Fidelity: Net zero puts oil on a rollercoaster ride

The race to decarbonise is constraining investment in long-cycle energy projects and could push oil prices even higher, although the adoption of green technologies will ultimately lead to lower demand over the longer term.

Oil markets have been on a rollercoaster ride over the last two years. The collapse in demand last March coincided with a battle between Saudi Arabia and Russia for market share and pushed oil contracts into negative territory before production cuts and the vaccine-led economic recovery prompted a rally in prices. Oil cartel OPEC+ has agreed to increase production slowly as demand recovers, which could create a broad equilibrium between supply and demand by next summer.

A net zero tailwind

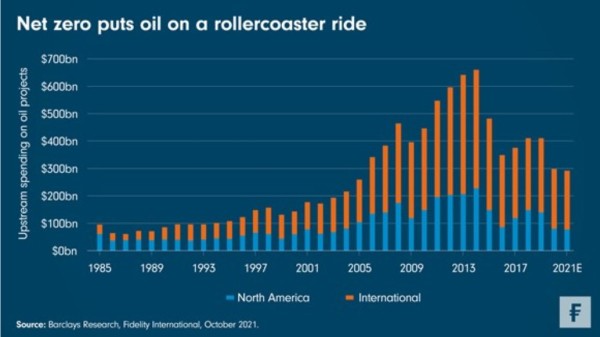

The road to net zero meanwhile is supporting prices by weighing on oil company investment plans. Investors are concerned about long-term demand for oil and are no longer rewarding companies for making longer-cycle investments in projects such as offshore oil. Upstream capital spending in the oil industry has fallen by 55 per cent since 2014.

Oil companies are not attracting the multiples seen in the past and need to pay out large dividends and repurchase shares to regain the interest of investors. Short-cycle investments such as US shale projects, which can deliver returns in as little as six months, are now the fastest way for companies to generate cash. But these investments will struggle to produce enough oil to meet demand, suggesting that prices could rise over the short to medium term.

Into the twilight years

Our outlook for oil prices has become more positive this year but headwinds still exist. A resurgence in Covid infections remains a threat, while oil-producing companies could push to resume drilling and increase supply. On the other hand, if prices remain high, more consumers will switch more quickly from internal combustion engines to electric vehicles, weighing on oil demand. The push to decarbonise may well be a near-term tailwind for oil prices, but over the long term, it will call closing time on the industry. In the interim, investors should brace for a bumpy ride.