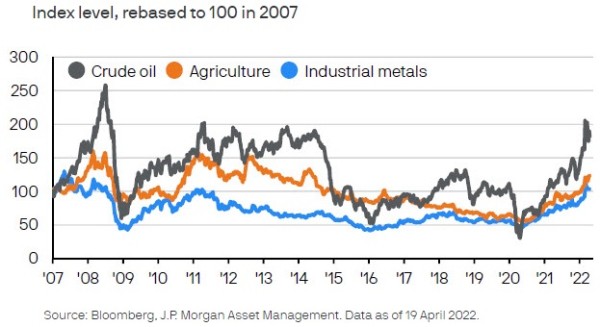

J.P. Morgan: Commodity prices have risen sharply

J.P. Morgan: Commodity prices have risen sharply

The effects of the war in Ukraine on energy markets have been documented extensively, but Russia’s role in commodity markets extends far beyond energy to many industrial metals and fertilisers.

Prices in the near term are therefore likely to be sensitive to developments around the war. Over the medium term, the conflict has catalysed a structural trend that should be supportive for the commodity asset class – Western economies are in a race to cut their dependency on Russian inputs as a matter of national security. In doing so, governments’ timelines on greening economies to achieve net zero have been turbocharged.

As we discuss in our article, A new supercycle – the clean tech transition and implications for global commodities, this reshaping of economies will prove a commodity intensive process that should mean demand over the medium term remains robust.