Quoniam AM: What distinguishes equity and credit factor investing?

Quoniam AM: What distinguishes equity and credit factor investing?

While equity factor strategies struggled in 2020, credit factor approaches held up well despite the market turmoil. We have investigated the distinguishing features of factor strategies in both asset classes.

By Harald Henke, Head of Fixed Income Portfolio Management, and Maximilian Stroh, Head of Research Forecasts, both working at Quoniam Asset Management

The year 2020 was characterised by significant performance differences for equity and corporate bond factor strategies. In equities, the value style strongly underperformed the market, leading to below-market returns of multi-factor signals. On the other hand, factor performance was textbook-like in corporate bonds. Higher risk factors, like the carry factor, underperformed in March, but staged a strong rally afterwards. At the same time, lower-risk factors, like equity momentum, displayed the opposite behaviour. Overall, credit factor strategies outperformed the market in 2020.

This disparity raises the question: what are the commonalities and differences between the mechanics of factor strategies in the two asset classes? We have identified three main areas in which the two asset classes differ markedly.

Asset class differences

A given company tends to have one main share class. At most there are a few share classes. Bond issues, however, differ in terms of various aspects, like maturity, seniority or liquidity. Valuing bonds and constructing bond portfolios present a higher level of complexity than doing the same for equities. Moreover, due to a high degree of customisation in fixed income strategies, the market is more segregated, for example between investment grade and high yield. The combination of complexity and segregation leads to pricing inefficiencies in credits compared to equities, which results in return opportunities.

A second difference between the asset classes is the asymmetry in corporate bond returns. Investment grade bonds have limited upside but considerable downside, whereas equity return distributions are much more symmetrical. Credit factor strategies, therefore, need to employ factors that incorporate this asymmetry. As equity factors need to focus on both ends of the return spectrum, one should best not draw conclusions from the way factors work in equities to those in credit. This is shown in the next section.

Differences in factor definitions

Factors capture different aspects in both asset classes, with value and equity momentum displaying the most striking differences. Value factors are always defined by comparing the price of an asset against a fundamental value measure. But there is a significant difference between equity value and credit value factors.

In equities, value factors tend to be simple, such as selecting stocks according to their dividend yield. Relevant measures that are essential for estimating the fair price of a stock, such as future dividend growth, are often ignored because they are very hard to estimate with adequate precision.

For corporate bonds, the picture is different. For example, we can estimate the expected loss of a bond with reasonable accuracy, which allows us to measure its fair value relative to its coupon and risk.

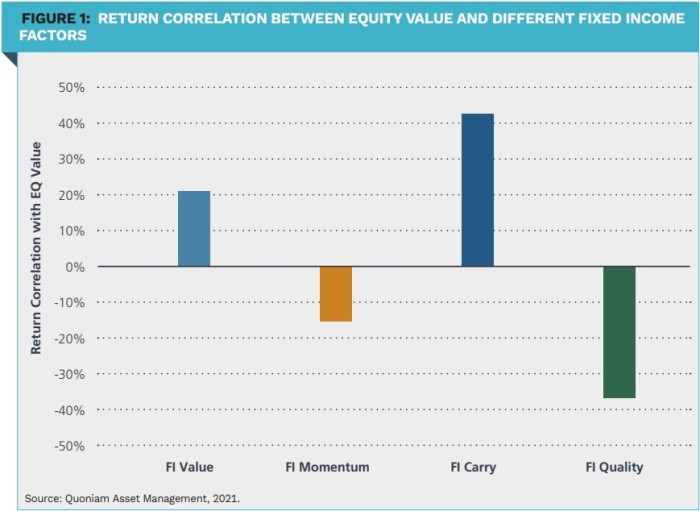

One can say that equity value has characteristics like the carry factor in credit, which ignores risk differences between bonds. In both cases, this leads to higher drawdowns and more volatility. The credit value factor, on the other hand, has a more balanced risk profile and is less prone to strong volatility. Figure 1 compares return correlations between equity value and various credit factors. One can see that the correlation between equity value and credit carry (43%) is twice the correlation between equity and credit value (21%).

Both asset classes also use equity momentum as a factor. In equity factor investing, equity momentum measures the trend in individual stocks and assumes that this trend continues. Equity momentum in corporate bonds assumes that equities incorporate information faster than corporate bonds and therefore the price action in equities has predictive power for credits. Therefore, in equities, momentum is rather a behavioural factor, whereas in corporate bonds, equity momentum captures the structural lead-lag relationships between different assets (equities and bonds) of the same company.

As the same variable, equity momentum, models different aspects in both asset classes, it has a distinct impact on an overall factor mix in both asset classes. In fact, we can see that the factor return correlation between equity momentum in equities and equity momentum in fixed income is zero. This means that there is no systematic relationship between the equity momentum factors in both asset classes.

Competition landscape

Factor investing in corporate bonds and equities differ in the competitiveness of the market environment. While in equities it has been applied for decades with a significant share of the market invested using factor strategies, in credit it is a relatively young approach. Therefore, there are limited offerings among active players in the credit market. The lack of consensus about choice and definition of corporate bond factors makes it unlikely that factor risk premia will disappear over the next years. Additionally, passive alternatives haven’t attracted a lot of demand and there is a lack of properly defined credit factor indices. There are, therefore, no indications that the factor space in credit becomes crowded and that factor premia might be reduced due to arbitrage in the market.

Conclusion

Factor-based investing has a large footprint in equity portfolios with applications in active, passive and smart beta strategies, whereas factor-based investing is still in its infancy for corporate bonds. However, studies show a recent pickup in interest in credit factor investing. If we see demand increase further, this could even provide a tailwind for factor strategies in the coming years. All in all, this makes it an excellent time to have a closer look at credit factor investing.

|

SUMMARY Equity factor strategies strongly underperformed the market in 2020, whereas credit factor strategies continued to perform textbook-like. This difference may be due to a combination of complexity, segregation and asymmetry leading to pricing inefficiencies in credits compared to equities. There is a significant difference between equity value and credit value factors. In credits, the gains and losses are easier to estimate than in equities. In equities, momentum is a behavioural factor, whereas in corporate bonds, equity momentum captures the structural lead-lag relationships between different assets of the same company. Factor investing in corporate bonds and equities also differ in the competitiveness of the market environment. |