SSGA: Do markets care about the US Midterms?

By Elliot Hentov, Head of Macro Policy Research, State Street Global Advisors

The consistency of the US electoral calendar offers a longer set of data series on how markets respond to changes in policy expectations. For first-term presidents, the third calendar year – i.e., the year after the midterms – tends to generate the highest equity returns during the four-year cycle, with an average of around 20% annual gain (covering the post-1948 period).

The common explanation for this phenomenon is that the midterms generally deliver a divided government, which ensures policy predictability in its aftermath. The upcoming year is likely to mirror this pattern, but not necessarily for the above reason.

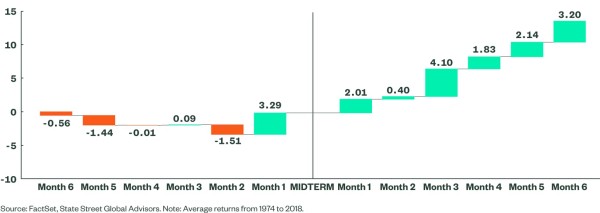

Figure 1 illustrates the short-term pattern of equity performance six months prior to and after the midterm elections. Markets tend to gain confidence about the election outcome in October and start rallying. In 2022, too, the pre-midterms followed this pattern albeit with much more volatility. Returns for October were near 8% after dropping nearly 10% in September. This begs the question: will the post-election returns follow the same pattern?

Figure 1: Average Returns 6 Months Before and After Midterm Elections Since 1974

For financial markets, the election outcome is relatively clear in that the Republicans will gain control of at least the House of Representatives, ensuing a likely political gridlock. While it is still unclear whether Democrats will continue to control the Senate, the outcome will have limited relevance for the prospect of legislative initiatives. But this is certainly not news, as polls and President Biden’s approval rating have been signaling it for several months. This implies that market performance is likely to hinge on macro dynamics rather than on policy implications.

In the near term, this is more likely to be a headwind to risk assets before offering an entry point during the first half of 2023. From a policy perspective, a divided US Congress is likely to diminish chances of fiscal stimulus regardless of an economic downturn, and an annual fiscal drag of about 0.4% of GDP should continue through 2024 (possibly accentuated by a government shutdown). In short, we are skeptical that the classic monthly pattern will hold, whereas the annual performance should align more closely as markets recover when the economy bottoms.

Midterms Could Raise Debt Ceiling Event Risk

The composition of the US Congress will not only affect the fiscal path in the coming two years but also a slew of other issues. Foremost, the next Congressional period will need to raise the debt ceiling again. After the Congress raised the debt ceiling by US$2.5 trillion in December 2021, the renewed lifting is currently expected to be needed latest by next summer. In other words, the debt ceiling will return as a market driver a few months earlier. However, this time, the political risks of an accident are much higher. Republicans wish to tie the debt ceiling to popular changes to energy policy, whereas Democrats believe Republicans will be blamed for any market turbulence.

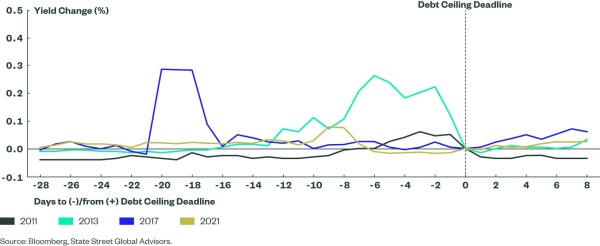

Over the past decade, the increased politicization of the debt ceiling has heightened market sensitivity. For instance, recent debt ceiling disputes are causing earlier and greater risk premia in the short-term Treasury market (Figure 2). However, this risk premia do not even address the tail risk of a calamitous financial accident in the political game of chicken. Only a renewed lifting of the debt ceiling during the November-December lame duck session could remove this market risk.

Figure 2: Change in 1-Month Treasury Bond Yields Around Debt Ceiling Deadline

Other Issues to Watch Out For

Foreign policy is the domain of the President, but Congress controls spending, including on foreign aid. The US has already committed to over US$40 billion in humanitarian and military aid to Ukraine and some Republicans have warned that future funding would be reduced. Even in such a scenario, we do not see a material impact on the outcome of the war, as future funding would only reach Ukraine by mid-2023 (at the earliest) when the battlefield is likely to have stabilized.

Other issues to monitor include the politicization of ESG regulation. While meaningful changes are emanating at the state level, a Republican Congress is likely to highlight ESG regulation and perhaps slow the pace of decisions over the course of 2023-24. Similarly, a Fed-induced recession in 2023 could invite more Congressional scrutiny. Only one seat on the Fed’s Board of Governors needs to be filled during the next Congressional session, but high inflation and a downturn expose the Fed to greater politicization.

Finally, the US midterms should set out the risks of a constitutional crisis in the 2024 elections. Here the outcomes of governor races in key swing states (such as Arizona, Nevada, Pennsylvania and Wisconsin) matter and will serve as signposts for the institutional integrity of the next presidential election.

Investment Implications

In contrast to previous US midterms and despite the recent market rally, we caution to wait for a later entry point into equities. In 2018, equities bottomed just around the date of the final rate hike, not before. An annual outperformance in 2023 is likely, but there is more monetary tightening to come before a market bottom. Risks around debt ceiling may provide opportunities to sell short-term Treasuries and together with global geopolitics, this justifies adding some tail risk insurance.