NN IP: Remaining cautious at the start of the year

NN IP: Remaining cautious at the start of the year

The November “rally in everything” came to a sudden end in December, when equities as well as fixed income instruments posted negative returns. Commodities, on the other hand, did relatively well; both gold and copper rose.

Central banks slowed the pace of rate hikes, but they spoiled the year-end party with their hawkish comments.

The European Central Bank sounded especially hawkish, which prompted us to push up our expectations for the terminal rate from 3% to 3.5%, despite the growing number of signs, including December CPI numbers, that headline inflation has passed the peak.

Fed Chair Jerome Powell, from his side, wants to see the US labour market cool off, which will need more policy tightening. We expect the Fed to reach a terminal rate of 5%-5.25% in Q1 of this year.

The biggest surprise came from the Bank of Japan, which expanded the band on the 10-year government bond yields from +/-25bp to +/-50bp. This looks like the BoJ’s first step towards policy normalization and eventually towards abandoning its yield curve control policy.

How long will central banks stay at the terminal rate? Market pricing indicates end-of-year rates below the peak. This is highly uncertain and will depend on the inflation dynamics. We expect inflation to normalize as some of the drivers dissipate.

Supply chain issues are clearing up, inventories are rising, and given the declining trend in house prices, we expect shelter inflation to cool down as well. Inflation expectations remain well-anchored and a wage-price spiral has not kicked in despite still-tight labour markets. A key factor is the speed with which inflation normalizes and whether a recession is needed for this to happen.

We think it is too early to add to equities. The earnings outlook for 2023 is negative and we think earnings growth will be well below current consensus estimates. Revenue growth will slow, and margins will come increasingly under pressure.

European natural-gas prices dropped sharply in December, helped by mild temperatures, improved storage levels and an agreed price cap. However, the energy crisis is not over and will continue to weigh on consumption, profitability, and investments. Governments are trying to alleviate the pain by providing stimulus, but they must also keep an eye on public finances. Debt sustainability remains important; if it is ignored, as the UK painfully learned, the bond vigilantes will do the job and refocus politicians.

International politics is another risk factor. No solution is in sight for the conflict between Russia and Ukraine and escalation risk remains high.

Trade relations between China and the US have soured with the introduction by the US of export controls of technology products. Domestically, China has abandoned its zero-Covid approach, which has led to a surge in infections and put the medical infrastructure under pressure. The re-opening of the border for international travel as from 8 January is worrying other countries, several of which are taking additional measures against inbound travelers from China.

The good news is that mobility seems to have bottomed out in major cities. China may see a growth recovery beginning at the end of Q1. The property sector is not out of the woods yet, although more stimulus is likely. Chinese growth is crucial for the evolution of cyclical commodities and global growth.

Finally – and here we are entering the left tail of the risk distribution – is the risk that central banks could cause a financial accident down the road and drain liquidity from the financial system.

What does this mean for our tactical asset allocation? The first few months will probably be difficult for investors. Cash returns have become positive again and offer a short-term alternative. US real yields are positive. Monetary policy will be on a tightening trend for another quarter, and economic and earnings growth are on a declining trend. The global political situation remains challenging with tensions in different areas.

This explains why we currently have a cautious asset allocation, with an underweight in equities and a neutral stance in the other asset classes. An underweight in equities is also the message from our top-down signals, which are negative. At the same, however, we believe several variables will either stabilize, as is the case with monetary policy, or improve, as with the growth outlook. This could lead to a bottoming process for risky assets and eventually a sustained rebound.

Equities

In the short term, we maintain our cautious view for global equities. The market may remain under pressure from at least two angles: earnings and monetary policy. Other risks include escalation in the Russian/Ukraine conflict, trade tensions with China, and regulatory risk. Finally, growth risks are rising. The IMF expects a third of the world economy to be in recession in 2023.

A sustainable turnaround needs to see a clear downward trend in inflation, a pause in policy tightening, and a bottom in growth sometime in the middle of the year. The peak in headline inflation is probably behind us, but the progress in core inflation may be much slower keeping central banks on guard. We expect a few difficult months ahead, after which the market could find a bottom in the first part of 2023.

From a regional point of view, we upgraded the Eurozone to neutral. Recently we saw some positive signs that could help the region’s relative performance. Gas prices have declined sharply over the past two months and economic data are exceeding expectations, implying that the recession in Europe could be shallow. However, the ECB will remain hawkish over the next couple of months and hike policy rates well into restrictive territory to combat inflation. This increases the risk of overtightening.

Developments in China could also influence European equities. The accelerated re-opening may lead to an economic rebound as from the end of Q1 after a period of Covid-related weakness. In the medium term, as we approach the peak in Fed hawkishness and nominal growth slows down, we expect the US to regain some of its attractiveness relative to the non-US markets.

On a sector level we steer a cautious course in the short term by overweighting defensive sectors (health care) at the expense of interest rate sensitives (real estate, communication services). We also prefer industrials over materials. In the medium term, profitable growth sectors may regain their leadership status if real bond yields move lower.

Fixed income

Bond yields rose in December, especially in Europe and Japan. Given the high volatility and low liquidity, we stayed neutral throughout December.

Currently we observe a noticeable difference in the Fed’s forward guidance and market expectations. The Fed reiterated in the latest minutes its determination to fight inflation and cited the low probability of rate cuts in 2023. Market pricing, however, implies one or two rates cuts before the end of 2023; in other words, the market considers recession, rising unemployment risks, and lower inflation pressure more likely than the Fed does.

While we are not planning any outright positions in rates markets, we expect the 10-year Treasury-Bund spread to tighten further because of a more hawkish ECB, increasing Eurozone bond supply, and lagging inflation dynamics. Our quantitative models are also more bearish on Bunds than Treasuries, given the European economy’s resilience and investors’ sentiment.

Credit markets continued their strong rally in December. In our quantitative models, European credits recovered on the back of bullish sentiment and strong momentum, whereas US credits stayed flat due to their higher exposure to monetary policy and financial conditions. Nevertheless, a bearish earnings outlook and less attractive valuation make us somewhat less bullish on credits. In addition, the ETF flows data flipped from quite positive to moderately negative for most intra credits, highlighting investors’ cautiousness. Therefore, we stayed neutral in fixed income spreads across the spectrum.

Real estate

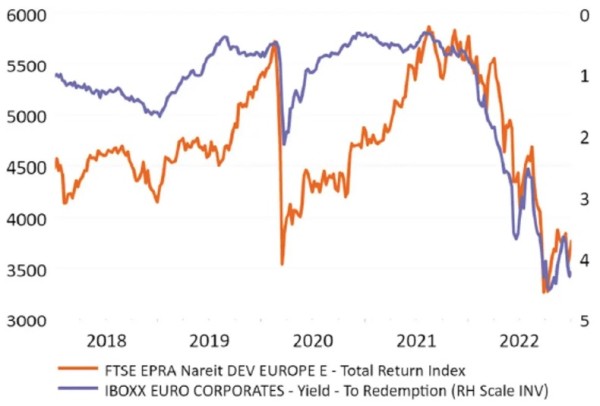

We are neutral in real estate. Real estate has been correcting sharply, with bond yields rising swiftly and hawkish central banks frontloading rate hikes. Real estate has also underperformed equities significantly.

We maintain our underweight position for the medium term. With central banks on a firmly hawkish path and near-term inflation still high, little support can be expected on the interest-rate front. Valuation versus corporate bond yields remains unattractive in the US. The earnings yield and the dividend yield versus 10-year Treasury yield is below its long-term average. Expected earnings growth for global RE next year is negative at -5%.

US EPS is expected to fall by 13%. The US National Association of Home Builders index, a gauge of builders’ views of home sales conditions, fell further in December. Soaring prices and rising interest rates have caused housing affordability to deteriorate notably. EPS for Eurozone real estate is expected to fall by 6% in the next 12 months and is likely to decline further on weakening growth.

Earnings momentum is negative in the US and in the Eurozone, and banks in both regions are tightening lending real estate standards. Fourth-quarter credit standards tightened further across the board.

Figure 1: Corporate bond yields and real estate returns (Europe)

Source: Refinitiv Datastream, NN Investment Partners

Commodities

We are neutral commodities. Opposing forces are at play in the complex. On one side looms the real risk of recession, which historically has been a drag on commodities, mostly on the cyclical segments – energy and industrial metals – and in agriculture. These recession concerns will remain in focus and be fuelled by hawkish central banks and the possibility of demand rationing as Russia cut gas flows to Europe.

Commodities also face lingering uncertainty regarding China’s lockdowns and its unresolved property crisis. Sharply higher US real interest rates and a much stronger US dollar also form headwinds.

On the other side, physical markets are tight, and curves are in backwardation. Inventories are low. In China, policy stimulus is increasing and the reopening has been brought forward with the scrapping of zero-Covid measures. Also, with the EU ban and the G7 price cap on Russian crude oil coming into force, supply disruption risks remain high while investor positioning is low across the complex.