MUFG Daily Snapshot – Beleggers verschuiven aandacht naar versoepeling lockdowns

FX Daily Snapshot COVID data improving outside of Japan as focus shifts to easing of lockdowns

USD: Focus starts to shift to easing of lockdowns as COVID-19 spread slows

The US dollar has weakened during the Asian trading session with losses most evident against commodity-related currencies. The tentative improvement in global investor risk sentiment has continued overnight following on from the 7% to 8% gain recorded in major US equity indices. It helped to lift the S&P 500 index to its highest level since the 13th March and it now stands just over 20% above the intra-day low recorded on the 23rd March. The near-term improvement in investor sentiment has been mainly driven by: i) building evidence that the lockdown measures are proving effective at slowing the spread of COVID-19 and ii) ongoing reports that the world’s largest oil producers are pressing ahead with talks for an unprecedented cut to production to help support the price of oil. It has already helped to lift the price of Brent back towards USD35/barrel from a recent low of USD21.65/barrel. One exception to the positive news flow at the start of this week was the announcement overnight that UK Prime Minister Boris Johnson has been placed in intensive care as

he attempts to fight off COVID-19. The pound fell sharply in response to an intra-day low of 1.2166 for cable and an intra-day high of 0.8865 for EUR/GBP. However, there was at least some encouraging news from the UK as well yesterday as the number of new COVID-19 cases dropped notably. The daily rate of change slowed to 7.9% and helped lower the five-day average to 11.9% which keeps the slowing trend in place.

With evidence continuing to build that the lockdowns are proving effective at slowing the spread of COVID-19, market participants’ focus is beginning to shift when and how the lockdowns could be eased. In our latest COVID FX Focus report (click here) we looked into the potential timing of the lockdown reversals. The main precedent so far has been China which is leading the way in the recovery from COVID-19. Wuhan announced a lockdown on the 23rd January, and will formally end its lockdown tomorrow. It will have been in lockdown for 76 days. The average length of lockdowns elsewhere in China has been shorter at 56 days. For comparison, in the euro-zone the countries which have been in the longest so far have been Spain and the Netherlands at just over 40 days each. Governments in Europe are already beginning to consider their plans for a gradual easing of the lockdowns. Austria became the first country to set out detailed plans. Smaller shops will be allowed to reopen from the 14th April and larger ones and shopping malls from the 1st May if all goes well. Hotels and restaurants could start to re-open in mid-May while schools will remain closed until mid-May. Public events though will remain banned until the end of June. The plans highlight that the return to normality will be a gradual step by step process.

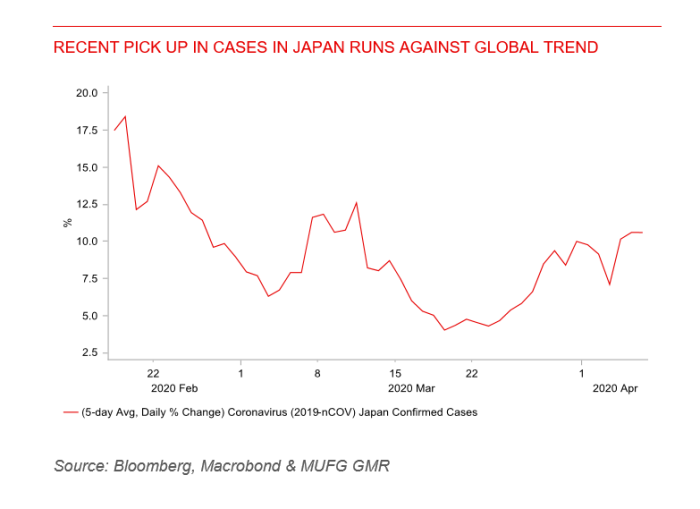

JPY: Japan steps up fiscal stimulus as spread of COVID-19 picks up While the spread of COVID-19 has been slowing in Europe and the US, there have been some worrying signs that it is picking up in Japan. The daily rate of change jumped over the weekend to an average of 18.2% although it did drop back yesterday to 6.9%. On average over the last five days, the daily rate of change has increased to 10.6% up from 6.6% ten days ago. The developments have prompted Prime Minister Abe to declare a roughly one month state of emergency for the seven prefectures of Tokyo, Kanagawa, Saitama, Chiba, Osaka, Hyogo, and Fukuoka. The seven prefectures account for around half of Japan’s GDP. The lockdown is not expected to be as restrictive for economic activity as in China and Europe but will nonetheless further increase downside risks for growth in Japan in Q2. The state of emergency declaration carries no legal force and basically represents a stronger request for voluntary restraint.

In response to the COVID-19 crisis, Prime Minister Abe has announced another substantial fiscal stimulus package. The headline figure for the fiscal stimulus package totals JPY108 trillion equivalent to around 20% of GDP. However, the headline figure is inflated by private-sector outlays. The government will compile an extra budget of JPY16.8 trillion (3.1% of GDP) to fund the new stimulus measures, which comes on top of the regular budget for the current fiscal year of JPY102.7 trillion. The extra budget’s major spending items include JPY1.8 trillion to contain the spread of COVID-19, develop drugs and help medical institutions, JPY10.6 trillion to support jobs and businesses, and JPY1.8 trillion to support the economic recovery. The developments have had little impact on the yen which has softened in recent days alongside the tentative improvement in global investor risk sentiment. The BoJ’s QE programme will continue to provide support for the government’s plans for increased debt issuance.