Fidelity: Quant indicator points to risk off

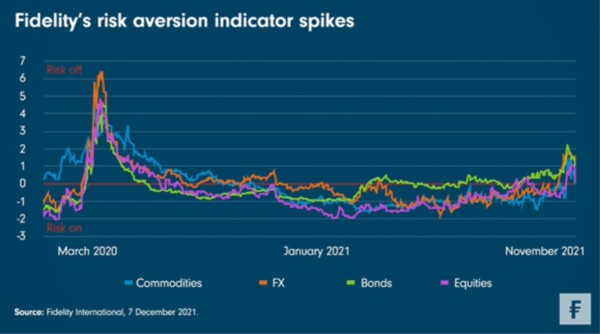

Fidelity’s Risk Aversion Indicator has quickly moved higher over the past few weeks and now recommends taking risk off the table.

The Risk Aversion Indicator (RAI) is designed to identify 'risk on' and 'risk off' market environments by analysing asset prices and implied volatility in four asset classes: equities, bonds, FX, and commodities. A score below zero indicates risk on, while above zero indicates risk off. The indicator has historically been able to identify periods of equity drawdowns.

The RAI had been pointing to a risk-on stance since the middle of last year but started to move higher over the last month. The bonds component was the first to drift into risk-off territory in October as investors started to price in additional interest rate hikes at several central banks.

Then, in the middle of November, the FX component moved sharply into risk-off mode, pulling the overall RAI reading with it. This was due to gyrations in the Turkish lira and increased volatility in the British pound after the Bank of England wrong-footed markets by declining to hike rates.

The deteriorating Covid situation in Europe put further pressure on the FX, commodities, and equities components. Meanwhile, the bonds component moved further into risk-off territory, driven by greater volatility following the announcement of the nominations for the US Federal Reserve chair and the release of the most recent US CPI inflation data.

Last week the emergence of the Omicron variant and the possibility that the Fed will speed up its asset purchase taper decisively pushed the oil and equity components into risk off too, leaving the overall RAI signal at its most bearish level since the initial wave of the pandemic in March 2020. Although the RAI has moderated over the past week, it remains in risk-off territory. Investors would do well to look out for what could be a bumpy ride ahead and be ready to take advantage of any pullbacks in areas that have previously appeared overvalued.