NN IP: Financial system risks increasing

Expectations of even tighter monetary policy, further evidence of a serious slowdown in global growth, concerns about rising financial system risks and a new escalation in the Russia-Ukraine war explain why risky assets remained under severe pressure over the past week. Global equities lost another 5%, while the 10-year Treasury yield rose by 30 bps. Against this backdrop we made no changes to our multi-asset model portfolio.

A difficult environment for risky assets

Recent data from the US, including stronger-than-expected September payrolls, suggest that a dovish pivot by the Fed is a long way off. Meanwhile, Fed Vice Chair Lael Brainard warned that the necessary speed of Fed rate hikes could create more stress in the financial markets and a sharper-than-expected slowdown in growth.

We are closely watching the market turmoil in the UK, where the Bank of England had to step up its gilt purchases over the past week, and capital outflows from the emerging world. While financing problems are intensifying across the world, global trade is declining much more rapidly than had generally been anticipated. South Korea – which because of its diversified product and geographical trade exposure can be seen as a good proxy for global trade – reported a 12% year-on-year export decline in the first ten days of October.

Still underweight equities

With global growth falling fast and financial system risks increasing as interest rates continue to rise, we maintain our underweight in global equities. One reason for this is that we still believe that 2023 earnings estimates are too high. Earnings season kicks off in the US this week, and guidance will be important.

This quarter might be the first in which companies feel comfortable enough to come out with bad news. After all, there are plenty of excuses that they can use: high energy prices, the global growth slowdown, adverse currency movements, weak financial markets, high inventories and, of course, geopolitics.

In addition to earnings headwinds, the rapid tightening of financial conditions is putting further pressure on valuations. The US market is most vulnerable in this respect as it is still trading in line with its 20-year average and at a sizeable premium to the rest of the world.

Upside risk for bond yields

In fixed income, we closed our large and long-held underweights in both rates and credit two weeks ago when bond yields reached our target levels. We chose to take profit and await key macro data, such as this Thursday’s US CPI figures, to assess whether the narrative of sticky inflation and rising rates would continue to hold.

For now, we still see significant upside risk for bond yields. A higher-than-expected CPI print combined with the labour market remaining tight would probably increase market expectations of the Fed becoming even more hawkish. The market pricing the Fed Funds rate above 4.5% for a longer period would probably create more upwards pressure on Treasury yields. In such a scenario, Bund yields would be likely to rise as well.

Problems for emerging markets

While it is expected that any possible Fed pivot will be delayed again due to the September payrolls data, there is increasing evidence that the Fed’s hawkish stance is causing problems outside the US. Higher US bond yields and the Fed’s determination to tighten policy more have led to a sharp appreciation of the dollar: the trade-weighted US dollar index has risen by 20% over the past 12 months. Recently, this has triggered several countries, including Japan, South Korea and India, to intervene in the foreign exchange markets to prevent their currencies from falling further.

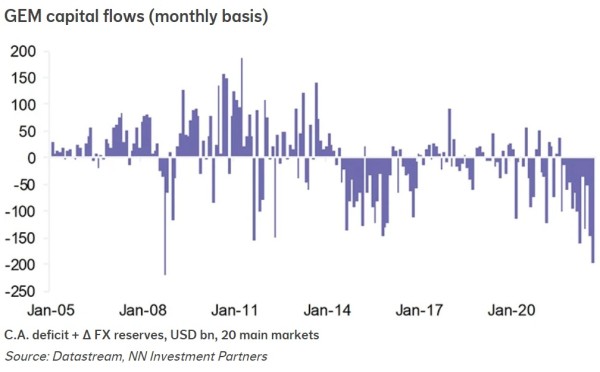

As global investors reduce their risk exposure due to increasing uncertainties and more attractive Treasury yields, and central banks sell some of their US dollar reserves, capital outflows from the emerging world are increasing. In fact, this has been happening since the Fed made its hawkish pivot in December 2021, although outflows have been accelerating since Fed rate hike expectations started to rise sharply in August. In Q3, total capital outflows from emerging markets hit USD 400 billion, the highest quarterly figure ever. And there were USD 200 billion of outflows from the emerging world in September alone, only slightly below the figure at the peak of the Global Financial Crisis in October 2008 (see figure).

GEM capital flows (monthly basis)

C.A. deficit + Δ FX reserves, USD bn, 20 main markets

Source: Datastream, NN Investment Partners

No crises – yet

It’s thanks to emerging markets’ much-improved overall external position that the capital outflows have not yet led to major balance-of-payments crises. But this does not mean that none will occur.

So far, most emerging-market central banks have been prudent in frontloading rate hikes and keeping pace with the Fed’s policy tightening. This is one of the reasons why domestic demand growth has remained subdued, preventing a widening of external imbalances. At the same time, export growth has been strong thanks to the pandemic-induced boom in global goods demand and the spike in commodity prices. But with global trade now falling sharply, seriously affecting export revenues, the trade balance in most countries is likely to deteriorate.

On top of this, more capital is flowing out, so without central bank intervention, emerging-market currencies will fall further. This will make imports more expensive, with the result that inflation will remain high, forcing central banks to keep interest rates high. In this kind of environment, economic growth is likely to continue to struggle. This is why we forecast average economic growth in the emerging world to remain soft at 4.5% in 2023.

Countries to watch

However, we are becoming more concerned about the outlook for countries that continue to adopt reckless economic policies, such as Turkey and Argentina, or that have large twin deficits, such as Colombia and Egypt.

The monetary financing of large fiscal deficits in Argentina and aggressive monetary and fiscal policy easing in Turkey are leading to structurally high inflation in these countries and their currencies to fall sharply. In the current environment, the pressure on these economies will increase further. Colombia and Egypt are different as their policymakers, despite having made mistakes in the past, are now implementing a relatively orthodox policy mix.

The problem in these two countries is that their fiscal and external imbalances have not been addressed for a long time: far-reaching reforms are required but are not materialising for political reasons. In Colombia, the new government has promised social reforms that might even increase the imbalances in the short term. Meanwhile, Egypt’s large deficits can only be financed with support from the Gulf states.

While macro imbalances in the emerging world look manageable overall, they are critical in Turkey and Argentina. The situation is also serious in Colombia and Egypt, but with a combination of orthodox monetary policy and bold fiscal policy choices aimed at longer-term reduction in expenditure and short-term increases in revenues, major financial crises can still be avoided.