Fidelity: China’s EV industry is charged for growth

Fidelity: China’s EV industry is charged for growth

Governments around the world have made green policies and investment central to their strategies to combat climate change, and China is no exception. President Xi Jinping has laid targets for China to be carbon neutral by 2060, and for "eco-friendly" cars to account for all auto sales by 2035.

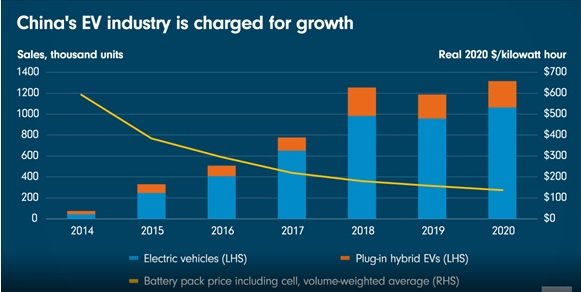

This week’s Chart Room shows how global battery prices, which are one of the largest cost inputs for EVs, have steadily decreased, amping up the growth of China’s EV and plug-in hybrid sales. Battery prices in 2020 were 13 per cent lower than in 2019, according to data from BloombergNEF, as more efficient battery pack designs were launched. China produces around three-quarters of the world’s EV batteries and is also the world’s biggest manufacturer of electric cars.

Lower battery costs and generous subsidies have sparked the growth of China’s EV industry. In turn this has boosted enthusiasm from capital markets. The entry of new players to the increasingly competitive industry will help the EV supply chain to cut costs yet further, and make owning an electric vehicle a more attractive prospect for consumers.

The road hasn’t always been smooth. China’s EV sales declined in 2019 upon the removal of some subsidies, and crashed to a four-year low in the first quarter of 2020 amid the outbreak of Covid-19. After governments around the world bolstered their commitment to green energy during the pandemic, China’s EV market is seeing a v-shaped rebound to new highs, and market expectations are still catching up. We think the penetration rate of EVs could surpass 40 per cent by 2030, from under 6 per cent in 2020.

Not all stakeholders will be rewarded equally. The increased competition in the EV market could reduce returns on capital and some companies will lose out. We think companies operating upstream in the value chain with better competitive positions are more likely to be winners. This includes leading battery companies which could benefit from greater scale, more advanced technology, and generally leading market positions.