WisdomTree: Brexit anguish is at the forefront again

WisdomTree: Brexit anguish is at the forefront again

By Mobeen Tahir, Associate Director, Research

The ‘B’ word is back. It was not making headlines for most of this year because both parties involved – the UK and Europe – were embroiled in a more urgent crisis in the shape of a pandemic. The two sides are still making heated exchanges over Brexit negotiations while the 31st December 2020 deadline for agreeing the terms of their future relationship approaches quickly.

Bad for Europe but worse for the UK

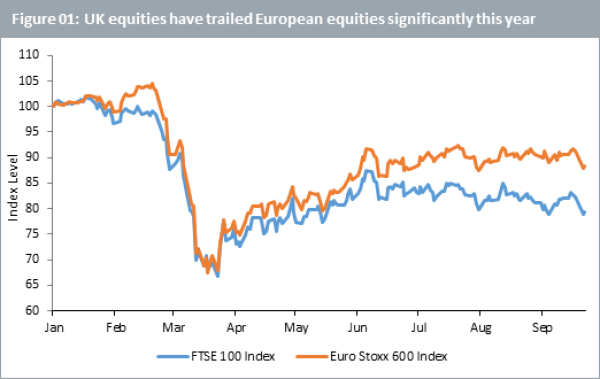

UK’s equity market has trailed Europe’s considerably this year. The UK’s FTSE 100 Index is down over 20%[1] while Euro Stoxx 600 Index is down just over 11%[2] year-to-date in sterling and euros respectively (see Figure 01 below). If we compare the two in Euros, the UK fares even worse on account of Sterling’s weakness relative to the Euro – another sign of the UK being hurt more by the risk of Brexit disruption and uncertainty.

Source: WisdomTree, Bloomberg. Data as of 22 September 2020. Total return indices shown in respective local currency. Indices rebased to 100 on 01 January 2020. Historical performance is not an indication of future performance and any investments may go down in value.

Now, while it is possible to make a case about the pandemic causing more economic damage to the UK than Europe, the Brexit factor can certainly not be disregarded. The European Union (EU) accounts for 43% of all UK exports and 51% of all UK imports[3]. The UK’s share in EU’s trade is not insignificant but is certainly smaller with the UK accounting for 14.9% of all EU exports and 10% of all EU imports[4]. UK falling out of the trade union without a conducive trade deal will put UK exports at a competitive disadvantage and sting the UK much more than the EU.

The silver lining may be short-lived

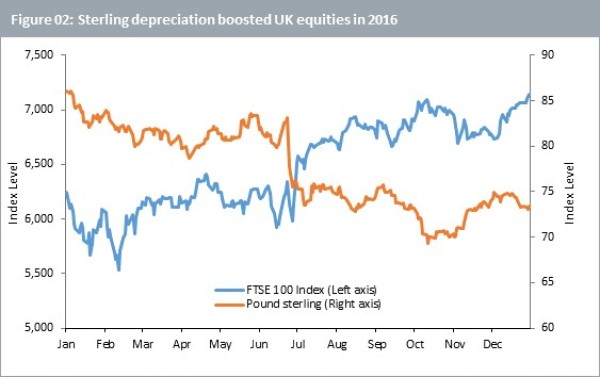

The FTSE 100 Index made gains of nearly 15% between 23 June 2016 – Brexit referendum day – and the end of 2016[5] (see Figure 02 below). This was not because markets perceived Brexit to bring significant economic benefits to the UK economy. Instead, it was triggered by a drastic fall in sterling – a sign that economic prospects had sharply deteriorated. Given FTSE 100 companies generate more than 70% of their revenue from abroad, sterling depreciation boosted the competitiveness of UK exports – in the short term – and hence, lifted UK equities.

Source: WisdomTree, Bloomberg. Data shown for 2016. Price Index shown for FTSE 100 Index. Pound Sterling is represented by Deutsche Bank GBP Trade Weighted Index. Historical performance is not an indication of future performance and any investments may go down in value.

A similar effect could provide a silver lining now with sterling likely to get weaker as the Brexit conundrum becomes more vexatious. The Bank of England’s recent indication that it is amenable to considering negative interest rates may also hold the currency from gaining strength. This short-term respite must not, however, mask UK’s Brexit challenge even if equity markets end up taking a myopic view. Investors could therefore consider continue to seek defensive hedges to not only mitigate the risk of a disorderly and disruptive Brexit, but also the uncertainty leading up to it.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] Source: Bloomberg, as of 22 September, on a total return basis

[2] Source: Bloomberg, as of 22 September, on a total return basis

[3] Source: UK House of Commons Library. Data for 2019.

[4] Source: European Commission. Data for 2019.

[5] Source: Bloomberg, on GBP total return basis