J.P. Morgan: Government bond markets are pricing meaningful liftoff from central banks

J.P. Morgan: Government bond markets are pricing meaningful liftoff from central banks

Last week saw both the Federal Reserve (Fed) and Bank of England (BoE) outline more detail on how they intend to normalise monetary policy.

The Fed meeting passed without surprise, announcing that it will now begin tapering its asset purchases, which are likely to conclude by next summer. The BoE delivered a dovish surprise.

After a series of hawkish comments from the Governor, markets had priced a 0.15 percentage point hike for the meeting and so were wrong footed when the Monetary Policy Committee decided to keep interest rates unchanged.

It did however signal that rate hikes would be needed in the coming months. Both central banks highlighted that the inflation outlook remains highly uncertain and so much will rest on future inflation and labour market data to determine how far and how fast central banks raise interest rates.

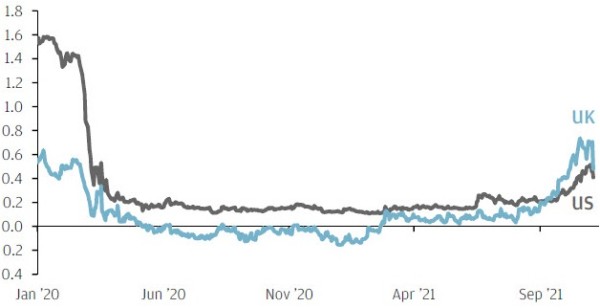

%, two-year government bond yields

Source: Refinitiv Datastream, J.P. Morgan Asset Management. Data as of 4 November 2021.