Achmea IM: Insight into the effect of ESG on performance

Achmea IM: Insight into the effect of ESG on performance

This article was written in Dutch. This article is an English translation.

ESG integration has become an integral part of the equity portfolios of institutional investors. This raises the question of what the effect of sustainability is on the return and risk of portfolios. More and better sustainability data is also becoming available, which creates the opportunity to align portfolios with investors' sustainability objectives. And machine learning techniques help to provide insight into the contribution of sustainability and other investment choices to returns.

By Dennis Thé, Head of Equities, and Mark Voermans, Senior Portfolio Manager Equities, both working at Achmea Investment Management

Sustainability integration within pension fund equity portfolios often takes place via passive solutions. Think of climate indices such as climate transition benchmarks, Paris aligned benchmarks and indices based on the SDGs. It is important that:

- With more specific sustainability data becoming available, we are able to incorporate more specific sustainability objectives into a portfolio.

- Control over unintentional and unwanted portfolio exposures can be achieved through quantitative portfolio construction.

- Machine learning techniques provide insight into how the positions in the portfolio have come about (the contribution of the various components of the portfolio construction to the position) and the contribution to the performance of ESG integration (such as exclusions, CO2 reduction and improvements from portfolio exposures to specific ESG themes).

Alignment with relevant sustainability themes

At their core, ESG indices are often constructs of best-in-class investments around a particular theme and are based on exclusions. They select companies that perform relatively well within their peer group (often a sector), but that does not make it a quality mark. For example, the MSCI World Climate Action and the MSCI World Climate Change (for 3.2% and 0.3% respectively) still invest in the energy sector, including companies such as TotalEnergies and Chevron Corp. It is a misconception that companies with a high ESG rating are always sustainable.

What plays a role in this is the question of whether an ESG index actually produces social impact. Is an ESG index sustainable? Opinions on this vary quite a bit and we are also skeptical about this. However, that doesn't mean we should say goodbye to ESG investing.

SDG 13 (Climate Action) and SDG 7 (Affordable & Clean Energy) are preferred SDG themes among pension funds, as are SDG 3 (Good Health & Well Being) and SDG 6 (Clean Water) (source: VBDO). The question is how these preferred themes translate into an ESG index. Investors looking for exposure to multiple themes find it difficult to use a generic ESG index, because the companies that score best on one theme do not always do so on the other and vice versa.

How is it possible? It is better to opt for an approach in which the most appropriate ESG data points are identified. By doing this for each preferred theme, companies are selected that score well on average on several themes. This allows a so-called sustainability factor to be created. This sustainability factor can then be used with its own weight in portfolio construction to select stocks. This brings the portfolio in line with the sustainability objective and (SDG) preferred themes.

The sustainability factor is used in the same way as traditional return factors (such as value, momentum and quality), but serves a different purpose.

We answer in the affirmative to the question of whether there are enough good data points available, without suggesting that it is all perfect. A few things are certain in our view:

- The quality and amount of ESG data is only increasing.

- Where on an aggregated level the ESG scores of the various data providers correlate low, this is often clearly higher on the underlying data points. So by selecting precisely these data points (at the theme level), it is possible to build a good portfolio with a more solid link to the sustainability objectives.

- There is a better insight into the individual risks to which companies are exposed, such as physical risks such as water stress for companies located in areas where climate change hits hard.

Control over portfolio and risk exposures

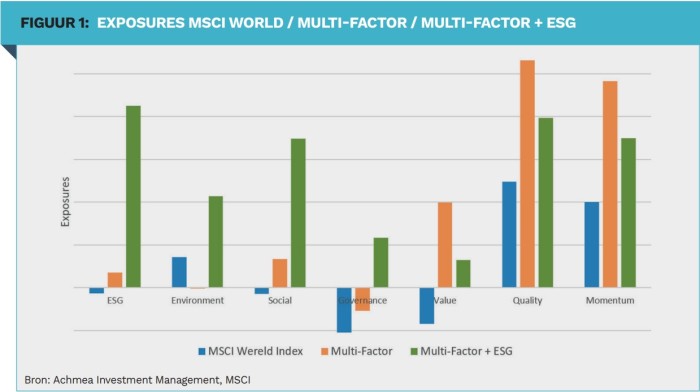

Many institutional investors use the MSCI World as a benchmark. The choice for ESG indices and/or customized indices creates deviations in sector and country weights and other risk or style exposures. Excluding individual companies or countries will therefore result in exposure deviations. That in itself is not a problem, as long as it is a consciously accepted risk. For example, the MSCI World Climate Paris Aligned and the MSCI World Climate Change invest close to the MSCI World in terms of country and region exposures, but invest more than 5% less in the energy sector and more than 5% more in IT. These indices also deviate in terms of factor exposures such as value, momentum and quality. The MSCI World Climate Paris Aligned and the MSCI World Climate Change both have less value exposure and less momentum exposure than the MSCI World, while the MSCI World already scores poorly on value from its construction (market cap investing invests more in relatively expensive companies) . The question is whether these deviating style exposures are in line with the investment beliefs of an institutional investor. We see in our multi-factor portfolios that it is possible to build exposure to ESG without losing too much style exposure.

Required approach: sustainable and robust A quantitative approach offers solutions. Unlike a market capitalization weighted index, this provides good opportunities to control portfolio and risk exposures. This brings these exposures to a desired level, both in absolute terms and versus the exposures of the generic market benchmark. In our view, sustainable investing in liquid equity portfolios requires an integrated approach in terms of sustainability objectives, risk and return (style exposures), and diversification (such as sector country exposures). An approach that goes beyond passive investing in a generic ESG index.

Performance attribution

Our methodology, in which we integrate sustainability objectives into portfolio construction via a sustainability factor, provides more insight and explanation both during portfolio construction and in the accountability. Machine learning techniques make it possible to indicate per share which parts of the portfolio construction (styles or restrictions) have determined the portfolio weight.

In addition, such an approach, using performance attributions, provides insight into the contribution of the sustainability factor to the return. The attributions also provide insight into the contributions of other ESG integration components (such as exclusions and/or CO2 reduction policies) and portfolio construction components (restrictions and style exposures). This makes the role of sustainability integration in the realized return more transparent and demonstrable.

|

SUMMARY ESG indices are by no means always sustainable and do not control return and risk exposures. A sustainability factor provides a more direct link to specific sustainability objectives and provides insight into the contribution of sustainable stock selection to the realized return. More and better ESG data are helping pension funds to concretise their sustainability ambitions. |