Monex: Dollar on the rise after strong US labor market figures

Monex: Dollar on the rise after strong US labor market figures

This is a commentary by Ima Sammani, FX Market Analyst at Monex Europe, on the US labor market report, the nonfarm payrolls report (NFP).

With 943K jobs added in July and a positive revision to June’s number, expectations have increased for an earlier QE tapering announcement by the FOMC compared to what the Fed suggested in July’s meeting, especially with gains being broad-based.

The vast improvement in the net employment data filtered through to the unemployment rate, which fell to 5.4% down from 5.9% previously, unlike June’s reading where the job gains failed to lead to higher overall employment in the household survey. The labour force participation rate came in at the expected rate of 61.7%, which is a good sign the drop in unemployment is representative of economic conditions, rather than a consequence of people leaving the labour force.

With the level of employment now sitting at 3.7%, or 5.7 million jobs away from its pre-pandemic peak, the onus lies on the leisure and hospitality figures to bring the unemployment numbers down. These sectors remain a drag on the overall employment figure and are still some 10.3% down from February 2020 levels. Beyond this, the recovery in other sectors is broader-based, which serves as a solid footing for a sustainable improvement in the US labour market.

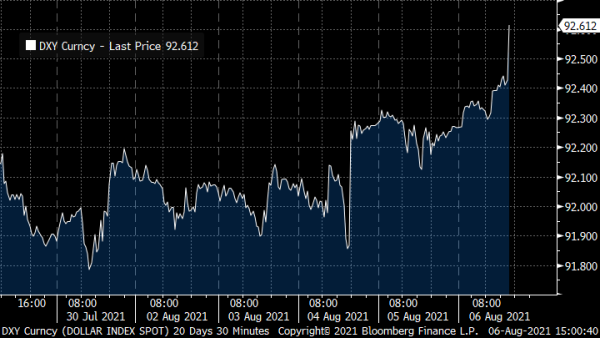

Today’s figures mark a step toward the Federal Reserve’s condition for policy normalisation, which is “substantial” further progress in the labour market recovery. Fed Governor Christopher Waller stated earlier this week that if the July and August reports show continued gains, he could see the Fed begin tapering asset purchases. This makes the prospect of tapering seem closer at hand, providing all the reasons for dollar traders to take a bullish stance today. The dollar’s strength was also supported in the Treasury market, with 10-year yields rallying back towards 1.3% after spending much of the week below the 1.2% handle.

The dollar takes it all after strong jobs report brings forward policy expectations