JP Morgan AM: Higher rates not necessarily detrimental to long-term investors

JP Morgan AM: Higher rates not necessarily detrimental to long-term investors

At the Federal Reserve’s September meeting, the 'dot plot' of policymaker views indicated that US rates may stay higher over the medium term than previously thought.

For investors used to a decade of low rates this might ring alarm bells. While the adjustment to higher rates can create short-term volatility in risk assets, history indicates that higher rates are not necessarily detrimental to long-term investors.

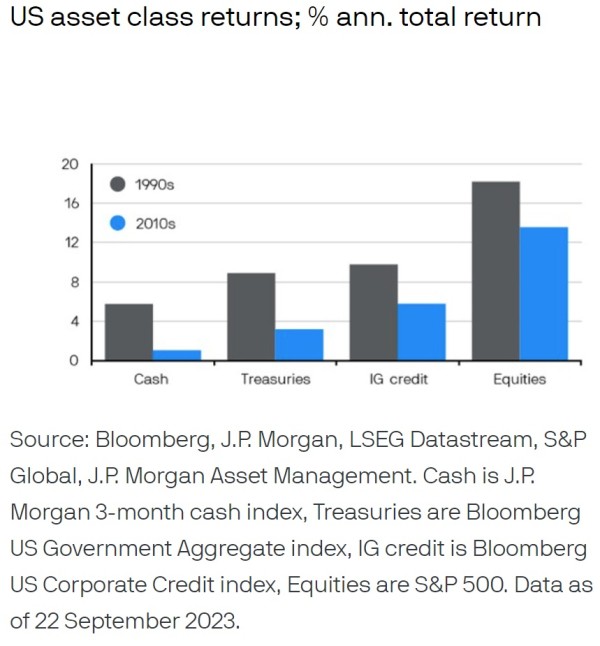

Sustainably higher rates are a sign of robust economic growth, and in this scenario higher risk-free rates can help deliver stronger returns across the board. In the 1990s, where economic growth and cash rates were sustainably higher, investors enjoyed better performance in all asset classes than they did in the 2010s.