La Française: Measure to understand, understand in order to act effectively

By Virginie Wallut, Director of Real Estate Research and Sustainable Investment, La Française Real Estate Managers

The building sector is responsible for one-third of greenhouse gas emissions in the European Union. Action must be taken. Under pressure from investors, users and new regulations, the decarbonisation of real estate portfolios must be accelerated.

To fight against global warming, fund managers must put in place the necessary tools which will allow them to measure carbon emissions in order to better understand, act effectively and preserve the value of their assets.

MEASURE IN ORDER TO BETTER UNDERSTAND

Theoretical energy consumption can be estimated through an analysis of the technical specifications of buildings. The accuracy of estimates then need to be validated by monitoring the actual consumption of real estate assets. Lowering energy consumption and CO2 emissions is in everyone's interest and can only be achieved by asset owners and tenants working together.

Carrying out an energy audit coupled with the monitoring of actual energy consumption is a prerequisite for effective energy management. This makes it possible to identify energy consumption improvement actions and to measure the subsequent positive effects of those actions on consumption and clearly highlights, from a long-term cost perspective, the necessity of defining emissions reduction targets.

During the selection phase and prior to investment, La Française Real Estate Managers (REM) audits the sustainable features of its deal flow, paying particular attention to energy and environmental performance. An ESG audit is systematically completed prior to signing a promise to purchase. The bid price and business plan must take into account capital expenditures, required to improve the sustainable features of assets. Therefore, our bidding prices naturally reflect a green premium or a brown discount

For the asset management phase, La Française uses a variety of monitoring tools and has signed partnership agreements with operators to analyse invoice data. This type of solution makes it possible to identify the buildings that consume the most energy and to prioritise actions moving forward. For larger buildings or those that consume more energy, and for which consumption is unjustified given the building's characteristics, La Française REM installs instrumentation systems in order to monitor real time consumption and generate alerts during peaks in consumption and drifts.

By cross-referencing different energy and building data, La Française is able to define realistic and objective-oriented action plans. Obviously, emissions reduction targets must be realistic and clear in order to avoid “greenwashing”.

ACT EFFECTIVELY

La Française REM partakes in the fight against global warming by setting CO2 emissions reduction targets compatible with the Paris Agreement for most of its real estate portfolios. To achieve this goal, La Française REM uses the decarbonisation pathway developed by CRREM (Carbon Risk Real Estate Monitor) to limit global warming below 1.5°C.

The global "carbon budgets" used by CRREM were selected in line with the COP21 objectives, i.e., the scenario of Rockström et al. (2017) for the 1.5°C objective (669 GtCO2e for 2019-2050). In this carbon scenario, reduction targets were determined following the framework of the Sectoral Decarbonisation Approach (SDA) developed by the SBT initiative.

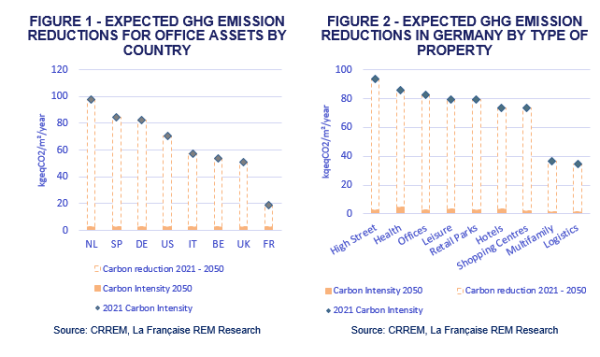

In order, this firstly involves a reduction target for the European building sector, followed by a target for each EU country and finally a target for each building based on its type. The efforts required to achieve the 1.5°C objective therefore vary depending on the country and the type of asset. The more carbon-intensive the country's current energy mix and the more energy-intensive the asset type, the greater the effort required. For example, offices in Germany will have to reduce their average emissions from 86.3 kgeqCO2/m2/year in 2020 to 2.8 kgeqCO2/m2/year in 2050, whereas logistics assets in France will have to reduce their average CO2 emissions from 12.8 kgeqCO2/m2/year in 2020 to 1.2 kgeqCO2/m2/year by 2050.

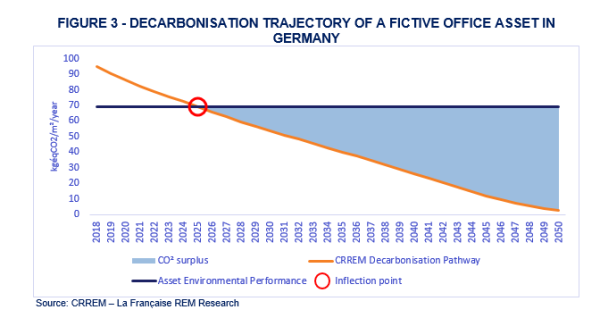

The CRREM methodology reveals the existence of an "Inflection point" or the point at which maximum authorized GHG emission values are lower than the actual emissions of the building. At this point, the building generates excessive GHG emissions, and from an environmental perspective is considered "obsolete". This “inflection point” marks a time after which the asset’s GHG emissions are at an environmental cost.

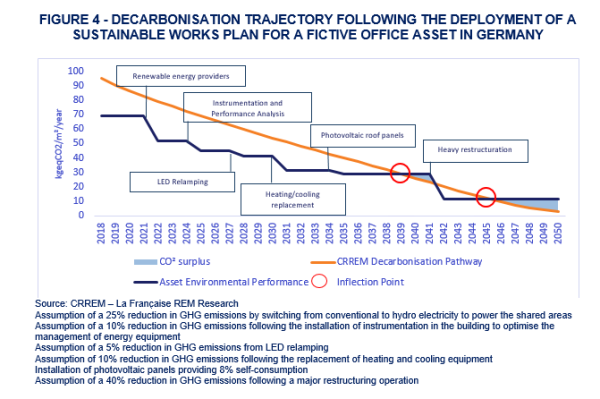

The CO2 emissions trajectory of the building is shown in Figure 3 as a constant over time, whereas it is up to the asset manager to influence this trajectory. To do so, the asset manager must define action plans to (i) decarbonise energy sources and (ii) improve the energy efficiency of buildings:

- In the short term, the asset manager seeks to use energy sources which produce lower emissions. The gains achieved will vary from country to country. For example, switching from a conventional electricity supply to hydropower will reduce CO2 emissions from building operations by a factor of 10 in France and 80 in Germany.

- In the medium term, since the majority of energy waste can be attributed to the use of the building, the asset manager associates tenants and all concerned parties (i.e., property managers, maintainers) in its plans to optimize the energy management of its real estate portfolio. As an example, buildings are equipped with instrumentation systems, which enable a more precise analysis of the breakdown in consumption and the identification of CO2 emissions reduction sources, all of which could contribute to an optimization of the environmental performance of the asset (up to 10% in savings).

- In the long term, the asset manager will have to implement energy renovation works tailored to each building. For example:

o The total LED relamping of an asset can reduce GHG emissions by around 5%.

o Replacing the Heating, Ventilation and Air Conditioning (HVAC) systems can result in a 15% reduction in carbon emissions.

PRESERVING VALUE

Low-carbon is the new norm. Voluntary initiatives are on the rise, such as commitments to the Net Zero Carbon initiative, which should result in lower rents and value discounts for carbon-intensive assets. Conversely, energy-efficient buildings should see increased demand, even though early data suggests that their supply will be limited.

In Europe, tighter regulations, imposing sanctions on buildings with high carbon emissions, continue to encourage a swift energy transition. By implementing an ambitious environmental policy, La Française REM seeks to preserve the value of its assets and protect its investor and user base from the scope of CO2 emissions sanctions.