Tikehau Capital: Decarbonisation and driving value in private markets

Following COP27, momentum has risen dramatically in the energy transition sector, with many investors looking for net-zero portfolios and solutions that will help finance the transition to a net-zero economy. Financial Investigator asked Pierre Abadie, Group Climate Director at Tikehau Capital, about the recent trends and drivers for growth in the energy transition market and the ways in which private markets can aim to take advantage.

By Esther Waal

What is decarbonisation and what makes it so topical in the current environment?

‘Decarbonisation, which is the reduction of greenhouse gas GHG emissions in the atmosphere, including CO2, is essential to limit global warming. In practice, this will require a major systemic shift from fossil fuel usage to alternative, low-carbon energy sources.

According to scientific consensus reported by the Intergovernmental Panel for Climate Change (IPCC), climate change presents a threat to human well-being and the planet1. The 2015 Paris Agreement aimed to respond to this by implementing targets for the global reduction of greenhouse gases. Specifically, to limit the increase in global temperature to no more than 2°C above pre-industrial levels and attempt to maintain it below 1.5°C.

Following the Paris Agreement, governments and businesses have made further commitments to reduce CO2 emissions, and many large corporations have publicly declared their intention to become carbon neutral by 2050. In our view, decarbonisation has therefore become a global imperative for society at large; recognised and accepted as a vital process for limiting global warming.

However, while incremental progress is being made in the race to net-zero at global, national, sector and local levels, recent estimates suggest we are all falling short of Paris Agreement targets. And – despite a massive influx of capital into the decarbonisation investment sector – a significant financing gap still exists at a global level. In North America, for example, it is estimated that building a net-zero America will require at least $ 2.5 trillion in additional capital investment into energy supply, industry buildings and vehicles over the next decade2.’

The climate investment universe appears saturated. Where is value in the sector?

‘Following COP27, momentum has risen dramatically in the energy transition sector. The pace of development and marketing of climate-focussed financial products has sharply accelerated, and many institutional investors are now aiming for net-zero portfolios by 20303.

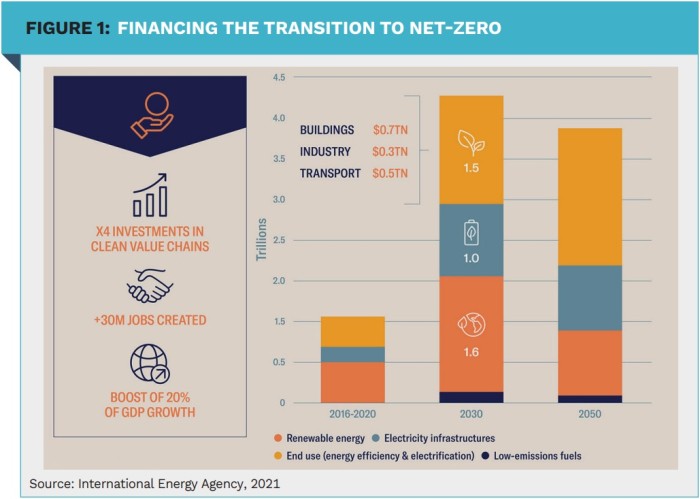

Given that valuations of companies operating in the decarbonisation space have escalated to an all-time high4, it would be reasonable to assume that it is impossible for investors to find real value. However, according to the International Energy Agency (IEA), every year more than $ 4 trillion will need to be invested globally between now and 2030 to finance the transition to a net-zero economy, which is significantly higher than the circa $ 1.5 trillion that was invested per year between 2016 and 2020, as illustrated in Figure 1. This shows that a sizeable financing gap still exists and demonstrates that pockets of opportunity remain, particularly in private markets.’

How is the current geopolitical situation affecting the energy transition market?

‘The war in Ukraine continues to seriously threaten European energy security. In our view, there has never been a more urgent need to sever international reliance on Russian fossil fuels.

We believe a simple and effective model exists to achieve energy security both quickly and efficiently, for any country that wishes to do so. The first step is to focus on reducing energy consumption in buildings and factories, which are heavily reliant on fossil fuels. By renovating these buildings, it is possible to generate energy efficiencies by switching to electricity for heating, cooling and production systems. This is also facilitated through the adoption of more sustainable materials that are better at preserving heat and recycling energy.

The second part of the model to reach energy security is to increase the use of both wind and solar sources. There are still some administrative stumbling blocks inhibiting progress in Europe, such as laws related to land accessibility for solar panel implementation. But if these rules are relaxed, we believe the shift to solar energy could be accelerated.

Crucially, the urgency in Europe to accelerate the energy transition and gain independence from Russia’s fossil fuels is likely to increase momentum in the US energy transition. We believe higher oil and gas prices produced by the war in Ukraine are also affecting the American consumer’s purchasing power and making the transition to renewables even more necessary in the short term.’

How does private equity lend itself to the decarbonisation transition?

‘According to the IEA, most CO2 emissions can be avoided with the use of existing technologies5. That is why private equity, specifically growth equity capital investment in viable, established businesses, naturally lends itself to the decarbonisation opportunity.

Such growth equity strategies typically invest from € 20 to € 100 million in profitable businesses with a well-established track record looking to accelerate sustainable growth. Other strategies, such as venture capital, tend to focus on new technologies to create products and services that will support the transition to a cleaner economy, but aren‘t completely proven yet, and therefore carry a much higher degree of development and market acceptance risks in the short term.’

How does your organisation approach this opportunity?

‘As part of our commitment to reach € 5 billion assets under management in climate-focused strategies by 2025, we have expanded the scope of our successful growth equity energy transition strategy, T2 Energy Transition, to have exposure to deals in North America. This global strategy builds on our success in Europe by investing equity capital into private companies whose product- or service offerings are expected to facilitate and benefit from the global transition towards an affordable, reliable, and cleaner energy mix.

The existing T2 strategy6 provides equity capital for 11 portfolio companies operating across the full breadth of the energy transition universe, predominantly in Europe. Its portfolio companies have developed energy efficiency solutions, increased renewable energy supply, and expanded low-carbon mobility. This is evidenced through less energy consumption, greener energy, and cleaner transport.

More broadly, we have launched a wide range of funds in this sector operating across infrastructure, regenerative agriculture, real assets and direct lending. From different angles, they each provide capital to companies contributing to the reduction of global carbon emissions.’

1 Source: IPCC Working Group II Sixth Assessment Report, 28th February 2022

2 Source: ‘Net-Zero America: Potential Pathways, Infrastructure, and Impacts’, Princeton University, December 2020)

3 Source: Preqin, Global Private Equity Report 2022

4 Source: Preqin, Global Private Equity Report 2022

5 Source: International Energy Agency, ‘Net-Zero by 2050’, 2021

6 Please note that the first vintage of T2 Energy Transition is no longer open for subscription. The successor strategy is currently in pre-marketing

|

SUMMARY A significant financing gap still stands in the way of reaching the Paris Agreement targets. This financing gap provides pockets of opportunity, particularly in private markets. The urgency in Europe to accelerate the energy transition and gain independence from Russia’s fossil fuels is likely to increase momentum in the US. Private equity and venture capital can help finance businesses working to accelerate the energy transition. |

| Important notice: This publication is intended as a marketing instrument and does not satisfy the statutory requirements regarding the impartiality of a fi- nancial analysis. This document is not an offer of securities for sale or invest- ment advisory services. This document contains general information only and is not intended to represent general or specific investment advice. Past perfor- mance is not a reliable indicator of future results and targets are not guaranteed. |