SSGA-SPDR: Euro high yield in a steady ascent

SSGA-SPDR: Euro high yield in a steady ascent

The recent wobbles in risk assets have been driven by uncertainty over the economic impact of new COVID variants. High yield has been among the asset classes impacted, with spreads to government bonds widening in July. The paring back of excessive overweight positions in high yield was also driven by how tight spreads had become, but there are reasons to retain overweight positions in high yield bonds, and European high yield in particular.

- Growth is still strong. Economic momentum may not be accelerating any longer but it remains strong. The final June Composite PMI for the euro area was higher than the May one, suggesting recovery remains firmly in place. Questions over how sustainable this will prove to be, given the rise in COVID infections, are valid. But the preferred route for politicians now appears to be to vaccinate and then learn to live with the disease. It is difficult to see a fresh round of economic lockdowns. In addition, fiscal policy remains loose with spending switching from immediate support measures for business to longer-term investment strategies.

- Companies appear to be in good shape. The big risk for the high yield market remains downgrades and defaults. However, the combination of government support measures with favourable financing conditions has left company balance sheets in good shape. This is clear for Europe with both S&P and Moody’s ratings agencies having an upgrades versus downgrades ratio of well above 1 for Q2 2021.1

- ECB policy support to remain in place. The implication of the ECB’s new policy framework was made clear at the latest meeting: the ECB will remain a buyer of bonds for a long time to come. Purchases of corporate bonds have totalled EUR 46.4 billion year to date and, while they do not stretch into the high yield market, the flows into government bonds and investment grade credit, which have depressed yields, should ensure the reach for yield persists as a market theme.

High yield spreads to government bonds remain tight from a historical perspective but, for the Bloomberg Barclays Liquidity Screened Euro High Yield Bond Index, the option-adjusted spread (OAS), at around 290bp, is still comfortably above the lows seen over the past five years of just over 200bp. The same cannot be said of the US high yield spread, where the Bloomberg Barclays US Corporate High Yield Bond Index spread is just 30bp off the lows, which were achieved in early July 2021.

The European index also represents relatively better value given that, while outright yields on the US index may be higher, that is a function of the higher underlying government bond yield. In fact, spreads for the two indices are remarkably similar, i.e. the additional yield pick-up an investor receives from taking on non-investment grade credit risk in their respective markets is very similar. With the ratings of the two indices the same, on the surface this does not seem inconsistent. However, the US index has typically traded with a wider OAS than its euro area peer and the OAS has been 50bp wider on average over the past five years,3 in part because the US index has a duration that is a half year longer.

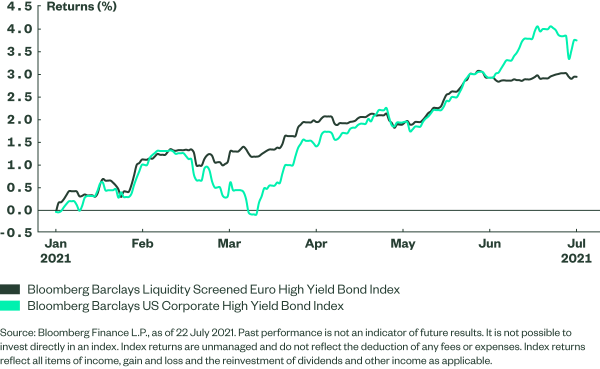

In short, investors in European high yield are taking on less price risk for the same amount of yield uplift over the risk-free rate. Higher growth and inflation in the US, coupled with taper talk (which is expected to emerge in the late summer), means we remain cautious on US duration exposure. Duration may have helped investors in early July but, as Figure 1 shows, returns for US high yield investors have been a lot more volatile. What is noticeable is the remarkably steady ascent European high yield has enjoyed. The July market swings have had a limited impact on the Bloomberg Barclays Liquidity Screened Euro High Yield Bond Index, with the spread widening to government bonds being almost entirely offset by the shift lower in government yield curves.

Euro vs. US High Yield Index Total Return Comparison