Harry Geels: Three reasons why inequality is decreasing again

This column was originally written in Dutch. This is an English translation.

By Harry Geels

New research shows that income inequality in the West is decreasing. The most likely causes are the tight labor market, deglobalization and better measurement methods.

In the last two weeks, the Economist published a number of articles about income inequality and the labor market, including one about an alleged economist battle over how exactly to measure inequality and one about a new 'golden age' of workers. The gist was that inequality has recently decreased. Let's list the three most likely causes for this and then make some forecasts for the future.

1: Tight labor markets

The tight labor market can be explained by the 'great resignation' (during the COVID-19 pandemic, many people left the labor market who are unlikely to return), the aging population (which causes a relative decline in the working population), the new view on work of the younger generations (who prefer to be 'gig workers' or part-time workers and especially want to do a lot about their personal development), and governments (which continue to expand).

According to a study by Autor, Dube and McGrew, the tight labor market mainly has a positive effect on the 'lower' layers of the working population. Figure 1 shows that the income increase here has been much faster than that of the middle incomes and the top 10%. According to the researchers, as of 2020, two-fifths of the accumulated inequality over the past four decades has now been made up for. By the way, it's not just the tight market. The increases in minimum wages have also made a positive contribution.

Figure 1

2: Deglobalization

Globalization has been associated with an increase in wage inequality for several reasons, for example because Western workers have come to compete directly with workers from Third World countries, especially in industries where labor can be easily outsourced. In the West, this competition has put downward pressure on real wages, especially for low-skilled workers.

Furthermore, companies that want to reduce their costs often outsource or offshore certain tasks to countries with lower wages. While this can lead to cost savings, it can result in job losses or wage stagnation for workers in countries with higher costs. Offshoring created more room in the West for policy officers who are usually better rewarded. Now that deglobalization trends are visible, the (negotiating) position of the local labor factor is improving again.

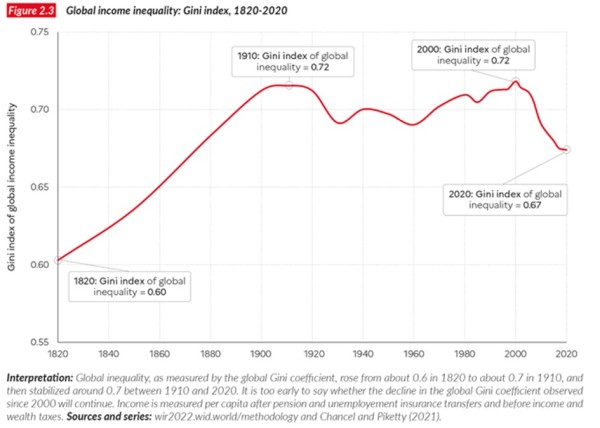

Moreover, globalization in the West (until a few years ago) has led to increasing inequality, but on a global scale it has actually caused inequality to (significantly) decrease. The GINI coefficient, an important economic benchmark for measuring inequality, is on average for the world at its lowest point in the past hundred years (the lower the more equal). So on a global scale, the statement that inequality has increased is not true at all, and has not been for years.

Figure 2

3: Better measurement methods

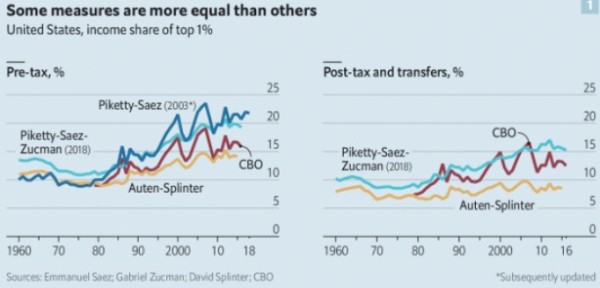

Many studies have been conducted on inequality in the last ten years. One of the most important sources on which the community based its perception of increased inequality were the studies of Thomas Piketty. The Economist cited recent research by Auten-Splinter showing that after various (logical) corrections, for example, the very richest category in the US has grown much less than Piketty predicted.

Figure 3

In an old column I stated that Piketty makes a number of errors. He does not correct capital and income growth for its risks. If we do, capital growth will compare much less favorably versus income growth. Furthermore, Piketty does not take into account the starting point of wealth. Capital growth really works, especially for the really rich. But most importantly, Piketty does not make a good analysis of the causes of inequality.

A forecast

Solving inequality starts with the correct root cause analysis. The main causes are the aforementioned globalization (for the West), but also the ultra-loose monetary policy since the 1980s (including all the 'Greenspan puts' for the financial markets) and the ever-growing companies that, often in oligopolies, build larger pay structures. The solution to inequality does not lie in more taxes, but primarily in stricter anti-competition rules and 'more normal' monetary policy.

Whichever way we look at it, inequality has of course increased, especially in the US. And it is encouraging that three causes now appear to show that a turnaround is underway. Deglobalization and tight labor markets do not appear to be simple trends that will quickly reverse. The data issues are mainly optical: we must realize that people with strong political opinions always like to use studies that fit their ideology.

And two more trends are visible that could be relatively more positive for lower wages than for higher ones.

Firstly, AI, which puts the now relatively high rewards for thinking and policy work (versus manual labor) into a different perspective. Secondly, the global pursuit of a fairer fiscal level-playing field. However, that is not only up to the legislator, but also to consumers and investors. No more buying products from or investing in companies that have too large a salary structure (huge factor between the lowest and highest paid in a company) or that do tax avoidance.

This article contains a personal opinion from Harry Geels