State Street SPDR ETF: Going to Japan, seeking doves in a world of hawks

US Federal Reserve (Fed) Chair Jerome Powell’s speech, at the Jackson Hole Symposium, swiftly removed any hopes that the Fed will turn dovish in the coming months. As a result, US equity markets quickly reversed the gains that were posted earlier in August. Meanwhile, Europe is awaiting a potential 75bps rate from the ECB.

As policymakers’ commitment to fight inflation has dampened market sentiment, investors could seek out regions that are less affected by the challenges related to rising prices and monetary tightening. Japanese resilience to inflation, in CPI terms, has been remarkable so far this year. Economists expect CPI to average 2.0%, which is significantly below the high single digit numbers expected for both Europe and the US. Low inflation allows the Bank of Japan (BoJ) to remain on its dovish course and keep its key rates around 0. This scenario enables companies to access cheap financing and supports equity valuations that, despite relative outperformance this year, remain undemanding with 12-month forward earnings yield at 8.2%.

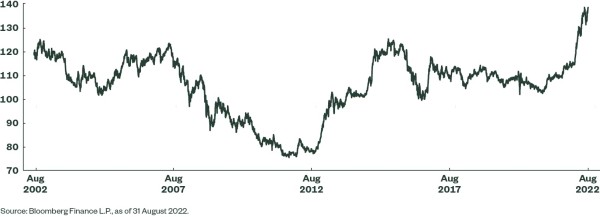

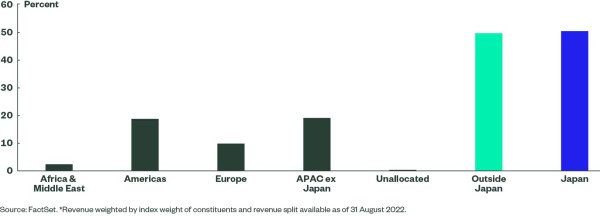

The divergence of the BoJ’s approach has led to sharp depreciation of the yen, which trades around a two-decade low against the US dollar. While currency is always a double-edged sword, it is expected that a weak yen continues to act as a supportive factor, given nearly 50% of revenue for companies within MSCI Japan comes from outside the country. This environment allows businesses using US dollar-denominated contracts to benefit already in the revenue line while global companies, which generate revenue and bear costs in foreign currencies, should see a positive impact upon translating bottom line earnings to weaker yen. The negative effect of a depreciated currency on local demand is mitigated by fiscal spending from a record state budget of JPY 107.6 trillion.

The gradual loosening of COVID restrictions has allowed Japan to benefit further from certain reopening dynamics, particularly in tourism, which may also impact the broader service sector to some extent. And the weak yen certainly makes Japan an interesting destination for tourists and investors alike.

Figure 1: USD/JPY Exchange Rate

Figure 2: MSCI Japan Revenue Split by Region*

Ryan Reardon, Senior Smart Beta Strategist at State Street SPDR ETFs:

“For investors seeking exposure to Japanese equities, or the wider Asia Pacific region, but who are worried about short-term volatility, a Dividend Aristocrats® approach should be considered. The SPDR S&P Pan Asia Dividend Aristocrats UCITS ETF offers investors the opportunity to play a long Asia Pacific exposure with a higher indicative dividend yield of 4.59% (a 178bps premium to the market benchmark MSCI All Country Asia Pacific Index). While the ETF is nearly neutral on Japanese equities overall, the stock selection within Japan tends to lean more defensive, toward sectors such as real estate.”