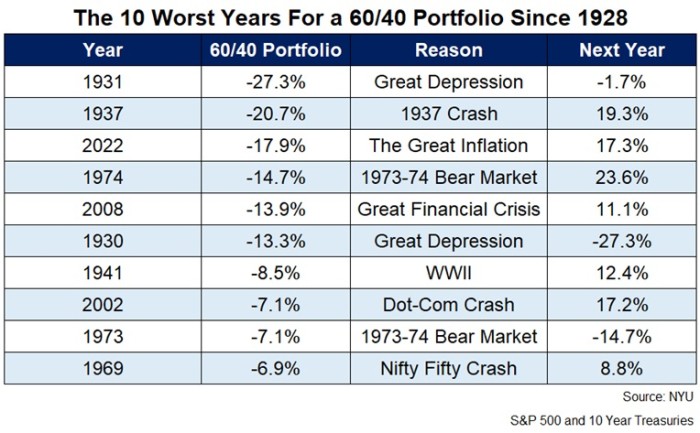

2023 has also become the resurrection of the diversification principle. The usefulness of diversification is regularly demonstrated by the performance of a 60/40 portfolio (consisting of 60% shares and 40% bonds). This portfolio has been declared dead in recent years, mainly because the diversification power of bonds would no longer work, as they entered a 'bear market' in August 2020.

But after the announcement of a likely looser monetary policy in 2024, November suddenly saw the best (bond) month since 2008, although this required the largest ever bear market in bonds. The end result was that the 60/40 portfolio (in dollars) had one of its best years ever. It shows how quickly the old investment principles are suddenly restored, and that in the year that Harry Markowitz, who received the Nobel Prize for demonstrating the usefulness of diversification, died (July 22, 2023).

Figure 2: The ten worst years for the 60/40 portfolio with returns from the following year

3) Yet another banking crisis (banks are and remain volatile-cyclical businesses)

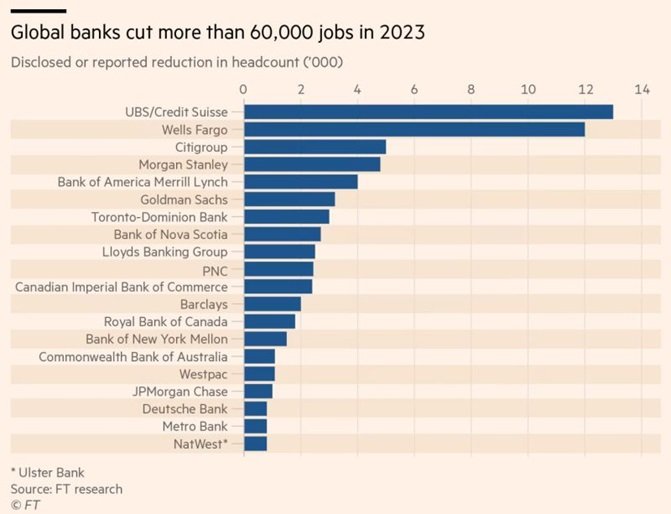

Due to the sharp rise in interest rates (especially in 2022), American banks (especially smaller ones) suddenly ran into problems at the beginning of 2023. A number of rescue operations had to be launched. Credit Suisse (CS) also had to be rescued in Switzerland by a takeover of UBS, although CS had run into problems mainly for reasons other than rising interest rates. There are several lessons to be learned from the latest banking crisis, for example, that banks are never safe from turmoil.

Meanwhile, banks worldwide are undergoing major reorganisations. The banking sector must become much less dominant. The European banking sector is still "overbanked," as recently stated by Elizabeth McCaul, member of the Supervisory Board of the ECB. Professor Arnoud Boot made a similar point in an interview in the latest issue of Financial Investigator magazine. Banks are therefore likely to remain volatile investments in the coming years.

Figure 3: Announced bank reorganisations worldwide by 2023

4) The sudden decoupling of gold (from yields, inflation, etc.)

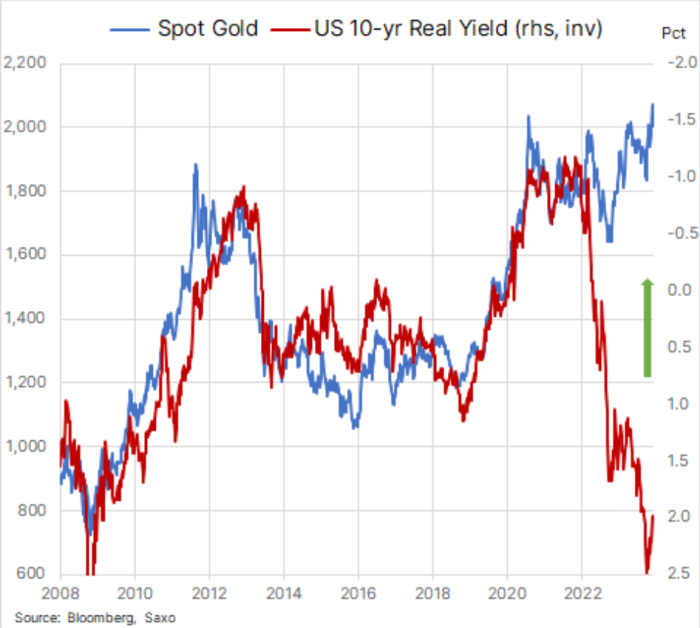

Gold had a remarkable performance last year. The gold price actually reached an "all-time high" after rising about 10% (for the record, that is less than 2% above its highest point three years ago and only 10% above its highest point 11 years ago). Several reasons have been put forward, including agitation over rising inflation, rising doubts about the dollar as a global reserve currency, the recent banking crisis, the war between Hamas and Israel, and sales by China and Russia of U.S. Treasuries with the alleged repurchase of gold as (monetary) reserves.

Normally, gold does not do as well as stocks do. But other well-known correlations are also "broken," such as the one with short-term interest rates: the lower the interest rate, the more is usually invested in gold. As Figure 4 shows, in 2023 interest rates rose hard (shown by the red line representing the inverse of short-term interest rates), while gold also rose. If the correlation still holds, gold or short-term interest rates (or both) should start falling hard.

Figure 4: Gold price versus US T-bills 10-yr

5) Five outstanding country achievements (elections matter, especially in emerging countries)

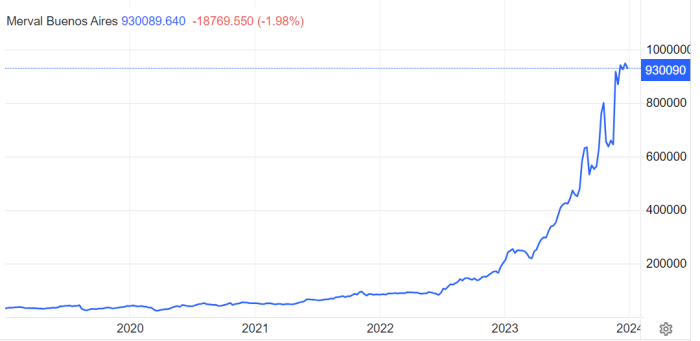

Finally, a number of striking country achievements. In 2023, the top 5 consisted of respectively Argentina (+50%), Poland (+45%), Japan (yen hedged: +43%), Greece (+40%), Mexico and Italy (more or less equal: + 35%). Most of these countries held elections last year (or at the end of 2022), electing governments that favor freer markets and make their countries more accessible to investment.

Figure 5: Argentian Merval Buenos Aires Index

This article contains a personal opinion from Harry Geels