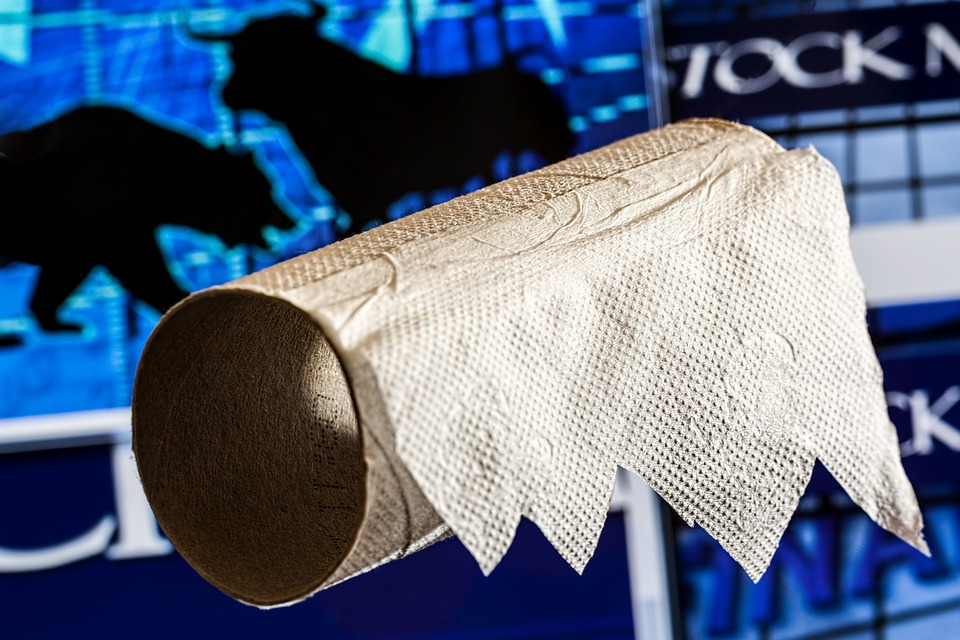

Natixis IM: 11 jaar na de ondergang van Lehman Brothers

Natixis IM: 11 jaar na de ondergang van Lehman Brothers

David Lafferty van vermogensbeheerder Natixis Investment Managers beschrijft de effecten die de ondergang van de Amerikaanse bank nu nog heeft, in hoeverre er nog risico’s zijn en wat dit betekent voor beleggers. Een analyse over de ondergang van Lehman Brothers (The Lehman Demise), op 15 september aanstaande 11 jaar geleden:

Comments for Lehman Demise – 11th Anniversary

•In the decade plus since the GFC, some of the risks have morphed, but many of the core issues remain.

•The GFC was first and foremost an issue of systemic risk within the banking system. This risk has diminished, but it has not gone away entirely. US banks have delivered significantly and rebuilt their capital buffers. However, European banks, while much improved on this front, have been less willing to swallow some of the tough medicine required like dealing Non Performing Loans and bolstering their capital ratios. This is a double-edged sword because necessary quality and liquidity requirements under rules like Basel III and Dodd-Frank potentially mean that institutions are more capital constrained – another macro headwind in a global economy that is already growing too slowly.

•A byproduct of systemic risk was that regulators discovered in many cases, financial institutions were “too big to fail.” Unfortunately, since the GFC, many banks and financial institutions have only gotten bigger as these firms need greater economies of scale to compete in a more costly (i.e., regulation) and technology-driven environment. Banks in the US are no required to have solvency wind-down plans, but no one knows how these plans, written during good times, will actually fare in the confusion of a real crisis.

•One lesson from the Lehman crisis was that illiquidity risk is sometimes more deadly than solvency risk. Large firms that are profitable in the long run can be plunged into crisis if they can’t fund their short-term obligations and operations. Across the financial landscape, it is clear that most companies have taken meaningful steps to manage their illiquidity and timing risks. But liquidity is a fickle beast – it can show up quickly and without warning and no firm or business strategy is completely immune when the capital markets shut down. This can also mean opportunity for businesses and investors who can ride out bouts of illiquidity and massive price dislocation. Value investors can still profit by distinguishing between a failed business model (insolvency/bankruptcy) and temporary impairment.

•What risks remain on the horizon? With ultra-low interest rates globally, debt and leverage have continued to grow in some important pockets. While consumers in developed markets aren’t stretching too far, sovereign governments and corporate borrowers have binged in uber-cheap debt. Provided servicing costs remain manageable, perhaps this risks won’t manifest into solvency problems. However, companies and countries remain dependent on open and free-flowing capital markets, low real rates, and low inflation rates. Non of these conditions is assured in the more distant future. The classic credit cycle has not been banished. The tide will go eventually.

• For investors, perhaps the key lesson is not to assume the inherent stability of financial institutions, no matter how solid they may look today. Buyers can go on strike. Assets are only liquid within the context of risk aversion. Losses rise up through the capital structure and derivatives are just as likely to exacerbate the pain as they are to hedge it. Low correlations are desired, but cannot be expected, and risk management can’t be reduced to a simple VAR guesstimate. The post-Lehman recovery and expansion has been historically long. The later we get in the cycle, the more discretion will remain the better part of valor.