MUFG: EM & Oil FX - Risks remain tilted to the downside

MUFG: EM & Oil FX - Risks remain tilted to the downside

By Lee Hardman, Currency Analyst, Global Markets Division for EMEA

The US dollar has strengthened during the Asian trading session alongside other low yielding safe haven currencies such as the yen. Trading conditions overnight have exhibited a more risk off tone with the sell-off in US equity markets at the end of last week following on into the Asian trading session. Weakness has been most acute though in the price of oil which has continued to fall to new lows of USD23.03/barrel for Brent while WTI holds at USD20/barrel. It has triggered another sell-off in oilrelated currencies especially in the Norwegian krone. We had cautioned in our latest FX Weekly (click here) that last week’s sharp relief rebound for the krone was built on shaky foundations.

High yielding emerging market currencies have also underperformed overnight. The rand has been hit hard by the announcement from Moody’s that it has finally decided to strip South Africa of its last remaining investment grade rating. USD/ZAR jumped above the 18.000-level hitting a new record high of 18.086 overnight. The rand has now lost around a fifth of its value since the start of this year. South Africa’s bond market had already experienced record capital outflows this month prior to the credit downgrade which will be reinforced further by Moody’s decision. Moody’s noted that the key driver behind the rating downgrade was the continuing deterioration in fiscal strength and structurally very weak growth. South Africa’s economy had already fallen back into recession prior to the negative COVID-19 shock that will now make it both deeper and longer. The loss of South Africa’s investment grade rating had become almost inevitable and it was always more a matter of timing.

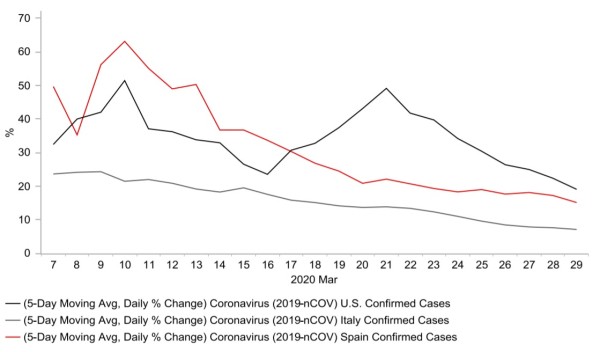

GROWTH IN NEW COVID-19 CASES IS SLOWING

Source: Bloomberg, Macrobond & MUFG GMR

In other news over the weekend, the PBoC has taken another step to loosen monetary conditions by lowering the rate at which it lends to banks. The PBoC lowered its 7-day reverse repo rate from 2.40% to 2.20%. It is the largest rate cut since 2015 and lowers the reverse repo rate to a new record low. Short-term repo rates have already fallen notably since the start of this year and are expected to fall further in the coming months as the PBoC continues to ease policy. The renminbi has remained relatively stable against the US dollar during the COVID-19 shock with USD/CNY currently trading just below the 7.1000-level. Market participants will be watching closely in the coming days for the release of the latest PMI surveys from China for March. The surveys are expected to show some improvement in business sentiment after the plunge to record lows in February as activity in China’s economy gradually picks back up again.

USD: Fed policy measures prove effective at reversing USD surge

The US dollar is coming off the back of its worst week since the Plaza Accord in September 1985 against other major currencies. The dollar index declined sharply by 4.3% last week on a closing price basis. Remarkably it leaves the US dollar largely unchanged in value against the other major currencies since the COVID-19 shock hit.

However, it has been a volatile period for the US dollar. There have been four main phases of US dollar performance since the COVID-19 shock hit. Firstly, the dollar index strengthened by around 2% between 5th February and 20th February.

Secondly, the dollar index fell sharply by around 5% between 21st February and 9th March. Thirdly, the dollar index surged higher by around 8.5% between 10th March and 20th March. Fourthly, the dollar index has since declined sharply again by just over 4% since the 20th March.

The current US dollar sell off has been triggered mainly by the powerful policy response from the Fed which has helped to ease tightening US dollar liquidity conditions at least in the near-term. In a sign that the Fed’s bold policy response is proving effective they have announced that they will moderate the extraordinary pace of US Treasury bond purchases towards the end of this week, although the size of purchases will remain huge in scale. More specifically, the Fed announced that they will continue to purchase USD75 billion of US treasury bonds/day through Wednesday, but the pace of purchase will then drop to USD60 billion later in the week. MBS purchases will also step down to USD40 billion/day this week from last week’s run rate of USD50 billion/day. The Fed’s efforts have helped to push US yields back towards record lows following the brief sell-off in the UST bond market between the 9th March and 19th March.

The volatile nature of US dollar performance in recent months has made it even more challenging to forecast performance. There is scope for the current stage of US dollar weakness to extend further in the near-term although we would caution that one should not be complacent in believing the policy measures taken to date will result in a further retracement of USD strength (click here). Uncertainty simply remains too high with downside risks to the global growth outlook and financial stability still in place. In a stark shift from two weeks ago, President Trump has warned that social distancing measures in the US will have to remain in place until at least 30th April.