BNP Paribas AM - Strategy update - No time to sell risky assets

BNP Paribas AM - Strategy update - No time to sell risky assets

Read below the executive summary:

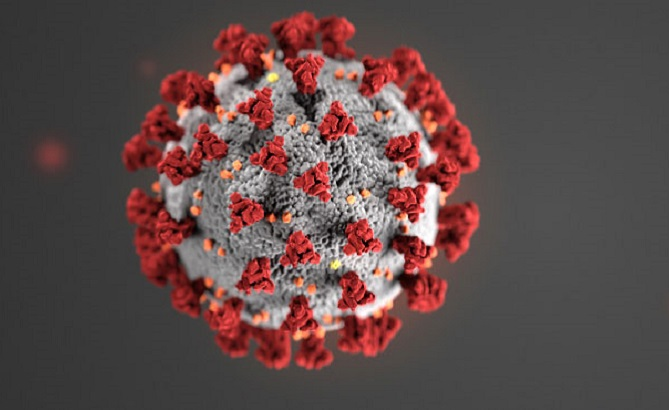

· The COVID-19 pandemic has tragically already claimed the lives of over 10 000 people. Many more will die in the coming weeks. Governments have been obliged to take extreme social distancing measures to combat the virus, effectively putting society on lock-down.

· The temptation in moments of crisis is to become fixated on the worst case scenario, turn defensive and focus on preservation of capital. We think that is a mistake: now is not the time to sell. The correction has already occurred and we are already priced for pandemic and arguably panic.

· The outlook is uncertain, but that does not excuse inaction. We do not have the luxury of being able to wait until there is complete clarity about the final impact of the virus on society and the economy before taking investment decisions. Markets will price in the end game for COVID-19 long before all the uncertainty has dissipated.

· As long-term investors we need to take a stand on the ultimate human, social and economic cost of the virus and then benchmark those views against current valuations. Prices look to have over-shot, fuelled by panic and dislocations in markets. Valuations are starting to look attractive and we are looking to add risk, not reduce.

· To be clear, we believe that the situation will get worse before it gets better. There will be a catastrophic loss of life and a sharp contraction in activity in the coming weeks. The authorities may be forced to impose multiple shut-downs in the coming months to keep the virus in check. However, we believe that the global policy response will eventually turn the tide.

· We believe that a combination of factors will ultimately help society learn to live with the virus without recourse to endless shut-downs – in particular: rising acquired immunity within the population; diagnostic and serological testing on an industrial scale; increased capacity within the healthcare system to deal with acute cases; and the adoption of best practice from around the world on containment strategies outside lock-downs.

Furthermore, we take comfort from the already significant and still building economic policy response to the crisis. The shut-downs will place huge stress on companies and households but the more the global policy response moves towards the “socialise all losses, whatever the cost” mentality, the more confident we become that the economy can weather the storm.

· The game changers are obviously the arrival of effective antivirals and ultimately a vaccine but at least as far as the latter is concerned there is a timeline of many months of trials ahead of us to demonstrate that any vaccine is safe, and that will be difficult to compress. However, credible news on progress will likely cause the market to fast forward to the end game.

· There are obviously risks around this baseline scenario, and in particular around the number and duration of shut-downs that the authorities will need to impose, and, around the delay in producing effective antivirals and a vaccine. We will update our view and our call on the market as news arrives using a number of key signposts – on the behaviour of the virus itself; on the public health response; on the economic cost of the shut-downs; on the economic policy response; on the state of business and consumer confidence; and on investor expectations.

· Equity valuations are starting to look attractive: our dashboard of valuations metrics across jurisdictions has shifted from red to green. The S&P 500 has fallen by about a third, reflecting a decline in both earnings expectations and a decline in the P/E ratio, despite much lower bond yields. Further declines in earnings expectations pose a downside risk to valuations – particularly in a multiple shut-down scenario – but the significant increase in the equity risk premium could act as a cushion for bad news ahead on earnings.