PineBridge Investments: ESG in Asian Fixed Income Investing

PineBridge Investments: ESG in Asian Fixed Income Investing

Asia’s ESG landscape is evolving. In recent years, the region’s largest economies have announced timelines toward carbon neutrality, measures to reduce greenhouse gas emissions, and investments in cleaner energy sources, electric vehicles and other green technologies in a bid to stem climate change.

By Arthur Lau, Co-Head of Emerging Markets Fixed Income and Head of Asia ex Japan Fixed Income, PineBridge Investment

Asia occupies a unique spot at the intersection of sustainability and finance. The continent is home to 60 % of the world’s population, two of the world’s top three energy-consuming countries, and a growing trillion-dollar credit market.1 At the same time, 99 of the 100 riskiest cities for environmental and climate-related threats are located in Asia.2

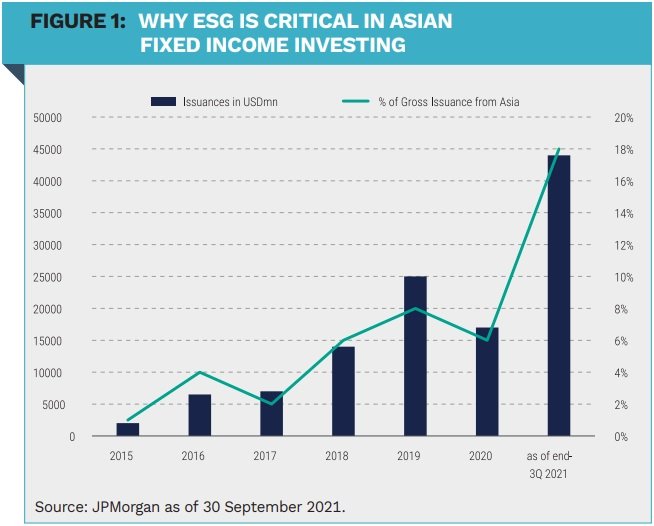

The United Nations estimates that developing Asia-Pacific economies require an additional investment of $ 1.5 trillion annually to meet the Sustainable Development Goals by 2030.3 Reflecting the financing gap and the regulatory push, Asia saw a surge in issuance of ESG-related bonds in 2021. These bonds offer opportunities for international investors to gain exposure to a new potential alpha source in Asia fixed income. When the Hong Kong government issued $ 2.5 billion in green bonds in 2021, European and US investors cornered a third of the total issuance.4

This investment environment presents exciting new frontiers. On one hand, capital dedicated toward ESG investments is growing. On the other, opportunities for capital appreciation increase as companies bridge ESG gaps. For now, it is a case of large amounts of money chasing few assets, which could lead to disappointment if investors are not carefully vetting the ESG processes of the underlying businesses they’re investing in and the securities selectors they’re engaged with.

The integration of ESG factors into investment processes is still relatively new in Asia compared to the US and Europe, given a limited understanding of its benefits and a relative lack of commercial motivation, among other reasons. Yet our experience investing in Asian fixed income for nearly two decades has shown that ESG factors have a measurable impact on outcomes in areas such as credit quality, defaults, and spreads.

Environmental: driven by regulation and investor demand

Regulations and institutional investor demand are the main drivers of environmental considerations in Asia. In certain sectors (including energy, metals and mining, and utilities, among others), environmental factors play an increasingly critical role, due to growing awareness of climate change and sustainable financing. Staying on top of environmental regulatory changes is key in Asia. In recent years, the Chinese government has put greater emphasis on sustainable growth, including imposing stricter environmental regulations. But companies’ noncompliance could be costly and pose an investment risk. In addition, Asia’s pivot to renewable energy has created opportunities in fixed income. We participated in an issue by one of the largest pure-play renewable energy generation platforms in India. With renewable energy a key priority for the Indian government, supportive regulatory measures in recent years have been positive for the bonds. Several international long-term investors also became shareholders, providing capital to support growth.

Social: a growing focus

Social factors typically have a small, short-term impact on businesses. However, social policies have taken greater priority in some governments’ agendas. China’s pivot toward ‘common prosperity’ policies in 2021 underscored the focus on sustainable and fair business practices. While the policies have upturned the afterschool tutoring and online gaming industries, as well as the economically important property sector, over the long term, sectors and businesses aligned with these new policies are expected to benefit from opportunities.

Governance: gaining a higher profile

The governance element continues to be a major focus in Asia, mainly because of the large number of issuers that are government-owned, family-owned, or part of intricate cross-share-holdings. We believe a proper assessment of corporate governance is critical in Asian fixed income investing. For example, the ownership structure can have direct implications on default risk. We encountered a case where an issuer marketed itself as a ‘state-owned enterprise’ during a bond roadshow, but then declined to discuss details of the formation of its board of directors.

China’s pivot toward ‘common prosperity’ policies in 2021 underscored the focus on sustainable and fair business practices.

State-owned enterprises may offer creditors added confidence in the form of a potential backstop or an implicit guarantee by the parent entity in the event of financial difficulties or default. This also allows the issuer to price bonds at a tighter spread. In this case, however, we found that the issuer’s shareholding structure was complex and determined that the company does not meet the definition of a state-owned firm. Our analysis led us to pass on the bonds, which later defaulted.

Asia’s evolving ESG landscape

Asia is narrowing the gap with other regions in ESG. Market regulators and securities exchanges have established a variety of requirements for ESG disclosures for listed companies. China is now one of the largest green bond markets in the world, while Hong Kong issued the first long-dated sovereign green bond in 2021, with a 30-year tenor, which is viewed as key in building a comprehensive benchmark curve for future issuers in Asia. Yet challenges remain. For now, we have yet to see a consistent green/ESG bond premium in Asia green bonds. Sustainability-linked bond issuances are a positive development, but issuers often have below-average ESG characteristics and have set out sustainability targets which, if not met, could result in a coupon step-up at a specific year (usually close to the final year).

Investors also still face some hurdles in Asia, including the alignment of domestic ‘green’ definitions with international principles, limited diversity of the types and sectors of issuers, and limitations related to transparency and credit ratings. That said, we expect growing investor interest in sustainable investing in Asia will drive greater focus on ESG for issuers, investors, and asset managers, boosting the case for alpha from ESG in Asia fixed income.

[1] Sources: Population: UN Department of Economic and Social Affairs, World Population Prospects 2019; Energy: BP Statistical Review of World Energy 2021; Market Size: JP Morgan, PineBridge as of 30 September 2021.

[2] Verisk Maplecroft, ‘Asian cities in eye of environmental storm – global ranking’, May 2021.

[3] UNESCAP, 2019.

[4] Hong Kong Monetary Authority, 27 January 2021.

|

SUMMARY Developing Asia-Pacific economies play a vital role in global sustainability efforts and will require an additional investment of $ 1.5 trillion annually to meet the Sustainable Development Goals by 20303. Opportunities for capital appreciation increase as companies bridge ESG gaps. Screening for ESG risks can reduce downside volatility, while identifying improving ESG credits can enhance total returns of active EM debt portfolios. |

|

Disclosure Investing involves risk, including possible loss of principal. The information presented here-in is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. |